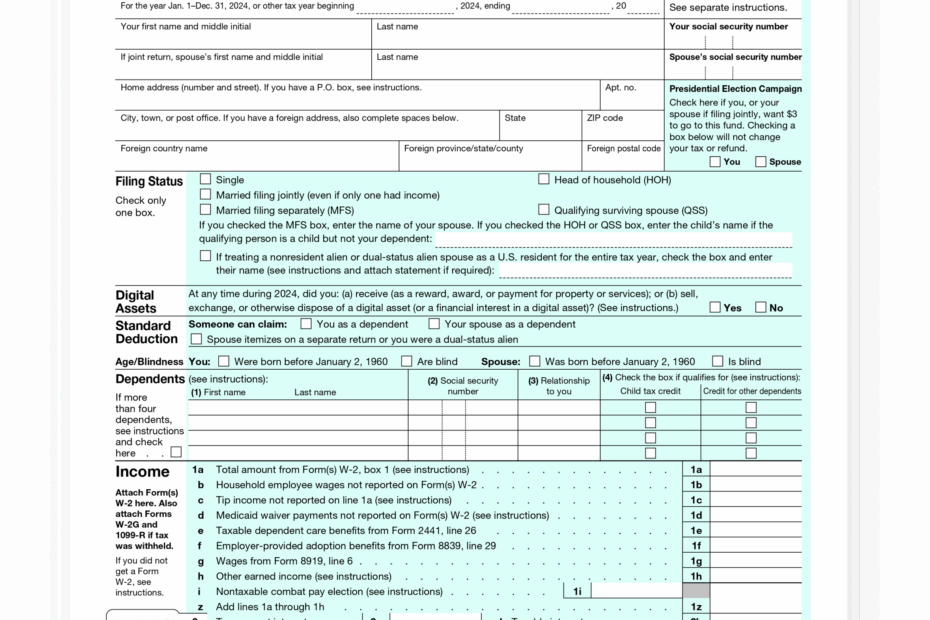

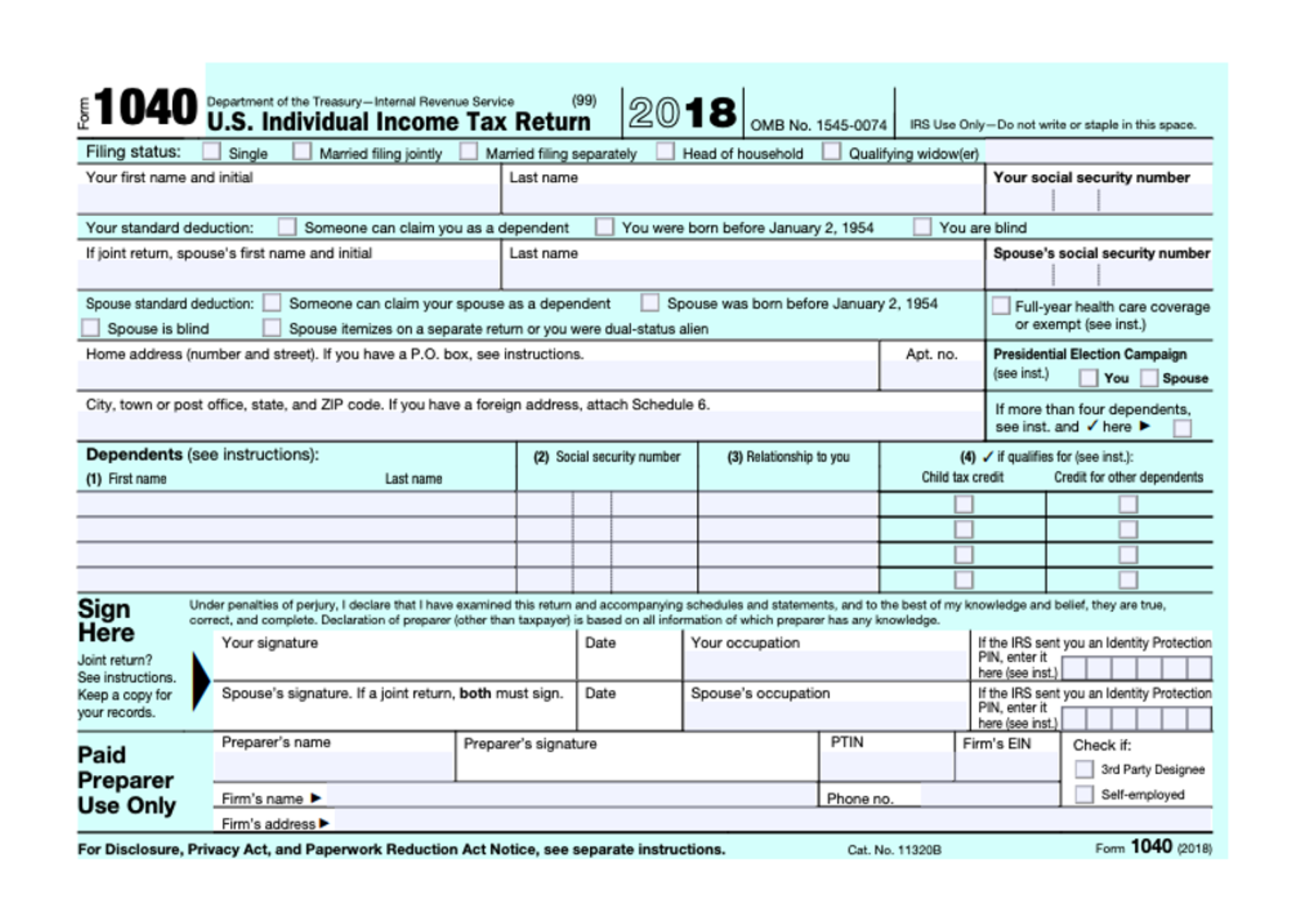

As tax season approaches, many Americans are preparing to file their annual tax returns. One of the most commonly used forms for individual taxpayers is the 1040 form. This form is used to report income, deductions, and credits to determine the amount of tax owed to the government or the refund due to the taxpayer.

While some taxpayers prefer to file their taxes electronically, others still prefer the traditional method of filling out and mailing in a paper form. For those who fall into the latter category, having access to a printable 1040 form is essential. This allows them to easily fill out the form by hand and submit it by mail.

Save and Print Printable 1040 Form

Free 1040 Form Generator Fillable 1040 By Jotform

Free 1040 Form Generator Fillable 1040 By Jotform

Printable 1040 Form

Printable 1040 forms can be easily found on the IRS website or through various tax preparation software. These forms are available in PDF format, making it easy to download, print, and fill out. The form typically includes sections for personal information, income, deductions, and credits, as well as spaces for signatures and relevant schedules.

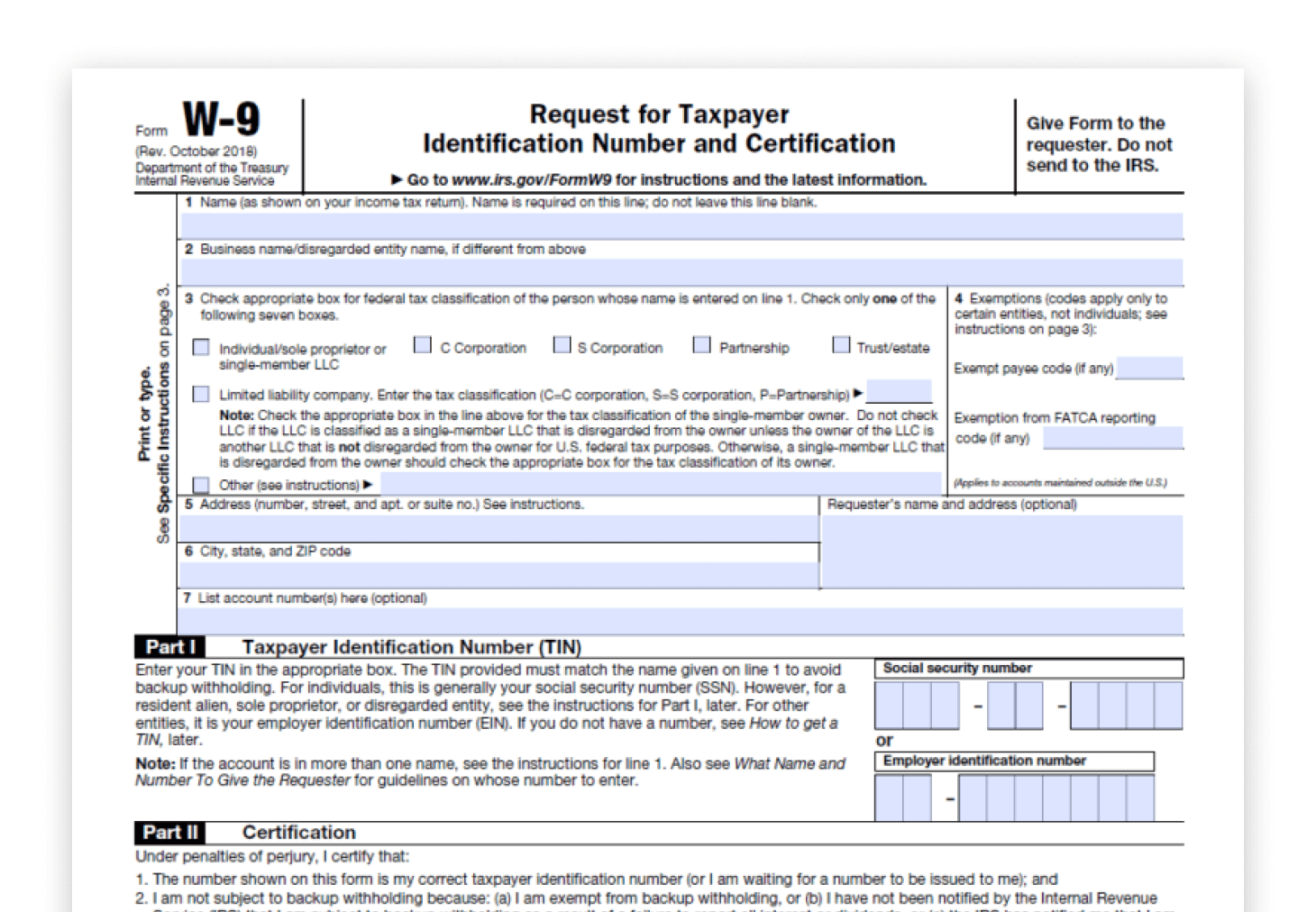

When filling out the printable 1040 form, taxpayers should ensure that they have all necessary documents on hand, such as W-2 forms, 1099 forms, and receipts for deductible expenses. It is important to carefully review the instructions provided with the form to ensure accurate completion and avoid any errors that could result in delays or penalties.

Once the form is completed, taxpayers can either mail it to the IRS or submit it electronically through approved e-file providers. If a refund is due, choosing direct deposit can expedite the process and ensure timely receipt of the refund. Taxpayers should keep a copy of the completed form for their records in case of any future inquiries or audits.

In conclusion, having access to a printable 1040 form is essential for those who prefer to file their taxes by mail. By carefully completing the form and submitting it on time, taxpayers can ensure compliance with tax laws and avoid any penalties. Whether filing electronically or by mail, it is important to be diligent and accurate in reporting income, deductions, and credits to avoid any potential issues with the IRS.