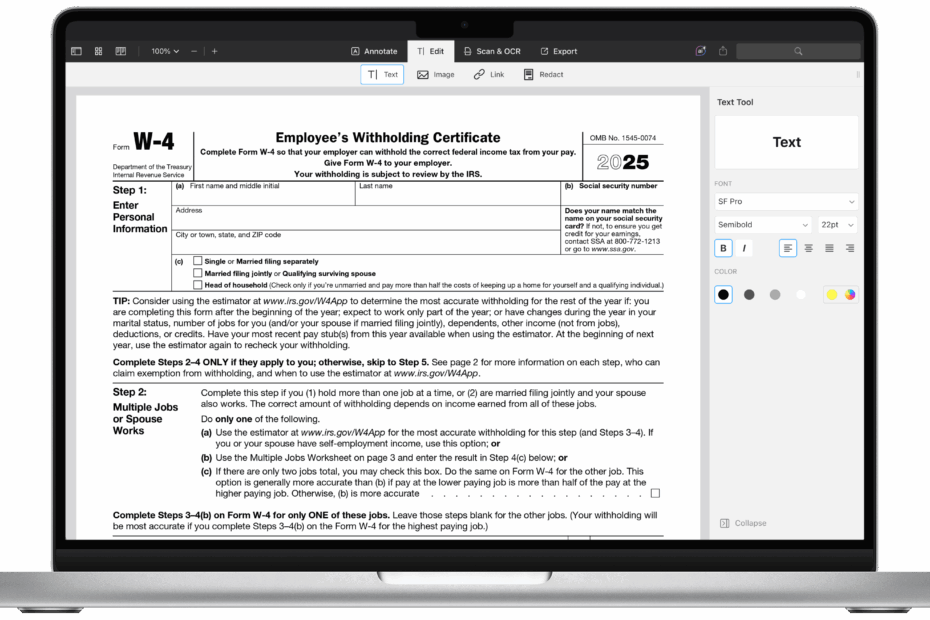

As tax time approaches, many individuals are looking for the most up-to-date tax forms to ensure they are in compliance with the IRS. One important form that individuals need to be familiar with is the W-4 form, which is used by employers to determine the correct amount of federal income tax to withhold from an employee’s paycheck.

For the year 2025, the W-4 form has undergone some changes to reflect the current tax laws and regulations. It is important for individuals to be aware of these changes and ensure they are filling out the form accurately to avoid any potential issues with their tax withholding.

Quickly Access and Print 2025 W 4 Form Printable

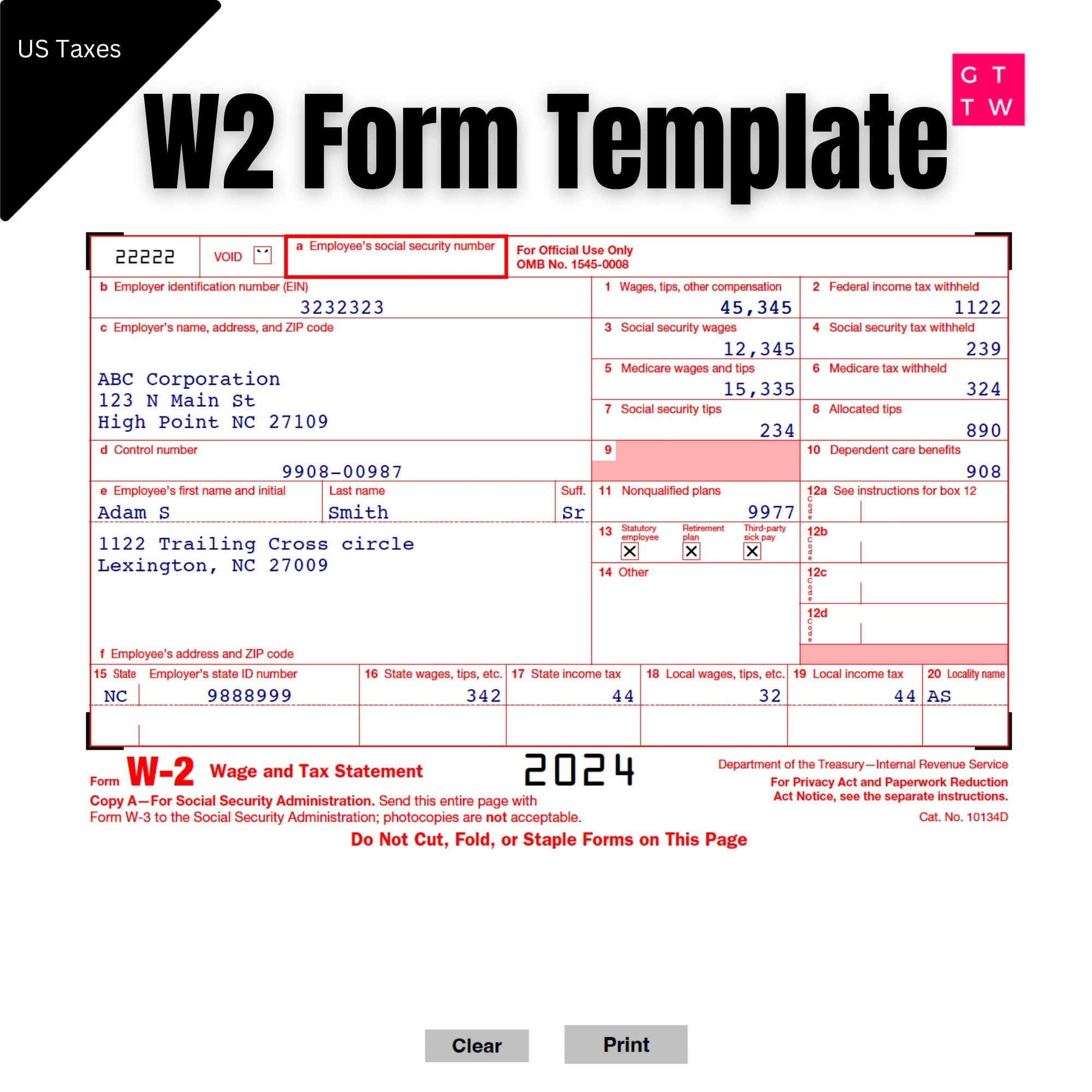

W2 Form IRS 2025 Fillable PDF With Print And Clear Buttons

W2 Form IRS 2025 Fillable PDF With Print And Clear Buttons

When looking for the 2025 W-4 form printable, individuals can easily find it on the IRS website or through various tax preparation software. The form can be downloaded and printed for easy access, making it convenient for individuals to fill out and submit to their employers.

One important change to the 2025 W-4 form is the elimination of withholding allowances. Instead of claiming a certain number of allowances, individuals will now be required to input their filing status and any additional income or deductions that will affect their tax liability. This new format aims to simplify the process and ensure accurate withholding amounts.

It is crucial for individuals to carefully review the instructions for the 2025 W-4 form to ensure they are providing accurate information. Failing to do so could result in under or over withholding, which could lead to owing additional taxes or receiving a smaller refund come tax time.

Overall, the 2025 W-4 form printable is an essential document for both employers and employees to ensure proper tax withholding. By understanding the changes to the form and accurately filling it out, individuals can avoid any potential issues with their taxes and ensure they are in compliance with the IRS.