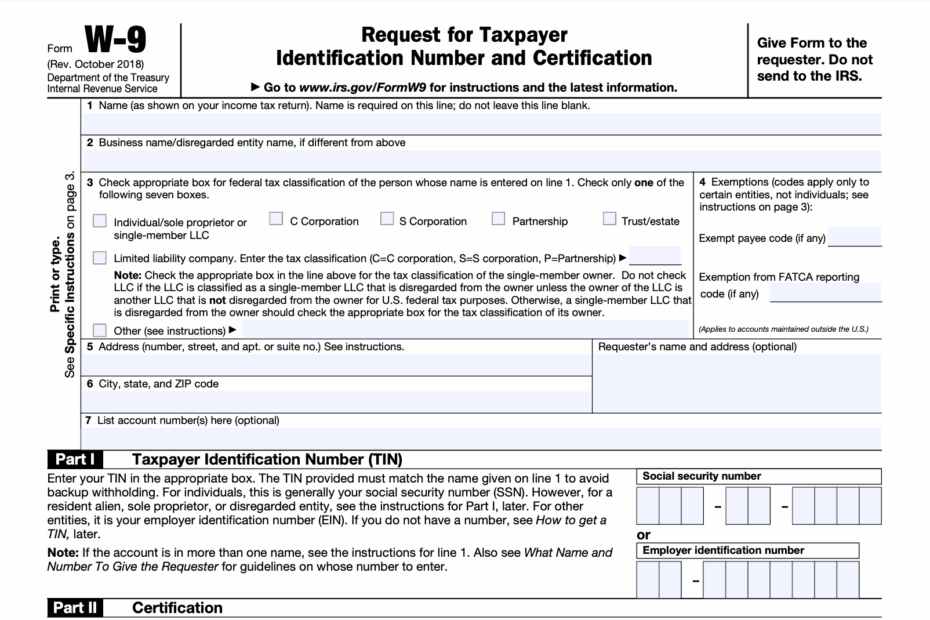

When it comes to tax documentation, the W-9 form is an essential tool for both businesses and individuals. This form is used to gather information from independent contractors, freelancers, and other non-employees for tax reporting purposes. It collects details such as the individual’s name, address, and taxpayer identification number (TIN), which is usually their Social Security number or employer identification number.

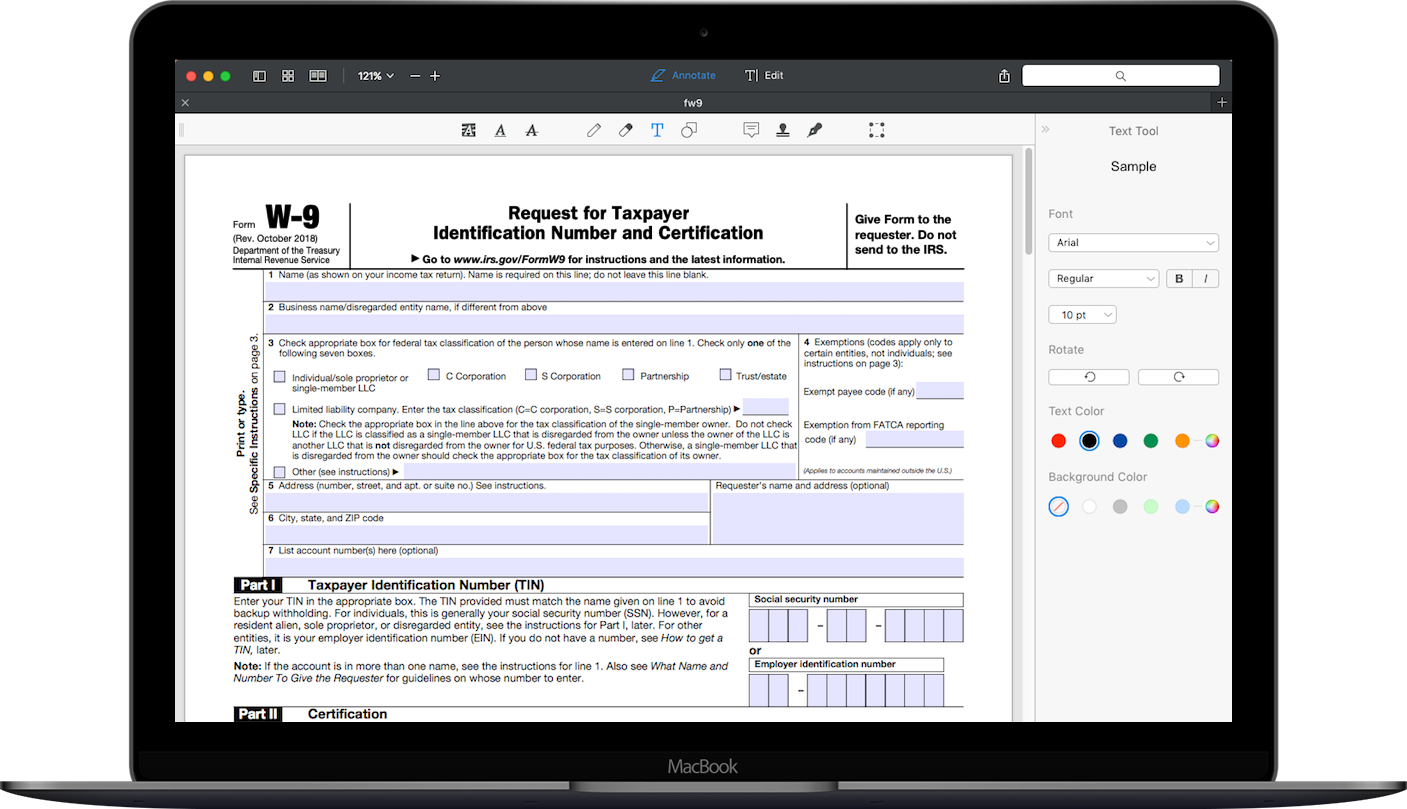

Having a printable W-9 form readily available can streamline the process of collecting this important information. It allows businesses to easily distribute the form to their vendors and contractors, ensuring that all necessary details are provided in a timely manner. This can help avoid delays in processing payments and ensure compliance with tax regulations.

Get and Print Printable W 9 Forms

Video Create A Substitute W 9 VIMCOE

Video Create A Substitute W 9 VIMCOE

Printable W 9 Forms

Printable W-9 forms are widely available online from various sources, including the Internal Revenue Service (IRS) website. These forms can be easily downloaded, printed, and filled out by individuals who need to provide their information to businesses for tax purposes. Having a printable version of the form makes it convenient for both parties involved in the transaction.

Businesses can also benefit from using printable W-9 forms as they can keep a record of the information provided by their vendors and contractors. This can help with tax reporting and compliance requirements, ensuring that all necessary details are accurately documented and reported to the IRS when needed.

Using printable W-9 forms can also help businesses stay organized and maintain accurate records of their vendors and contractors. By collecting this information upfront, they can avoid last-minute requests for information and ensure that all necessary documentation is readily available when needed. This can save time and effort in the long run and help businesses avoid potential penalties for non-compliance.

In conclusion, printable W-9 forms are a valuable tool for businesses and individuals alike when it comes to tax reporting and compliance. By utilizing these forms, both parties can ensure that all necessary information is collected and reported accurately, helping to streamline the process and avoid potential issues down the line.