When starting a new job, one of the first forms you’ll likely encounter is the W-4 form. This form is used by employers to determine how much federal income tax to withhold from your paycheck. It’s important to fill out this form accurately to avoid any surprises come tax season.

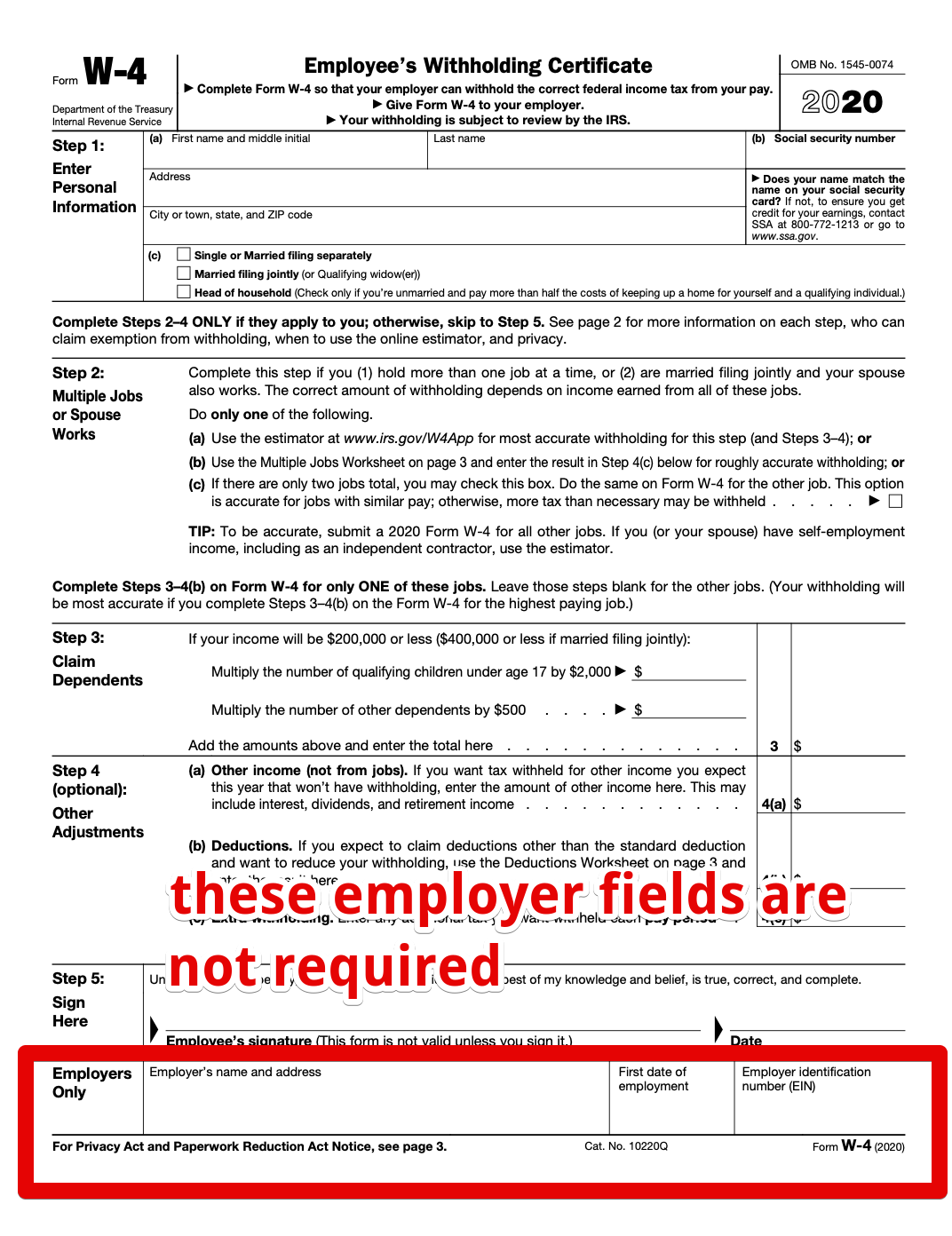

Understanding the W-4 form can seem daunting at first, but with a little guidance, you’ll be able to navigate it with ease. The form asks for information such as your filing status, number of dependents, and any additional income you expect to receive. By providing this information, you can ensure that the correct amount of taxes is withheld from your paycheck.

Get and Print Printable W 4 Form

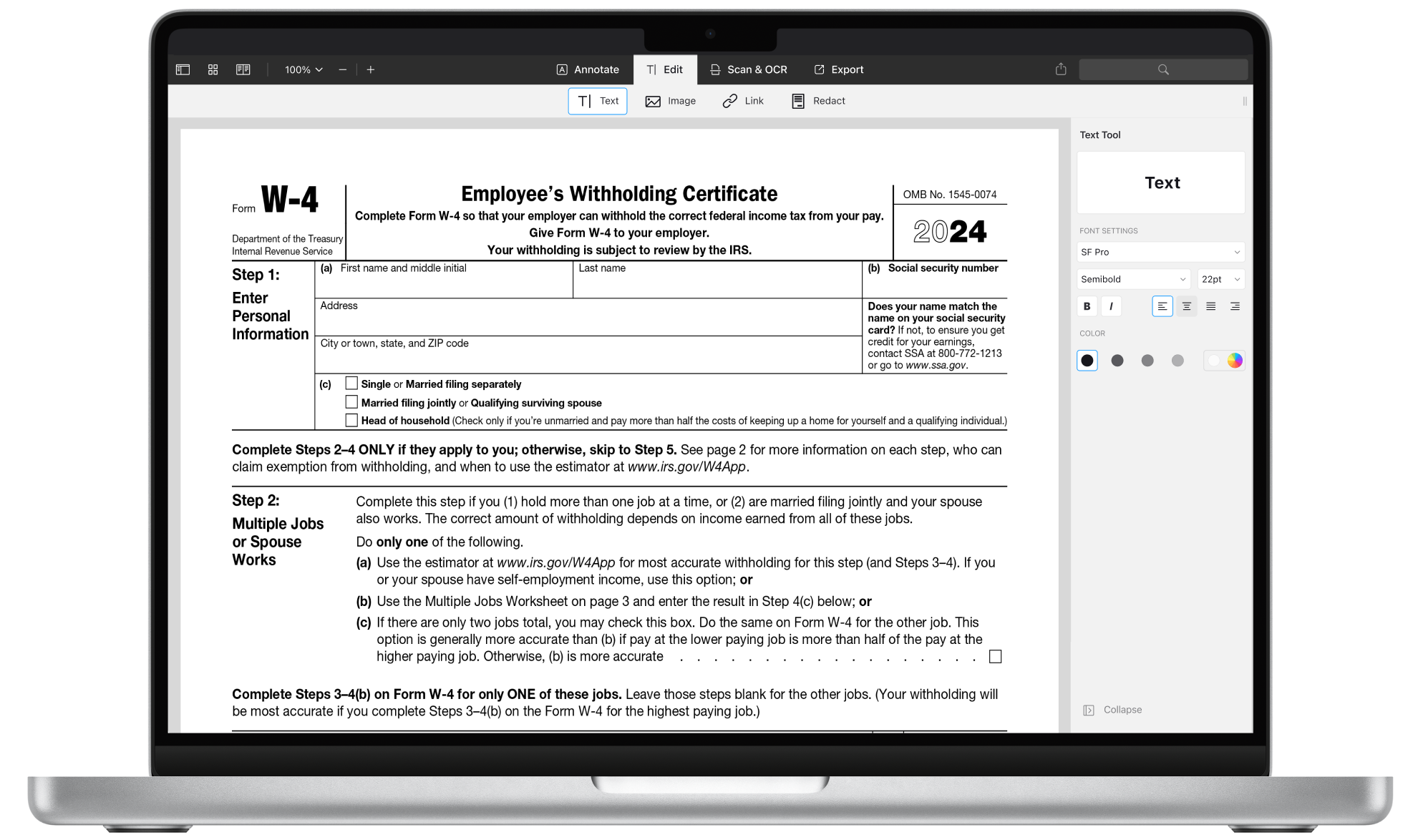

Das IRS Formular W4 F R 2024 Als PDF Ausf Llen PDF Expert

Das IRS Formular W4 F R 2024 Als PDF Ausf Llen PDF Expert

Printable W-4 Form

If you’re looking for a printable W-4 form, you’re in luck! Many websites offer downloadable versions of the form that you can fill out electronically or print and complete by hand. Having a printable W-4 form on hand can make the process of updating your tax withholding information quick and convenient.

When filling out the W-4 form, it’s important to carefully review each section and provide accurate information. This includes indicating your filing status, claiming any allowances you are eligible for, and specifying any additional withholding amounts you’d like to have deducted from your paycheck. By taking the time to fill out the form correctly, you can help ensure that you’re not overpaying or underpaying your taxes.

Once you’ve completed the W-4 form, be sure to submit it to your employer as soon as possible. Your employer will use the information you provide on the form to calculate the amount of federal income tax to withhold from your paycheck. Keep in mind that you can update your W-4 form at any time if your financial situation changes, such as getting married, having a child, or taking on a second job.

In conclusion, understanding and correctly filling out the W-4 form is essential for managing your tax withholdings effectively. By utilizing a printable W-4 form and following the instructions carefully, you can ensure that the right amount of taxes is withheld from your paycheck. Take the time to review your tax withholding information periodically to ensure that it aligns with your current financial situation.