As the tax deadline approaches, many individuals find themselves scrambling to gather all necessary documents and information to file their taxes on time. However, for those who need more time to complete their tax return, the IRS offers Form 4868 as an extension request. This form allows taxpayers an additional six months to file their taxes, pushing the deadline from April to October.

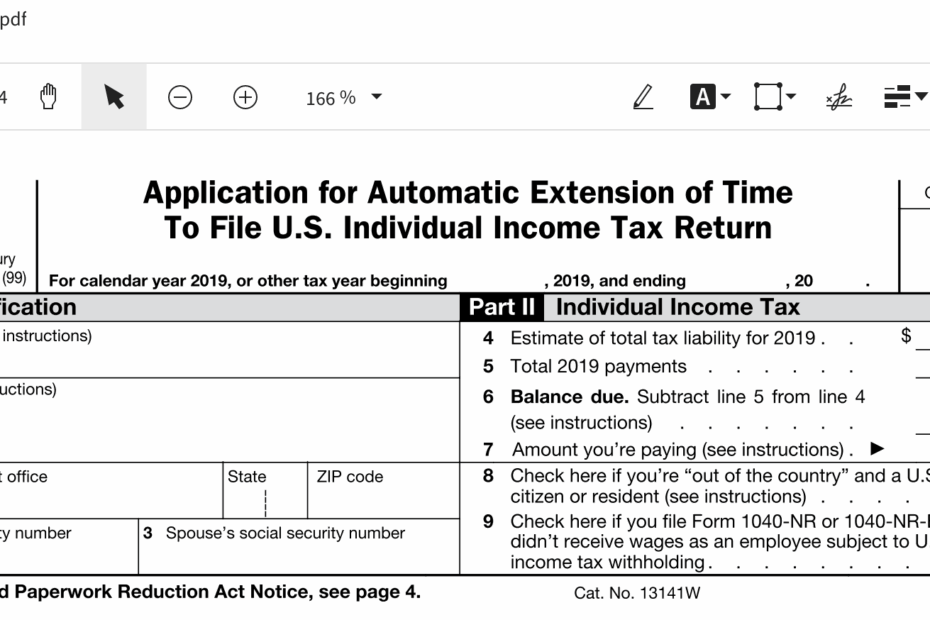

Form 4868 is a simple one-page document that requires basic information such as name, address, Social Security number, estimated tax liability, and the amount of tax already paid. By submitting this form by the original tax deadline, individuals can avoid late filing penalties and interest charges.

Easily Download and Print Printable Irs Form 4868

Form 4868 2024 2025 Fill Edit Download Forms PDF Guru

Form 4868 2024 2025 Fill Edit Download Forms PDF Guru

Once the form is completed, taxpayers can choose to file electronically or mail it to the IRS. Many online tax preparation services also offer the option to submit Form 4868 electronically, making the process quick and convenient.

It’s important to note that while Form 4868 grants an extension for filing taxes, it does not extend the deadline for paying any taxes owed. Taxpayers should estimate their tax liability as accurately as possible when completing the form to avoid underpayment penalties.

For those who need even more time to file, the IRS does allow for additional extensions under certain circumstances. However, these extensions are typically granted on a case-by-case basis and may require a valid reason for the delay.

In conclusion, Form 4868 is a valuable tool for individuals who need extra time to file their taxes. By submitting this form before the original tax deadline, taxpayers can avoid penalties and interest charges while ensuring they have ample time to complete their tax return accurately.