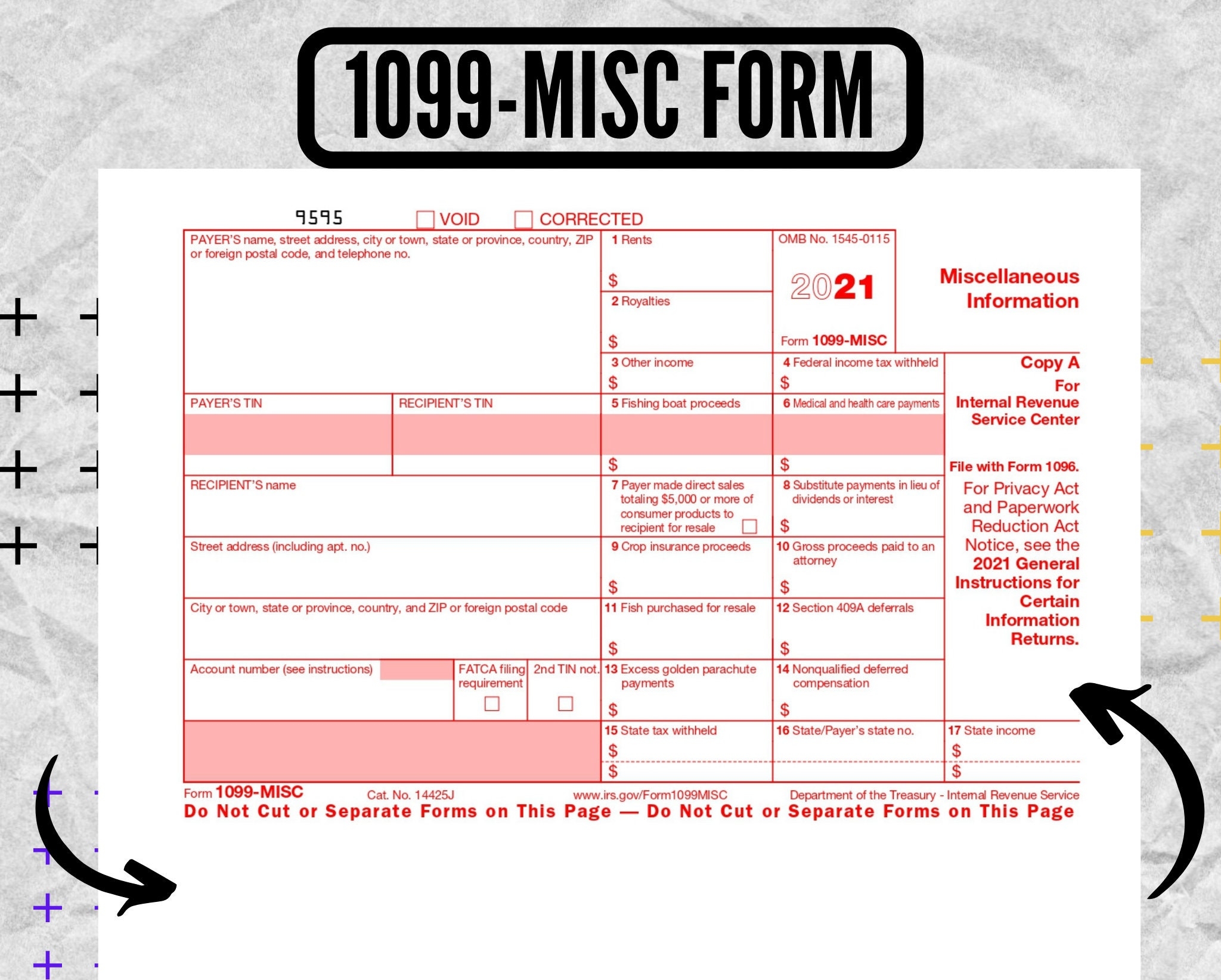

As a freelancer or independent contractor, receiving a 1099 form is a common occurrence. This form is used to report income earned from self-employment, investments, or other sources. It is essential to understand how to handle and file your 1099 form correctly to avoid any potential issues with the IRS.

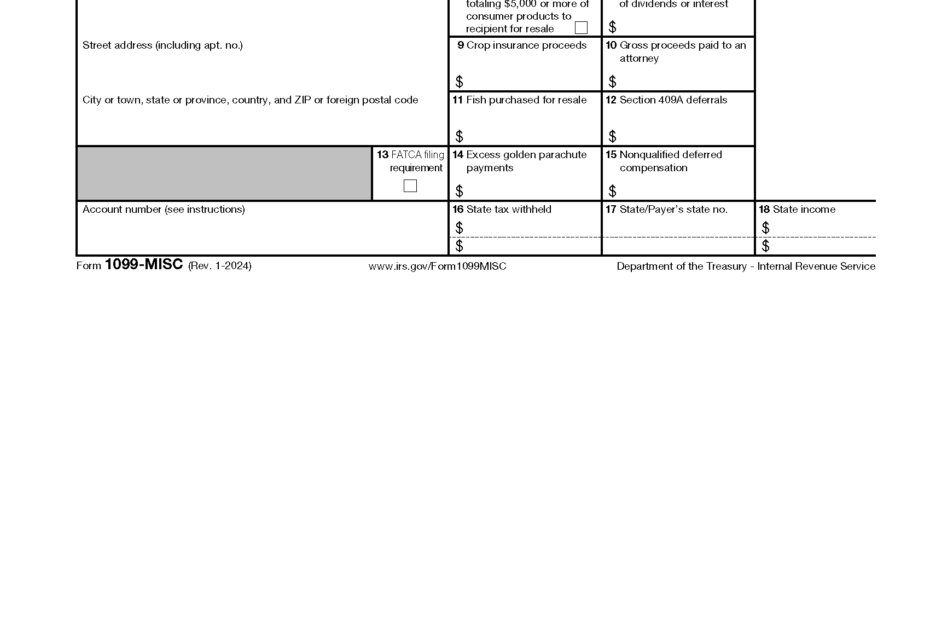

One of the easiest ways to obtain a 1099 form is by printing it online. There are various websites that offer printable versions of the form, making it convenient for individuals to access and fill out the necessary information. Having a printable 1099 form allows you to easily report your income and ensure compliance with tax regulations.

Easily Download and Print 1099 Form Printable

1099 MISC Form 1099 Misc 2020 1099 Misc Form 2020 Printable 1099 Form Etsy UK

1099 MISC Form 1099 Misc 2020 1099 Misc Form 2020 Printable 1099 Form Etsy UK

1099 Form Printable

When using a printable 1099 form, it is crucial to ensure that all information is accurately filled out. This includes your personal details, income earned, and any deductions that may apply. Double-checking the form for any errors or missing information can help prevent delays or issues with your tax filing process.

Additionally, it is important to keep a record of your 1099 form for your records. This will come in handy when filing your taxes and may be required in the event of an audit. Staying organized and maintaining proper documentation can save you time and stress when it comes to tax season.

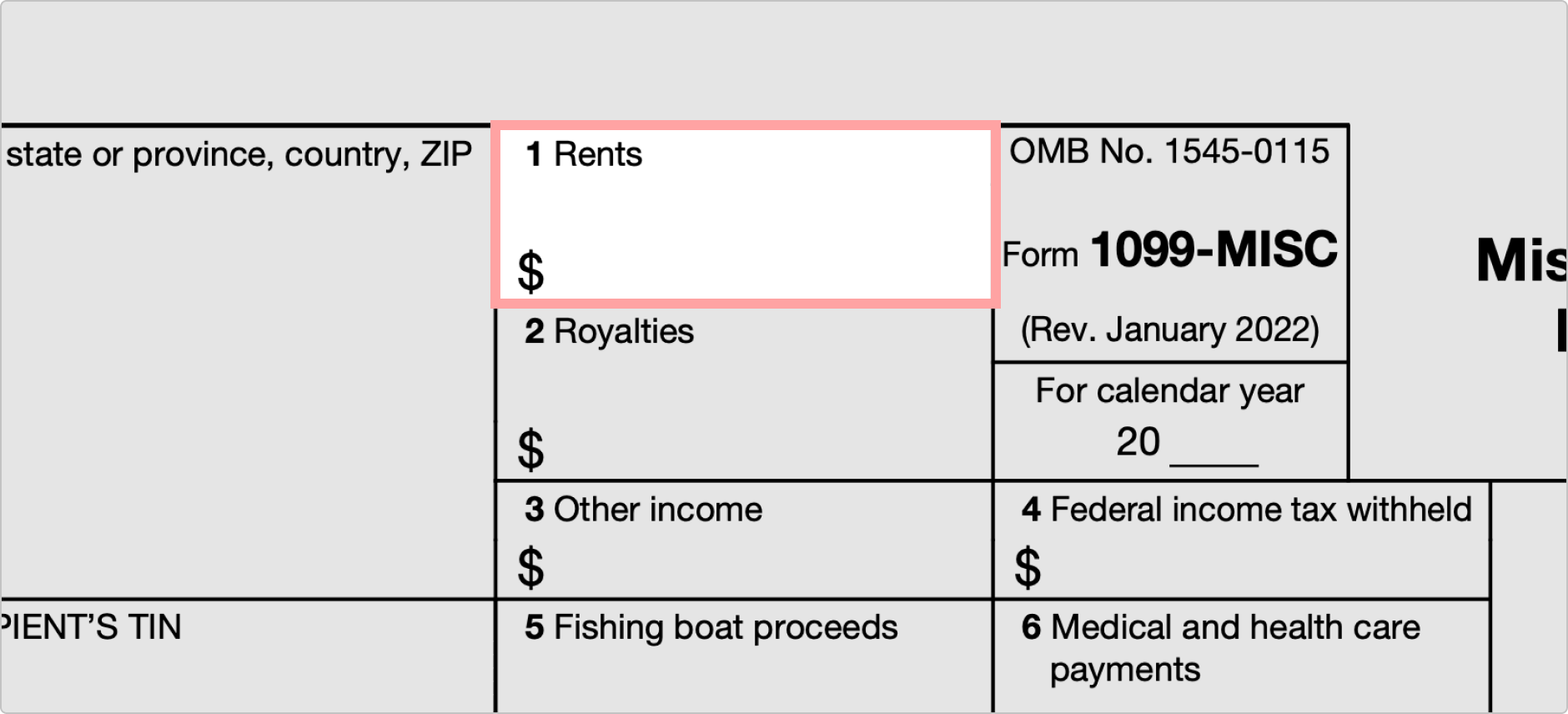

It is also worth noting that different types of 1099 forms exist, depending on the nature of your income. For example, if you received income from rental properties, you may need a different form than someone who earned income from freelance work. Understanding which 1099 form applies to your situation is crucial for accurate reporting.

In conclusion, utilizing a printable 1099 form is a convenient and efficient way to report your income as a freelancer or independent contractor. By ensuring that all information is accurately filled out and keeping a record of your form, you can navigate the tax filing process with ease. Remember to stay informed about the specific 1099 form that applies to your income sources to avoid any potential issues with the IRS.