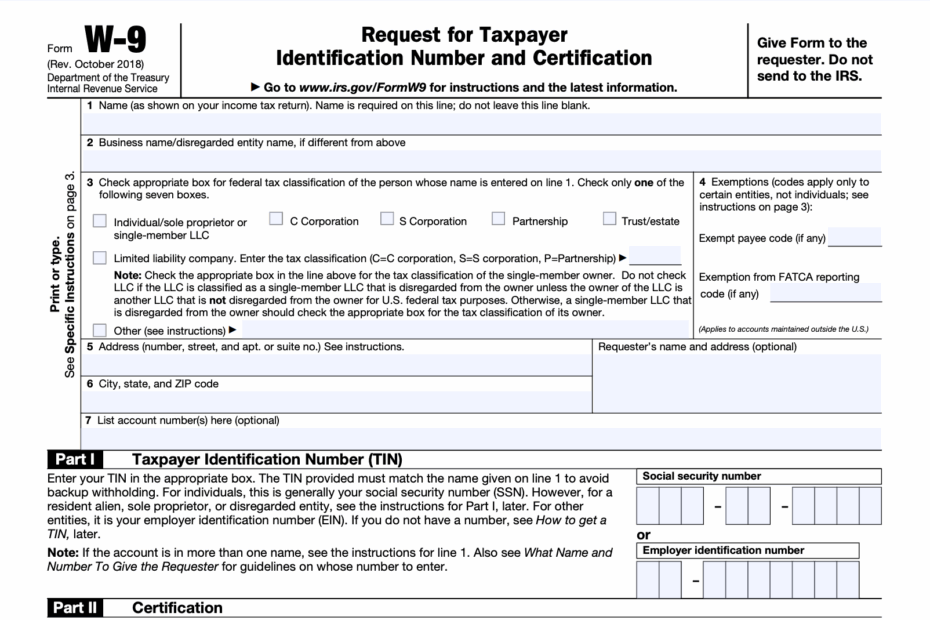

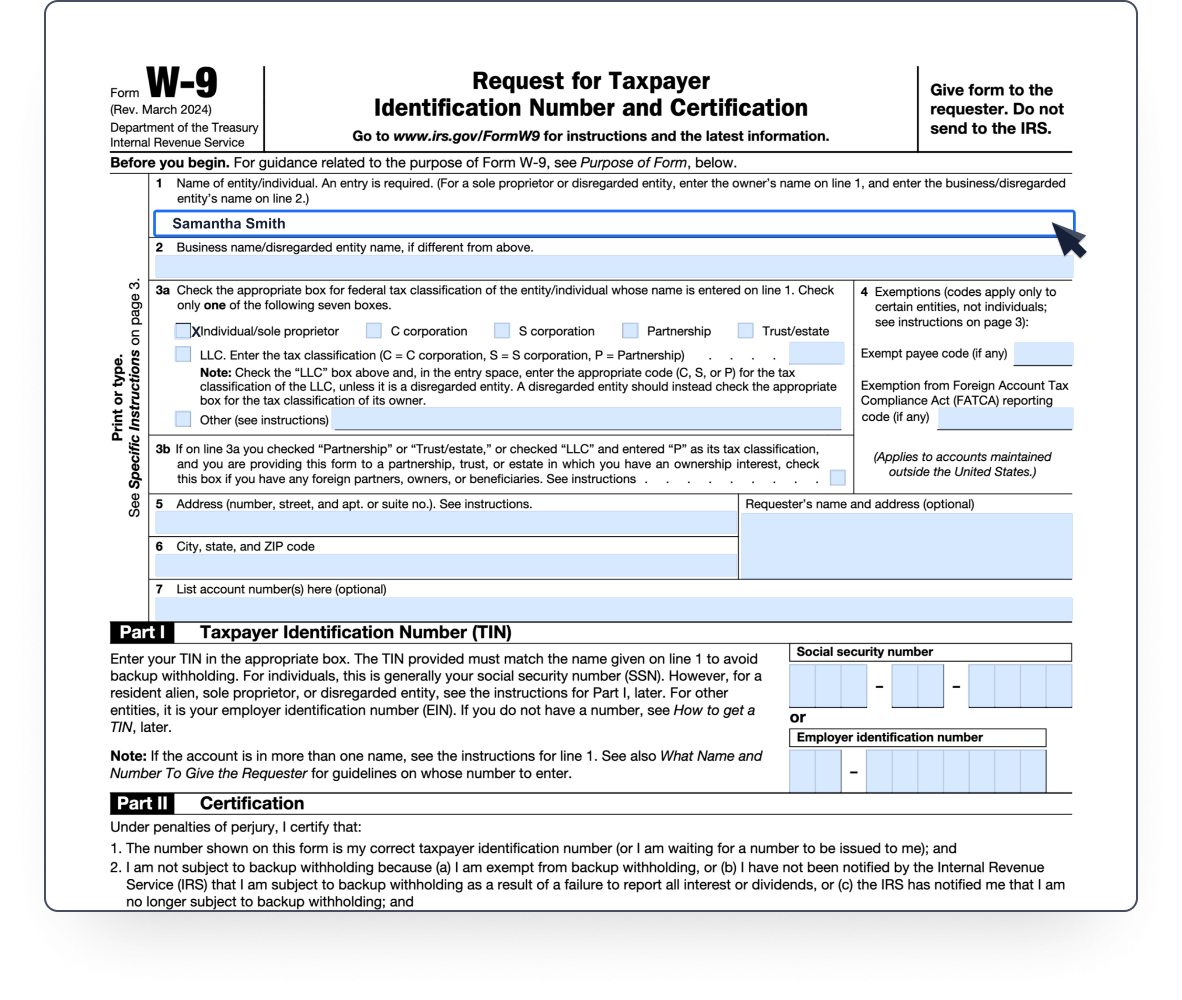

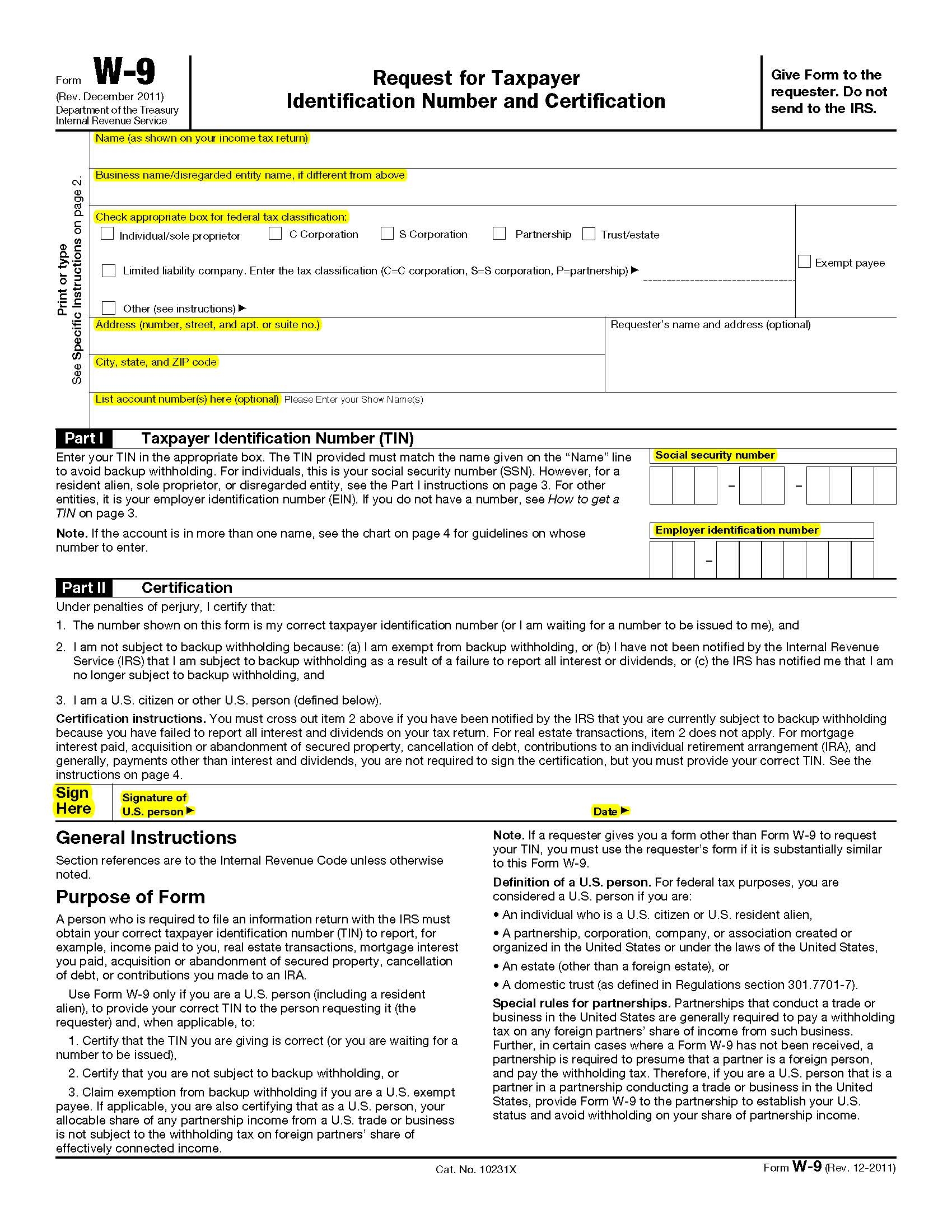

When it comes to tax season, one of the most important forms that individuals and businesses need to be familiar with is the W9 form. This form is used to request the taxpayer identification number (TIN) of a U.S. person, including resident aliens, for tax reporting purposes. It is essential for businesses that hire independent contractors or freelancers to have them fill out a W9 form to ensure compliance with IRS regulations.

Completing a W9 form is a straightforward process, as it requires basic information such as name, address, TIN, and certification. The form is used by the paying entity to report payments made to the individual or business to the IRS. It is crucial for both parties to accurately fill out the form to avoid any potential penalties or fines.

Quickly Access and Print W9 Printable Form

One convenient option for obtaining a W9 form is to use a printable version that can be easily accessed online. This allows individuals and businesses to download the form, fill it out electronically or manually, and submit it as needed. Having a printable W9 form on hand can streamline the process of requesting and providing taxpayer information.

It is important to note that the W9 form is not submitted to the IRS but is kept on file by the paying entity for tax reporting purposes. However, if there are any discrepancies or issues with the information provided on the form, the IRS may request a copy for verification. Therefore, it is crucial to keep accurate records and ensure that the information on the W9 form is up to date.

In conclusion, the W9 form is a vital document for tax reporting purposes, especially for businesses that engage independent contractors or freelancers. By utilizing a printable version of the form, individuals and businesses can efficiently collect and provide the necessary taxpayer information. It is essential to understand the importance of the W9 form and ensure compliance with IRS regulations to avoid any potential penalties or fines.