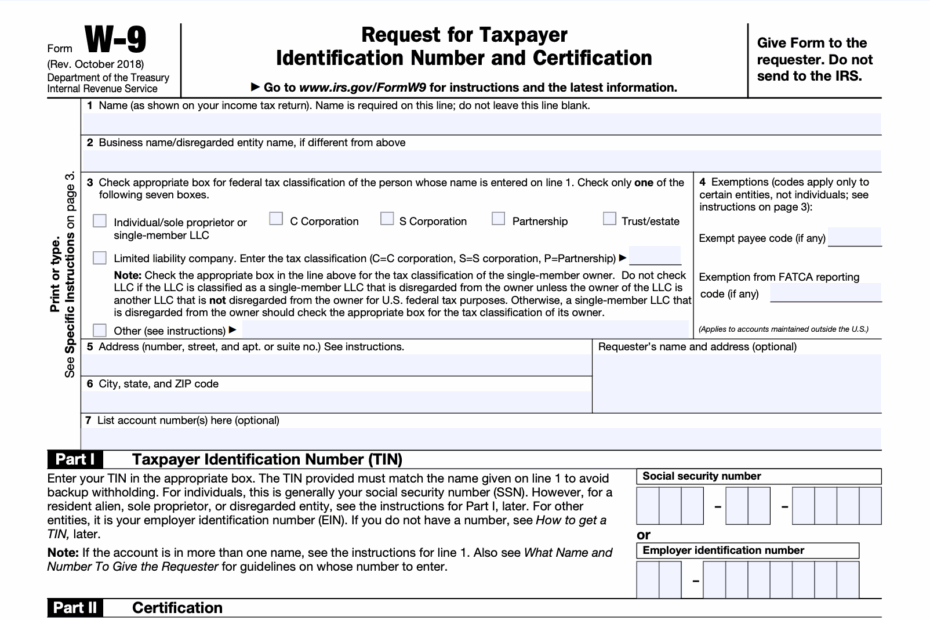

When it comes to taxes and financial matters, it’s important to have the necessary documentation in order. One such form that is commonly used in the United States is the W-9 form. This form is used to gather information from individuals or businesses that will be paid by another party, such as a client or employer. The information collected on the W-9 form is used to report payments made to the IRS.

Having a W-9 form on hand is crucial for both parties involved in a payment transaction. It ensures that the payer has the necessary information to report payments accurately, and it also helps the payee avoid any potential tax issues down the line. With the rise of digital forms and online document management, it’s easier than ever to access and fill out a W-9 form.

Easily Download and Print W 9 Forms Printable

2024 W 9 Form Fillable Printable Downloadable 2024 Instructions

2024 W 9 Form Fillable Printable Downloadable 2024 Instructions

W 9 Forms Printable

For those who prefer a more traditional approach, printable W-9 forms are readily available online. These forms can be easily downloaded, printed, and filled out manually. This option is ideal for individuals or businesses that prefer to have physical copies of important documents on hand.

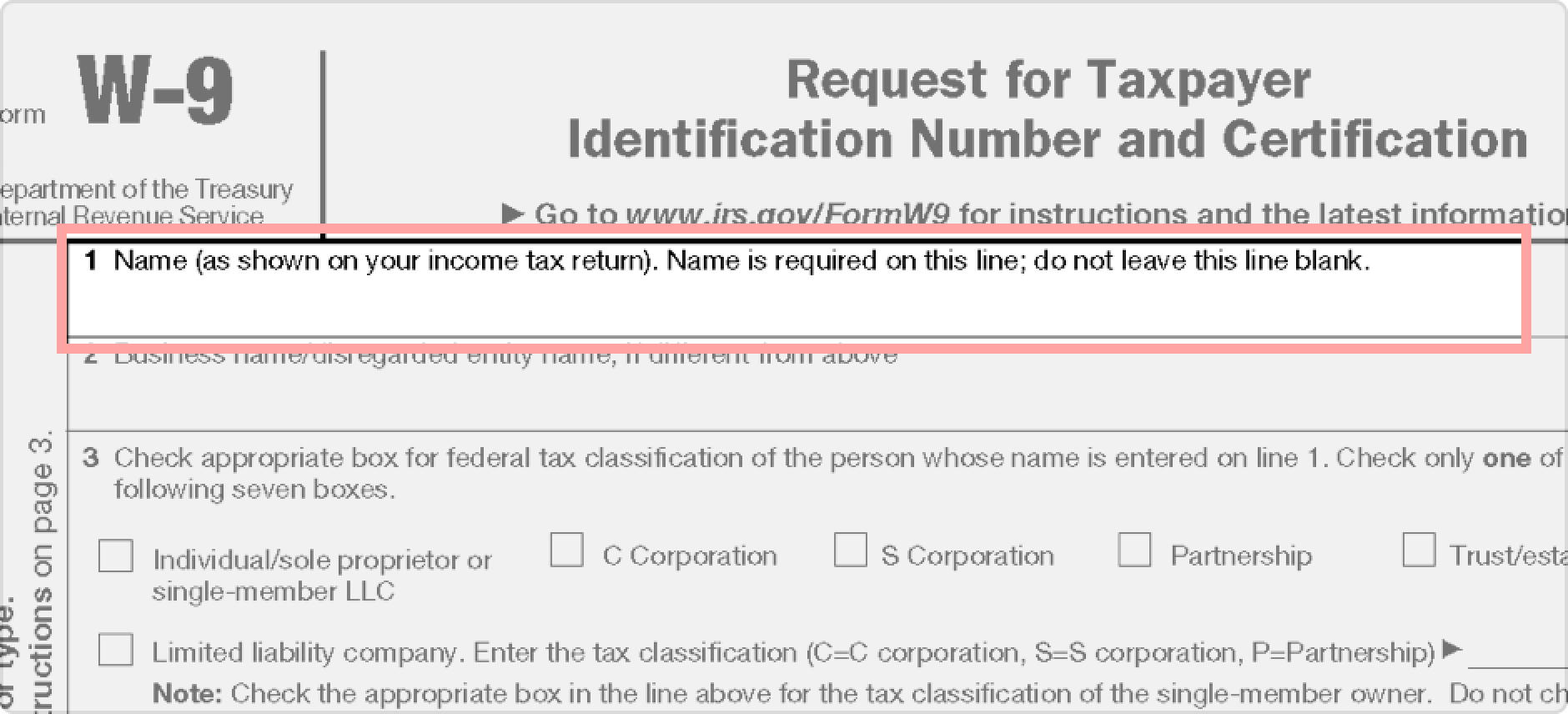

When filling out a printable W-9 form, it’s important to provide accurate and up-to-date information. This includes your legal name, business name (if applicable), address, taxpayer identification number (TIN), and any other required details. Once the form is completed, it should be submitted to the payer as soon as possible to ensure timely and accurate reporting of payments.

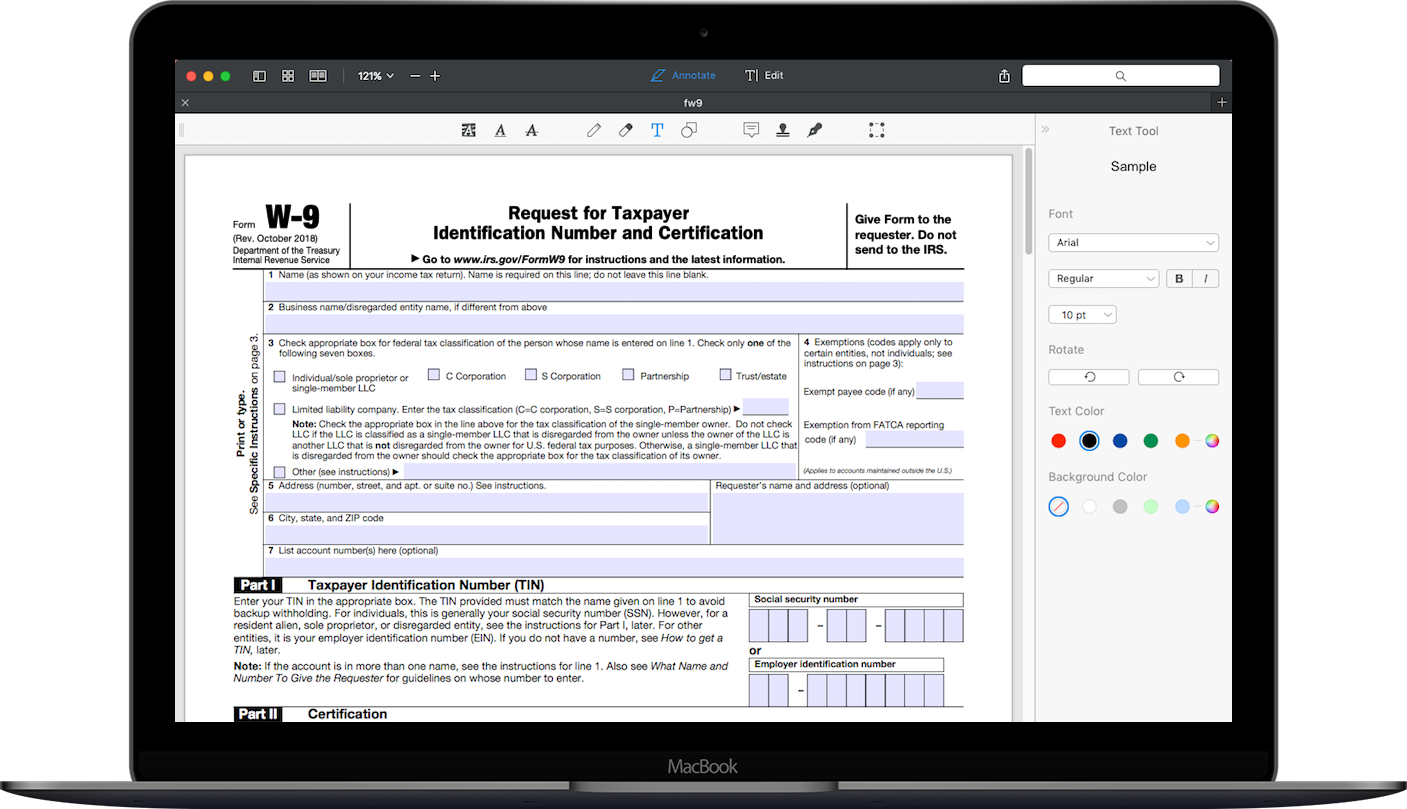

In addition to printable versions, many online platforms offer digital W-9 forms that can be filled out electronically. This option allows for a more streamlined and efficient process, as the form can be completed and submitted online with just a few clicks. Digital W-9 forms also provide the added benefit of being easily accessible and stored securely in a digital format.

Whether you choose to use a printable or digital W-9 form, the key is to ensure that all required information is accurately provided. By staying organized and up-to-date with your tax documentation, you can avoid potential issues and ensure smooth financial transactions.

In conclusion, having a W-9 form on hand is essential for anyone involved in payment transactions. Whether you opt for a printable or digital version, the important thing is to provide accurate information and submit the form in a timely manner. By doing so, you can help ensure compliance with tax regulations and maintain good financial standing.