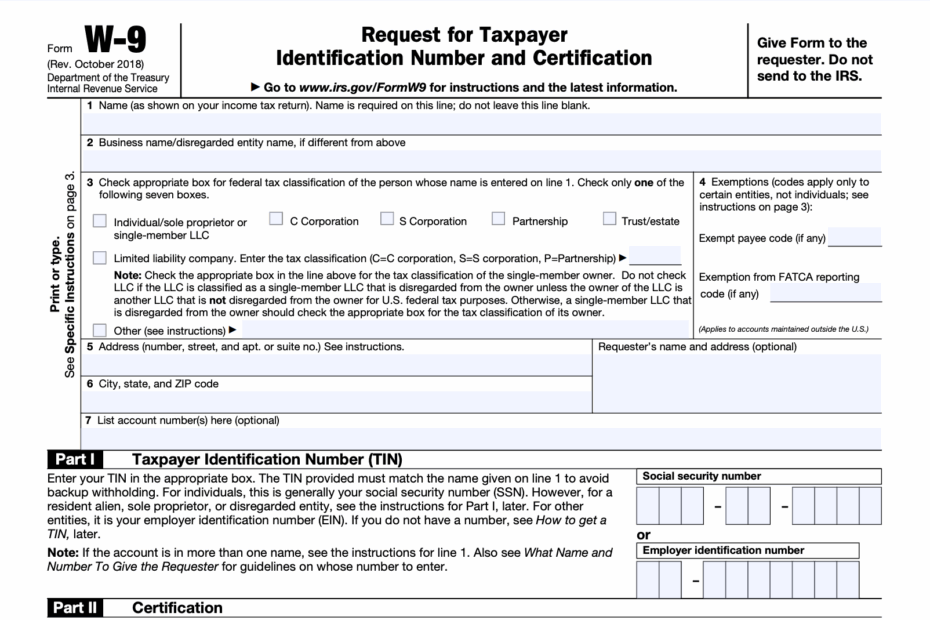

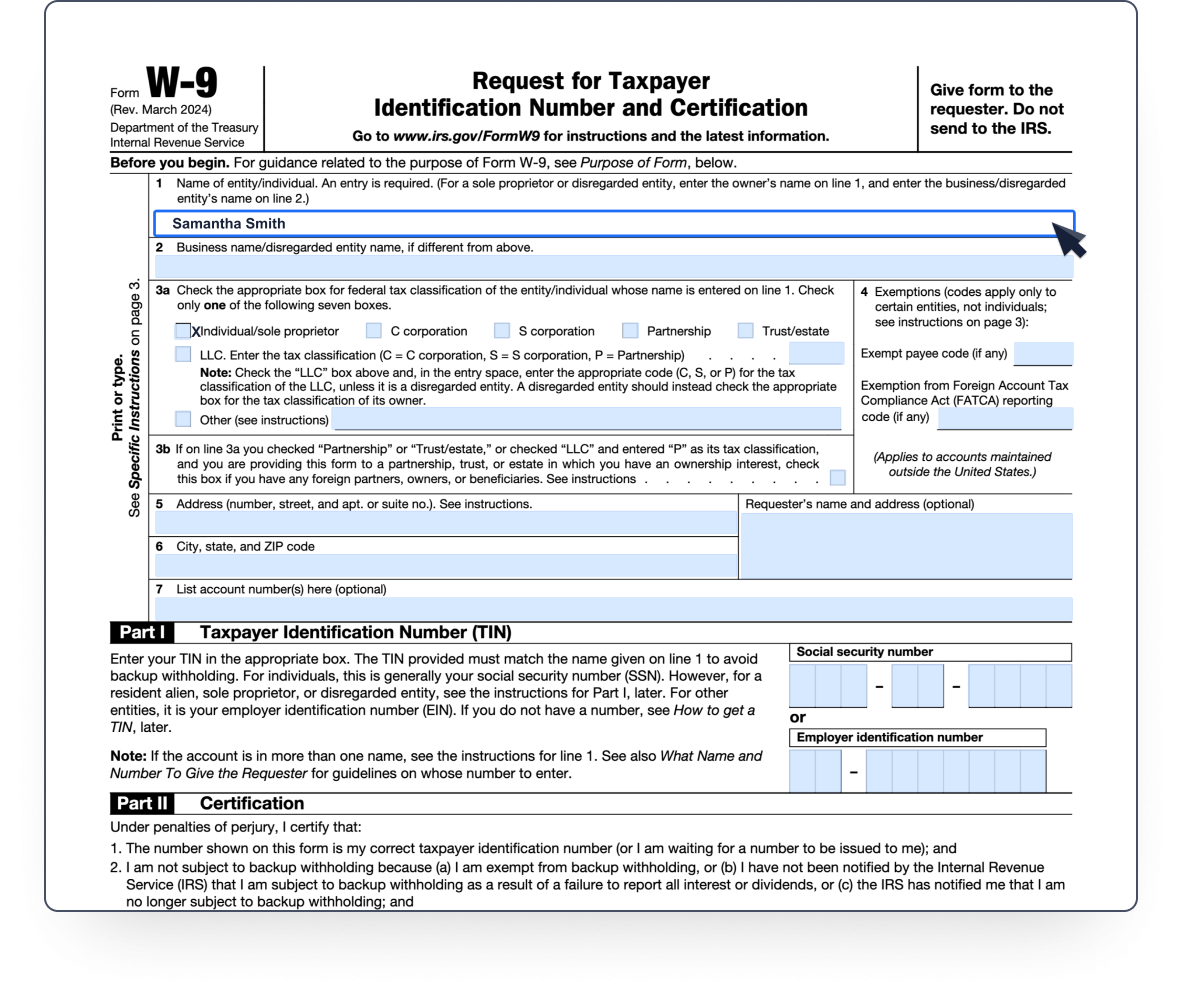

When it comes to tax season, having all the necessary forms ready is crucial. One important form that businesses often require from their vendors or independent contractors is the W9 form. This form is used to collect information about the taxpayer for reporting purposes. While it may seem like a hassle to fill out, having a printable W9 form on hand can make the process much easier.

A printable W9 form is a convenient way to gather the necessary information from vendors or contractors without having to worry about physical copies. This form typically includes fields for the individual’s name, address, taxpayer identification number, and signature. By providing a printable version of the W9 form, businesses can streamline the process of collecting important tax information.

Get and Print Printable W9 Form

W 9 Form 2024 Fillable PDF For Secure And Legal Tax ID Sharing Worksheets Library

W 9 Form 2024 Fillable PDF For Secure And Legal Tax ID Sharing Worksheets Library

One of the main benefits of using a printable W9 form is the ease of access. Instead of having to request a physical copy from each vendor or contractor, businesses can simply provide a link to the printable form on their website or through email. This saves time and ensures that all the necessary information is collected in a timely manner.

Additionally, printable W9 forms can be filled out electronically, making it even more convenient for both parties. The form can be easily downloaded, completed, and submitted online, eliminating the need for printing and mailing. This not only saves time but also reduces the risk of errors that may occur when filling out the form by hand.

Overall, having a printable W9 form available is a practical solution for businesses looking to streamline their tax reporting process. By providing vendors and contractors with easy access to the form, businesses can ensure that all necessary information is collected accurately and efficiently. So, if you’re in need of a W9 form, consider using a printable version to simplify the process.

With the convenience and efficiency that printable W9 forms offer, businesses can easily gather the required tax information from their vendors and contractors. By providing a simple and accessible solution, businesses can ensure compliance with tax regulations and avoid any potential issues during tax season.