Filing income taxes can be a daunting task, but having the necessary forms at your disposal can make the process much easier. In Georgia, taxpayers have access to printable forms for the 2016 tax year that can be filled out and submitted either online or by mail.

Whether you are a full-time employee, self-employed individual, or a retiree, it is important to stay organized and informed when it comes to filing your taxes. By utilizing the 2016 Georgia income tax printable forms, you can ensure that you are meeting all necessary requirements and maximizing your potential refunds.

2016 Georgia Income Tax Printable Forms

2016 Georgia Income Tax Printable Forms

Download and Print 2016 Georgia Income Tax Printable Forms

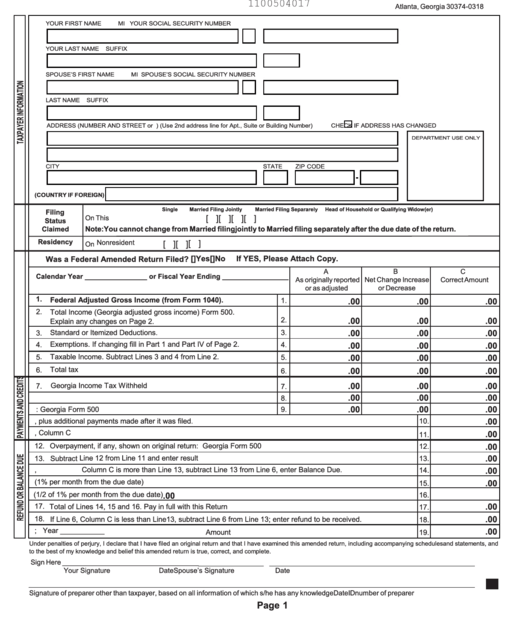

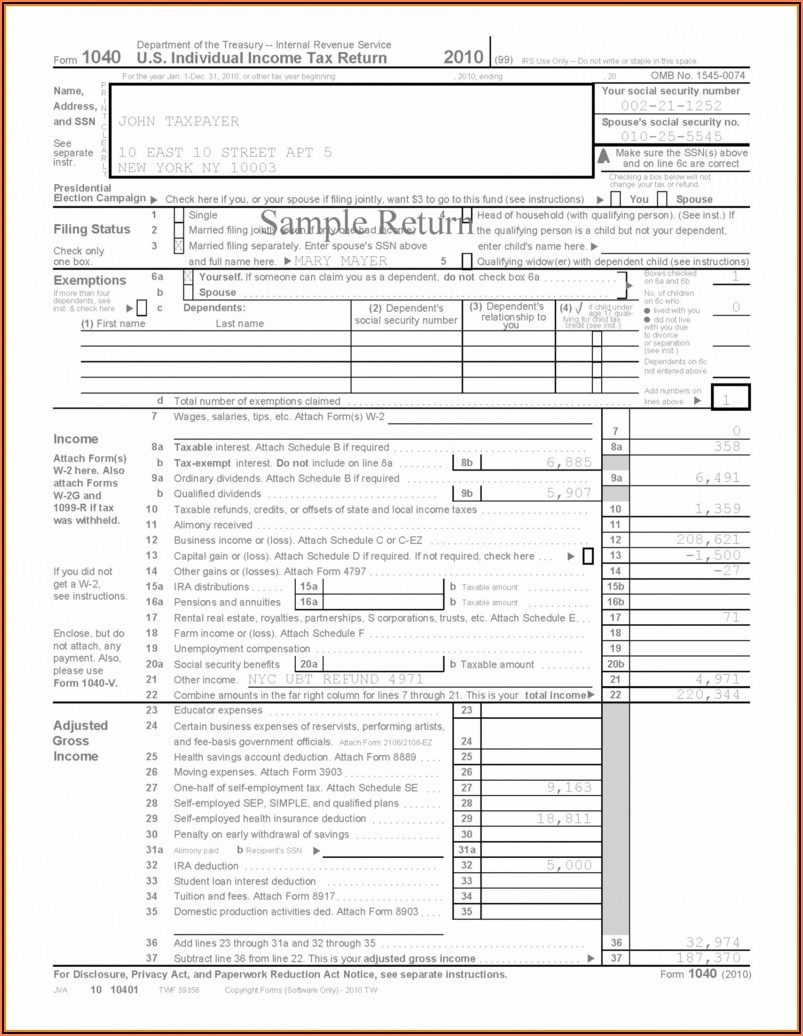

There are various forms available for different types of income and deductions. Some of the commonly used forms for the 2016 tax year in Georgia include Form 500 for individual income tax returns, Form 500EZ for simplified individual income tax returns, and Form 500X for amended individual income tax returns.

In addition to these forms, taxpayers may also need to fill out schedules for specific deductions or credits, such as Schedule 1 for adjustments to income, Schedule 2 for tax credits, and Schedule 3 for nonresident or part-year resident allocations.

It is important to carefully review each form and schedule to ensure that all information is accurate and up to date. Any errors or omissions could result in delays in processing your return or potential penalties from the Georgia Department of Revenue.

Once you have completed all necessary forms and schedules, you can submit them either electronically through the Georgia Tax Center or by mailing them to the appropriate address. Be sure to keep copies of all documents for your records and to track the status of your return.

In conclusion, having access to the 2016 Georgia income tax printable forms can simplify the tax filing process and help you meet your obligations as a taxpayer. By staying organized and informed, you can ensure that your return is filed accurately and on time.