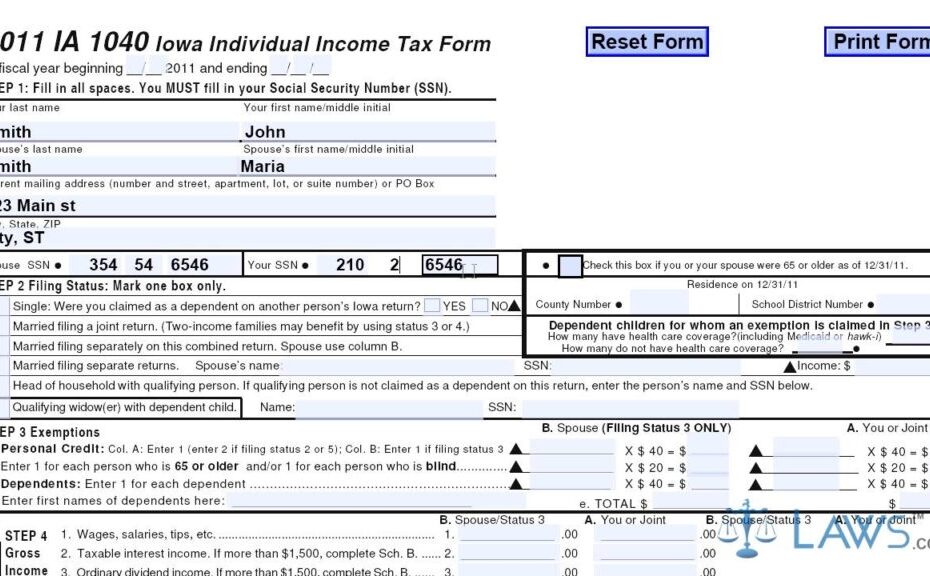

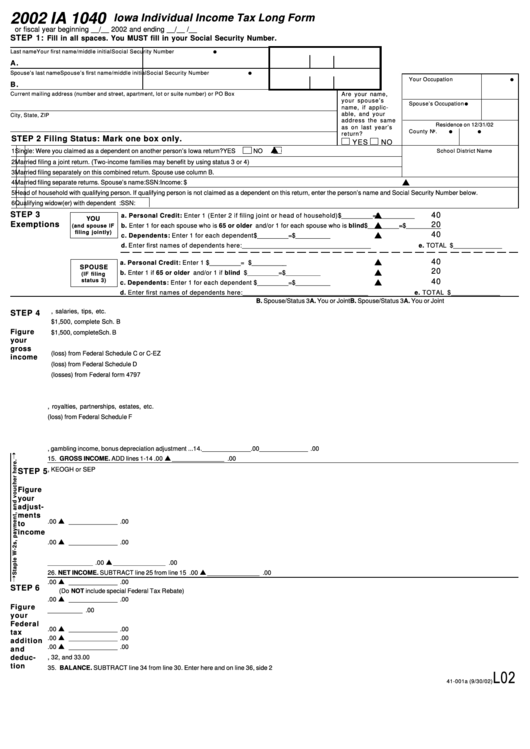

Filing taxes can be a daunting task, but having the right forms can make the process much easier. The IA 1040 Iowa Individual Income Tax Form is an essential document for residents of Iowa to report their income and calculate their tax liability for the year.

For the tax year 2018, the IA 1040 form is available for download and print on the Iowa Department of Revenue website. This form includes sections for personal information, income sources, deductions, and tax credits, making it comprehensive and user-friendly for taxpayers.

2018 Ia 1040 Iowa Individual Income Tax Form Printable

2018 Ia 1040 Iowa Individual Income Tax Form Printable

Quickly Access and Print 2018 Ia 1040 Iowa Individual Income Tax Form Printable

When filling out the IA 1040 form, taxpayers must ensure that all information is accurate and up-to-date to avoid any discrepancies or delays in processing. It is important to double-check calculations and review all entries before submitting the form to the Iowa Department of Revenue.

Additionally, taxpayers may need to include additional schedules or forms depending on their specific financial situation, such as income from rental properties or self-employment income. These supplementary documents should be attached to the IA 1040 form when filing taxes.

After completing the IA 1040 form and any necessary schedules, taxpayers can submit their tax return either electronically or by mail. Electronic filing is often faster and more convenient, but some individuals may prefer to file by mail for security or personal reasons.

Overall, the 2018 IA 1040 Iowa Individual Income Tax Form Printable is a valuable resource for residents of Iowa to fulfill their tax obligations and ensure compliance with state tax laws. By following the instructions carefully and submitting all required documentation, taxpayers can successfully file their taxes and avoid potential penalties or audits.