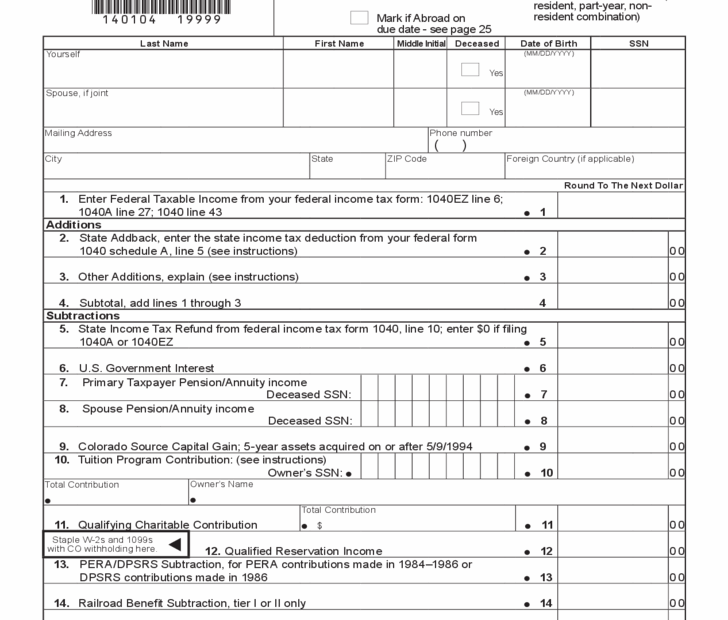

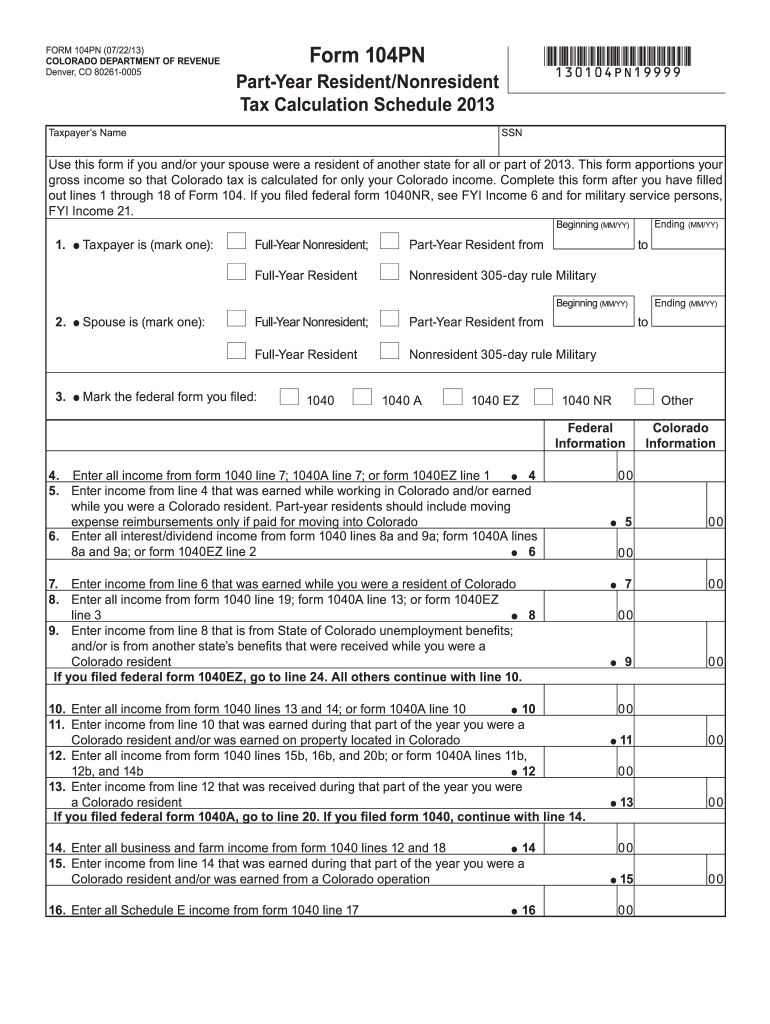

Filing taxes can be a daunting task, but having the right forms at your disposal can make the process much easier. For Colorado residents, the Income Tax Form 104 is a crucial document that needs to be filled out accurately to ensure compliance with state tax laws.

Whether you are a new resident or a long-time taxpayer in Colorado, understanding how to properly fill out the Income Tax Form 104 is essential. This form is used to report your income, deductions, credits, and calculate the amount of tax you owe or the refund you are entitled to receive.

Printable Colorado Income Tax Form 104 2019

Printable Colorado Income Tax Form 104 2019

Easily Download and Print Printable Colorado Income Tax Form 104 2019

Printable Colorado Income Tax Form 104 2019

The Printable Colorado Income Tax Form 104 for the year 2019 is readily available online on the Colorado Department of Revenue website. This form can be downloaded, printed, and filled out manually, or you can choose to fill it out electronically using tax preparation software.

When filling out the form, make sure to carefully follow the instructions provided and double-check all the information entered to avoid any errors. It is important to include all sources of income, deductions, and credits accurately to ensure that your tax return is processed smoothly.

Once you have completed the form, you can either mail it to the Colorado Department of Revenue or file it electronically through their online portal. If you are expecting a refund, filing electronically can expedite the process and help you receive your refund faster.

Remember that the deadline for filing your Colorado Income Tax Form 104 for the year 2019 is typically April 15th, unless an extension has been granted. Failing to file on time can result in penalties and interest charges, so be sure to submit your tax return before the deadline.

In conclusion, the Printable Colorado Income Tax Form 104 for the year 2019 is a crucial document that all Colorado residents need to fill out accurately and submit on time. By familiarizing yourself with the form and following the instructions carefully, you can ensure that your tax return is processed smoothly and efficiently.