When tax season rolls around, it’s important to have all the necessary forms ready to ensure a smooth filing process. For residents of Pennsylvania, knowing where to find and how to fill out the state income tax forms is crucial. Thankfully, the Pennsylvania Department of Revenue provides printable forms online for taxpayers to easily access and complete.

Understanding the tax forms and requirements can be daunting, but with the right resources, you can navigate through the process with ease. Whether you are filing as an individual or a business entity, having the correct forms is essential to accurately report your income and deductions to the state.

Printable Pa State Income Tax Forms 2018

Printable Pa State Income Tax Forms 2018

Save and Print Printable Pa State Income Tax Forms 2018

Printable Pa State Income Tax Forms 2018

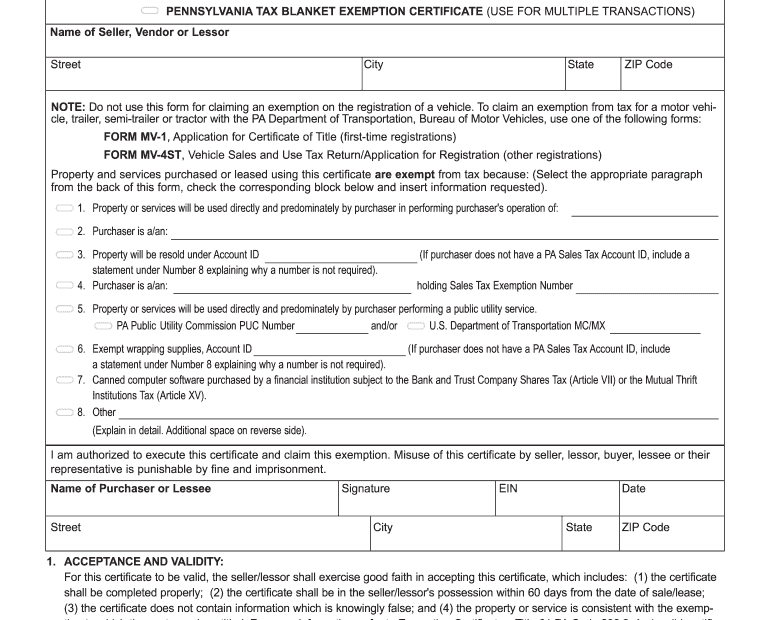

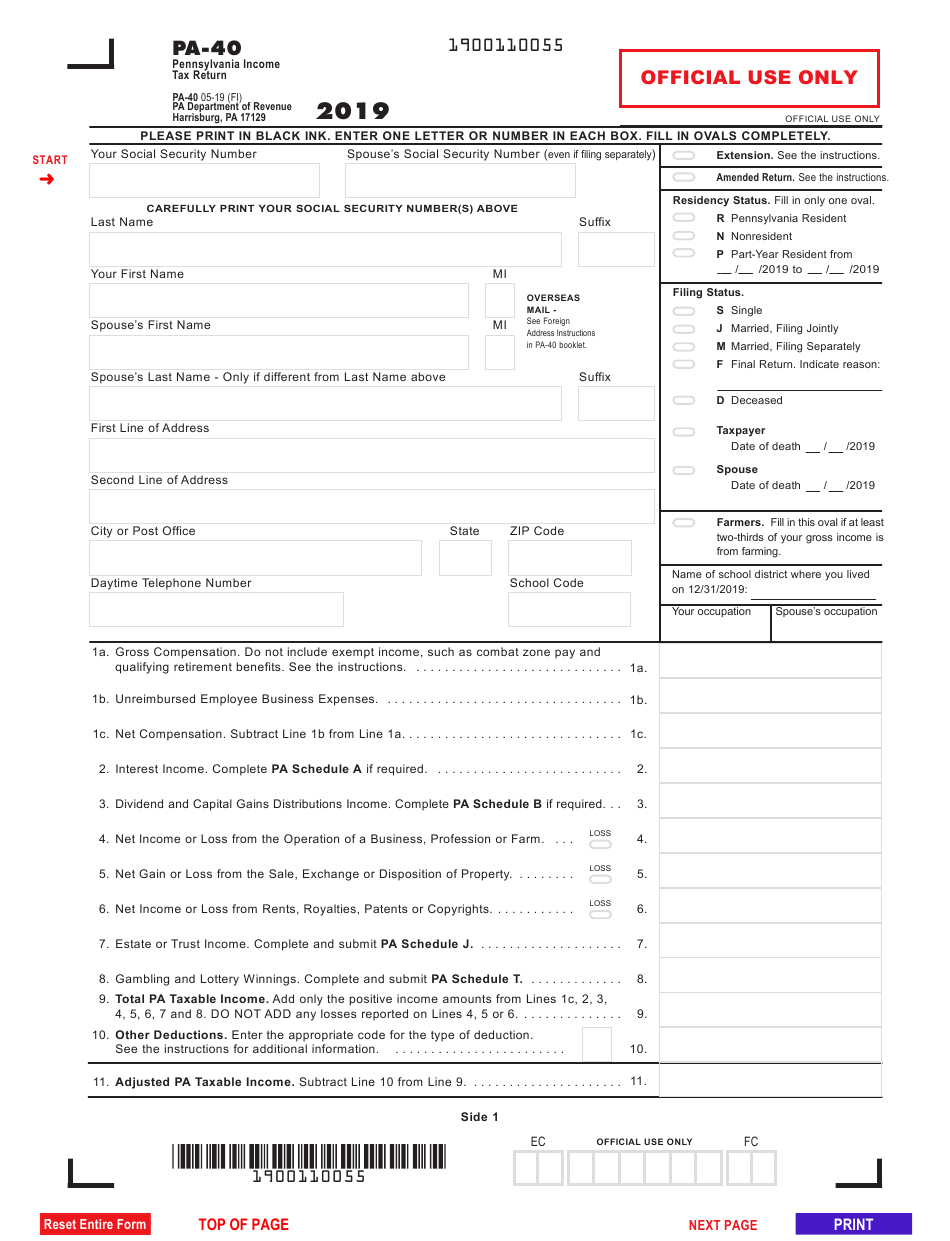

For the tax year 2018, Pennsylvania offers a variety of printable tax forms on their official website. These forms include the PA-40 Individual Income Tax Return, PA-20S/PA-65 Corporate Tax Report, and PA-41 Fiduciary Income Tax Return, among others. Each form is tailored to different types of taxpayers and serves specific purposes in reporting income and deductions.

It’s crucial to carefully review each form’s instructions before filling them out to ensure accurate reporting. Additionally, taxpayers may need to attach supporting documents, such as W-2s, 1099s, and other income statements, to complete their tax returns fully.

By utilizing the printable Pa State Income Tax Forms 2018, taxpayers can conveniently file their taxes from the comfort of their homes. These forms are designed to streamline the filing process and provide clear guidance on what information is required for each section. With the correct forms in hand, taxpayers can accurately report their income and deductions to the Pennsylvania Department of Revenue.

In conclusion, having access to Printable Pa State Income Tax Forms 2018 is essential for Pennsylvania taxpayers to fulfill their tax obligations. By utilizing these forms and following the instructions provided, individuals and businesses can accurately report their income and deductions to the state. With tax season approaching, it’s crucial to gather all necessary forms and documents to ensure a smooth filing process.