As tax season approaches, it’s essential for Georgia residents to be prepared with all the necessary documents to file their income tax returns. One crucial form that individuals need is the Georgia income tax form, which outlines the various income sources and deductions that taxpayers must report to the state government. By having a printable version of this form, taxpayers can easily fill it out and submit it in a timely manner.

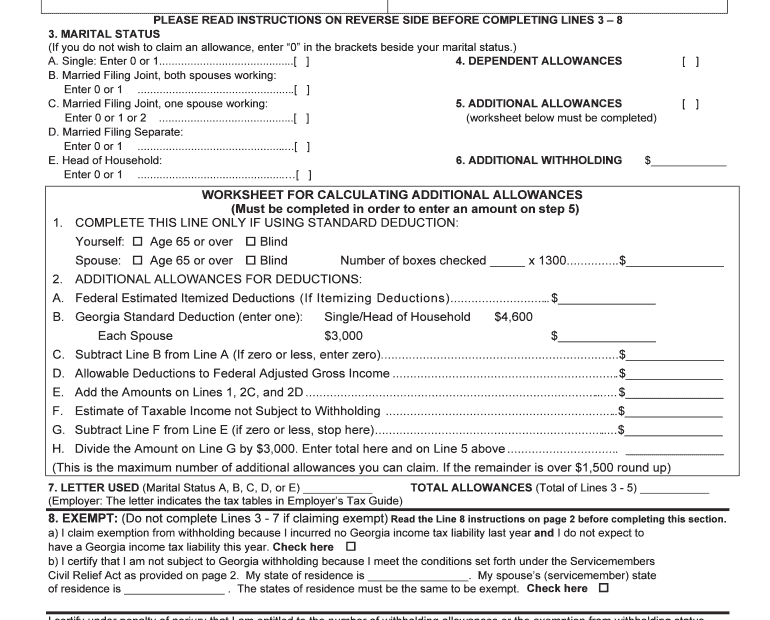

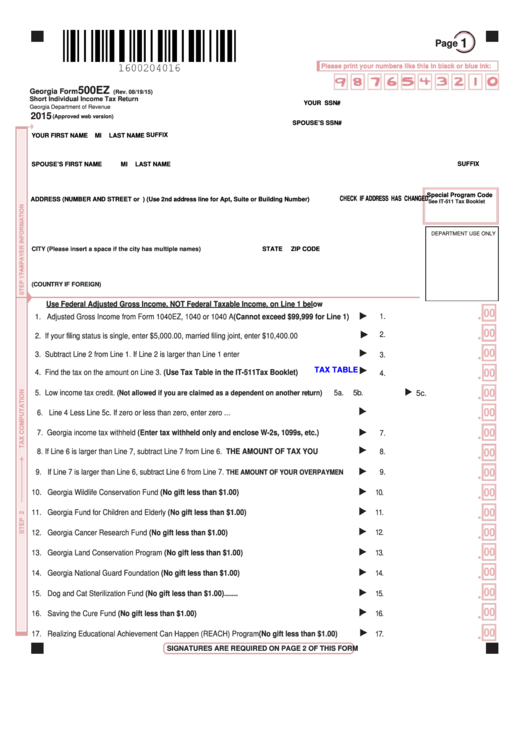

Printable Ga Income Tax Form is a convenient option for individuals who prefer to fill out their tax forms manually rather than using online tax software. It allows taxpayers to have a physical copy of the form that they can easily access and refer to when needed. This form typically includes sections for personal information, income sources, deductions, credits, and tax liability calculation.

Quickly Access and Print Printable Ga Income Tax Form

When using the Printable Ga Income Tax Form, taxpayers must ensure that they accurately report all their income sources, including wages, salaries, self-employment income, rental income, and investment income. They must also list any deductions they are eligible for, such as mortgage interest, charitable contributions, and education expenses. By filling out this form correctly, taxpayers can minimize their tax liability and potentially receive a refund.

It’s important for taxpayers to carefully review the instructions provided on the Printable Ga Income Tax Form to ensure they are completing it accurately. Any errors or omissions on the form could result in delays in processing the return or even penalties from the tax authorities. By double-checking their entries and seeking assistance from a tax professional if needed, taxpayers can avoid potential issues with their tax returns.

In conclusion, having access to a Printable Ga Income Tax Form is essential for Georgia residents who need to file their income tax returns. By utilizing this form, taxpayers can ensure they are reporting all their income sources and deductions accurately, which can help them reduce their tax liability and potentially receive a refund. It’s important to take the time to fill out the form correctly and review it before submission to avoid any errors or penalties.