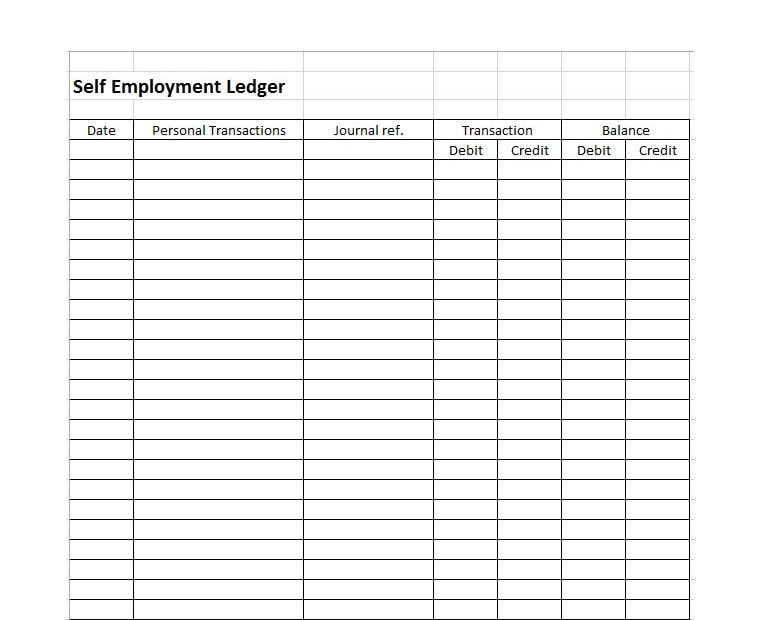

Being self-employed comes with a myriad of benefits, from setting your own hours to being your own boss. However, one of the challenges self-employed individuals face is keeping track of their income and expenses for tax purposes. This is where printable self-employment income forms come in handy.

Printable self-employment income forms are essential for self-employed individuals to accurately report their earnings to the IRS. These forms make it easier to track income, expenses, and deductions, ensuring that you are prepared come tax time.

Printable Self Employemnt Income

Printable Self Employemnt Income

Quickly Access and Print Printable Self Employemnt Income

Printable Self Employment Income

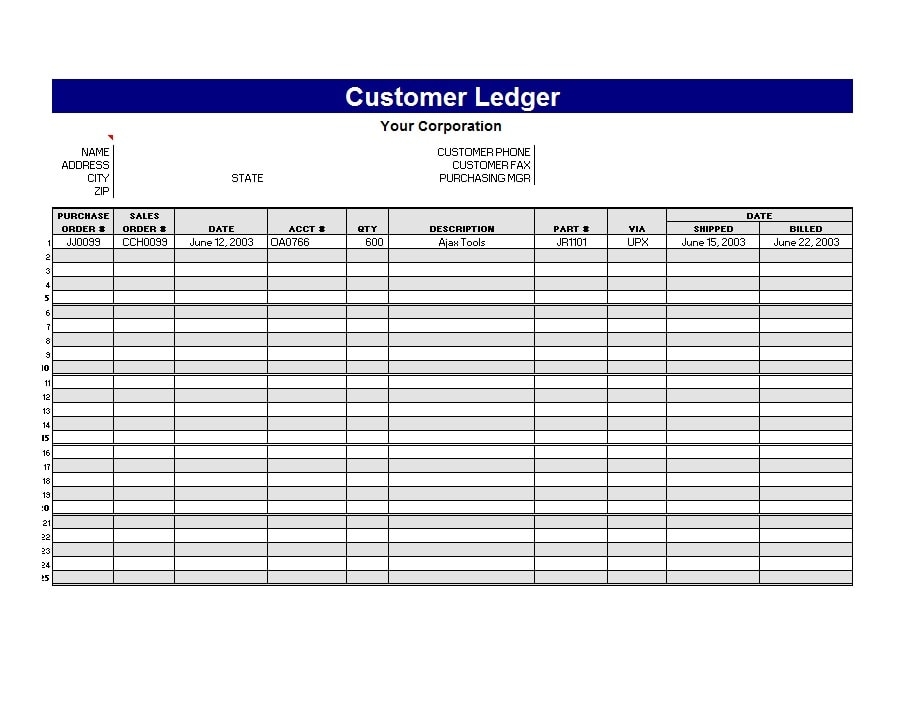

One of the main advantages of printable self-employment income forms is their convenience. These forms are easily accessible online and can be printed out at any time. This means you can keep track of your income and expenses in real-time, making it easier to stay organized and on top of your finances.

Additionally, printable self-employment income forms are customizable to fit your specific needs. You can tailor the forms to include all the necessary information for your business, such as income sources, expenses, and deductions. This level of customization ensures that you are accurately reporting your earnings to the IRS.

Another benefit of printable self-employment income forms is that they make it easier to analyze your financial data. By keeping track of your income and expenses on a regular basis, you can identify trends and make informed decisions about your business. This can help you maximize your profits and minimize your tax liability.

In conclusion, printable self-employment income forms are an essential tool for self-employed individuals to accurately track their earnings and expenses. By using these forms, you can stay organized, compliant with tax laws, and in control of your finances. So why wait? Start using printable self-employment income forms today and take the stress out of tax season!