As the tax season approaches, it is important for individuals to ensure that they have all the necessary forms in order to file their federal income taxes accurately. In 2013, the IRS released a set of printable federal income tax forms that taxpayers can use to report their income, deductions, and credits for the year.

These forms are essential for individuals who are required to file taxes and must be filled out carefully to avoid any errors or discrepancies. By using the printable federal income tax forms for 2013, taxpayers can ensure that they are meeting their obligations and avoiding any potential penalties or audits from the IRS.

Printable Federal Income Tax Forms 2013

Printable Federal Income Tax Forms 2013

Quickly Access and Print Printable Federal Income Tax Forms 2013

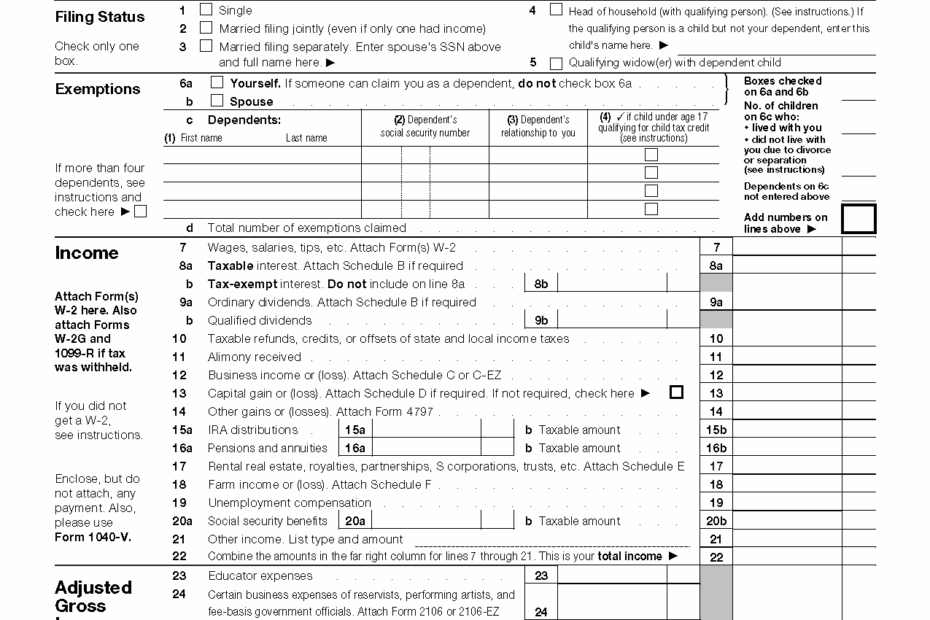

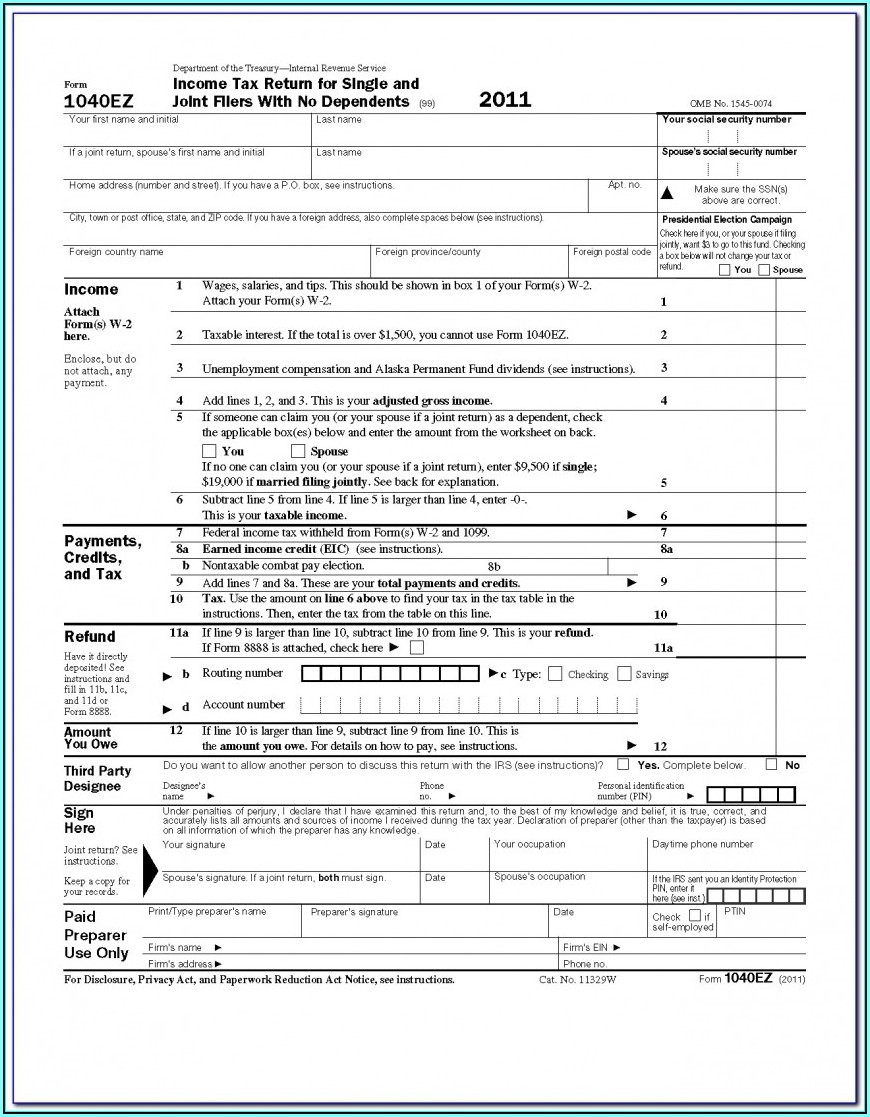

When it comes to filing taxes, having the right forms is crucial. The 2013 federal income tax forms include the 1040, 1040A, and 1040EZ forms, which cater to different types of taxpayers based on their income level and filing status. These forms provide a comprehensive overview of an individual’s financial situation and help determine the amount of tax owed or refunded.

In addition to the basic forms, there are also schedules and worksheets that taxpayers may need to complete depending on their specific circumstances. These forms can be downloaded and printed from the IRS website or obtained from local tax offices or libraries. It is important to double-check that you are using the correct forms for the tax year 2013 to ensure accurate filing.

By using the printable federal income tax forms for 2013, taxpayers can simplify the process of filing their taxes and ensure that they are complying with federal tax laws. These forms provide a structured format for reporting income, deductions, and credits, making it easier for individuals to calculate their tax liability and any potential refunds.

Overall, having access to the printable federal income tax forms for 2013 is essential for individuals who are required to file taxes. By using these forms, taxpayers can accurately report their income and expenses, maximize their deductions, and ensure compliance with federal tax laws. It is important to take the time to fill out these forms correctly and submit them on time to avoid any penalties or issues with the IRS.