Managing your finances effectively is crucial for maintaining financial stability and achieving your financial goals. One important aspect of financial management is understanding your debt-to-income ratio. This ratio shows how much of your income goes towards paying off debts, and having a high ratio can indicate financial distress. To help you calculate your debt-to-income ratio, you can use a printable worksheet designed for this purpose.

By using a debt-to-income worksheet, you can easily input all your monthly income and debt obligations in one place. This can help you see a clear picture of your financial situation and identify areas where you may need to make adjustments. Having a visual representation of your debt-to-income ratio can also motivate you to take action and work towards reducing your debt load.

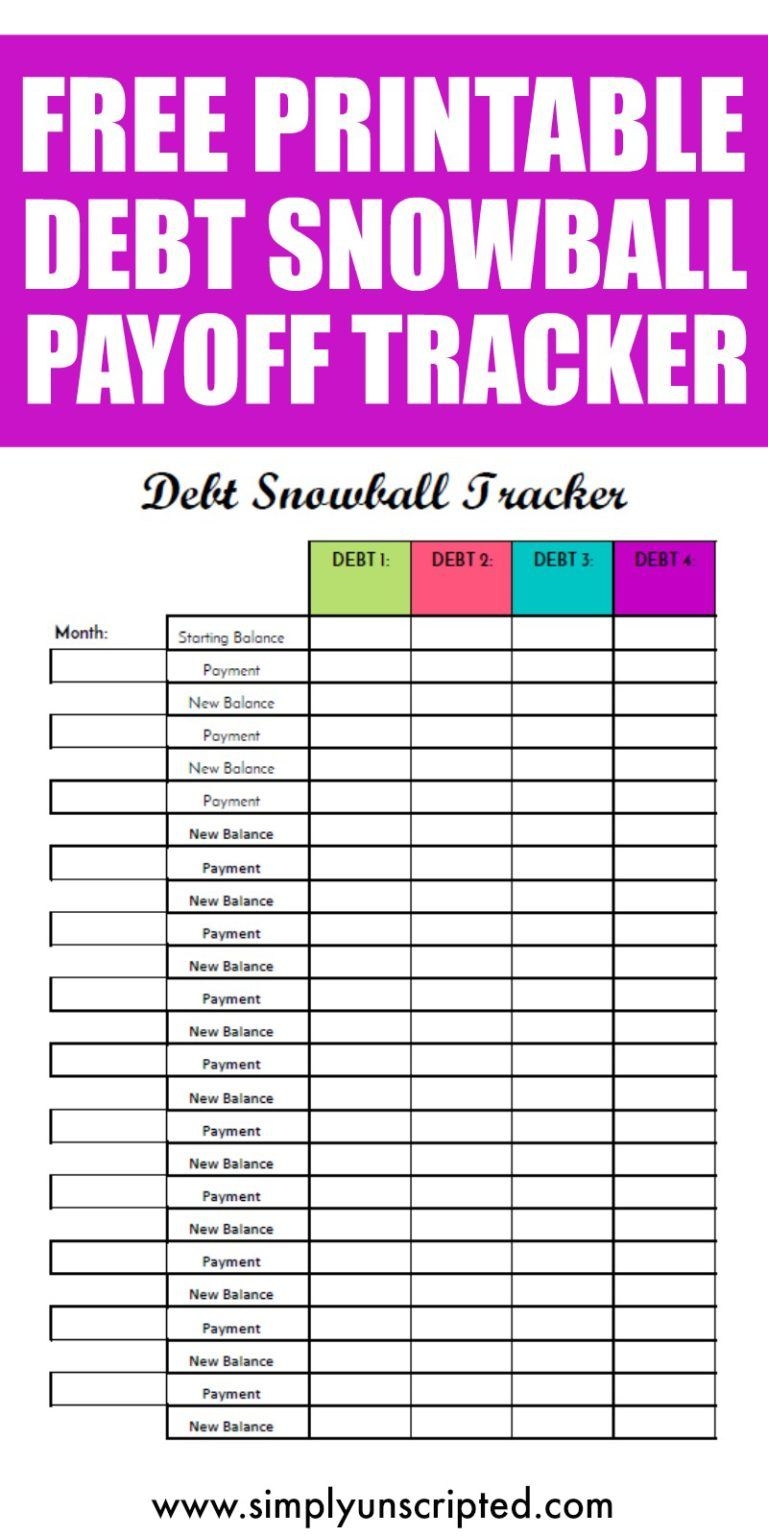

Printable Debt To Income Worksheet

Printable Debt To Income Worksheet

Easily Download and Print Printable Debt To Income Worksheet

When using a printable debt-to-income worksheet, start by listing all your sources of income, including your salary, bonuses, rental income, etc. Then, list all your monthly debt obligations, such as mortgage payments, car loans, credit card payments, and student loans. Total up your monthly income and debts separately to calculate your debt-to-income ratio.

Once you have calculated your debt-to-income ratio, compare it to the recommended guidelines. Financial experts generally advise that your debt-to-income ratio should not exceed 36%. If your ratio is higher than this, it may indicate that you are spending too much of your income on debt payments and may need to make some changes to improve your financial health.

Using a printable debt-to-income worksheet can be a valuable tool in helping you understand and manage your financial situation. By regularly tracking your debt-to-income ratio, you can make informed decisions about your finances and work towards reducing your debt burden. Remember, financial stability is achievable with careful planning and discipline.

In conclusion, a printable debt-to-income worksheet can be a useful resource for individuals looking to improve their financial management skills. By calculating your debt-to-income ratio and monitoring it regularly, you can gain better control over your finances and work towards achieving your financial goals.