As tax season approaches, it’s important to have all the necessary forms ready for filing your taxes. In 2013, there were several income tax forms that were required for individuals to report their earnings and deductions to the IRS. These forms are essential for accurately calculating how much taxes you owe or how much of a refund you may be eligible for.

Whether you are filing as an individual, a married couple, or a business owner, having access to printable income tax forms can make the process much easier. By having these forms readily available, you can fill them out at your own pace and ensure that all the necessary information is included before submitting them to the IRS.

2013 Income Tax Forms Printable

2013 Income Tax Forms Printable

Download and Print 2013 Income Tax Forms Printable

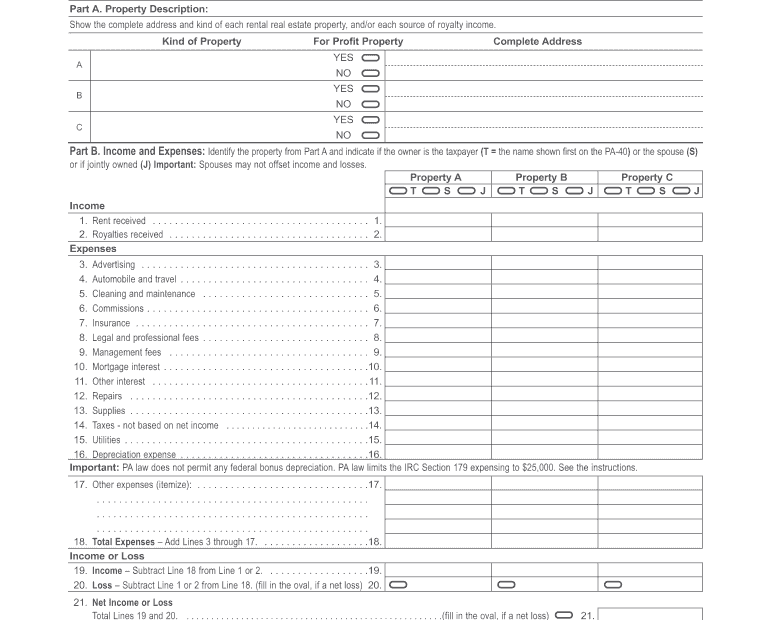

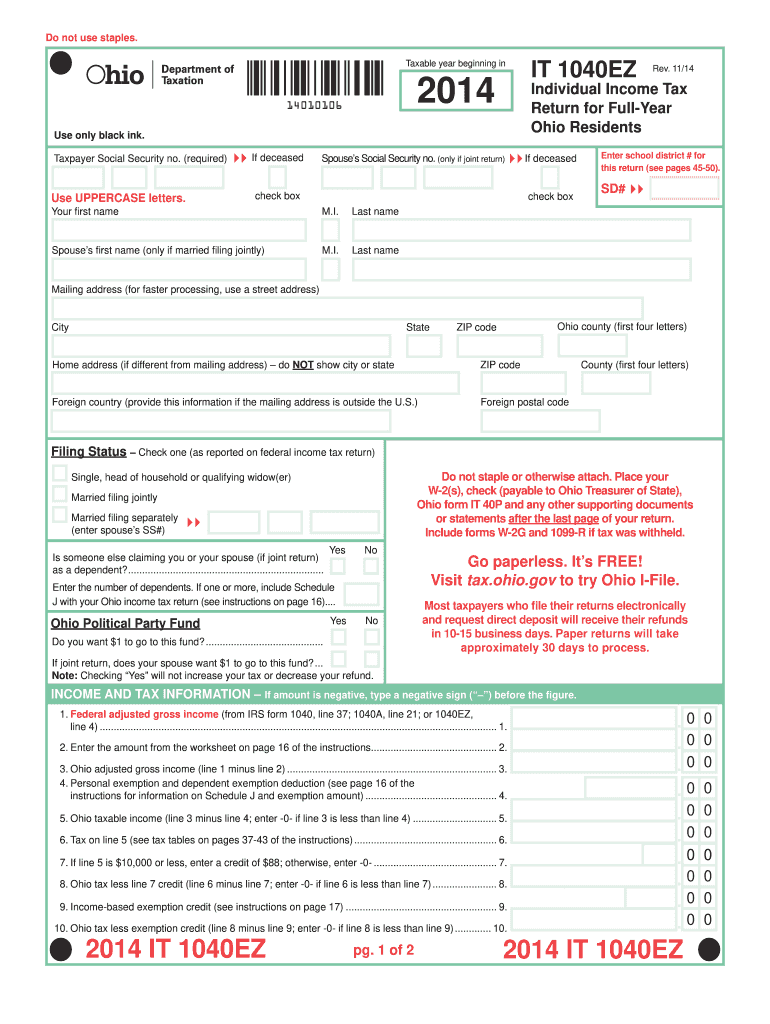

One of the most commonly used forms in 2013 was the Form 1040, which is used by individuals to report their income, deductions, and credits. This form is essential for calculating your tax liability and determining if you are eligible for any tax breaks or credits. Additionally, there were other forms such as the 1099 series for reporting various types of income, as well as schedules for itemized deductions and business expenses.

For those who prefer to file their taxes online, many tax preparation software programs offer the option to fill out and submit these forms electronically. However, having printable forms on hand can be useful for reference and for keeping a physical copy for your records. It’s important to double-check all information before submitting your forms to avoid any errors that could delay your refund or result in penalties from the IRS.

Overall, having access to printable income tax forms for the 2013 tax year can streamline the filing process and ensure that you are accurately reporting your earnings and deductions. Whether you choose to file online or by mail, having these forms ready will make the process much smoother and less stressful. Be sure to gather all necessary documents and consult with a tax professional if you have any questions or concerns about filing your taxes for the 2013 tax year.