As tax season approaches, many individuals are looking for ways to file their federal income tax returns. One option available is to use printable forms that can be filled out and submitted to the Internal Revenue Service (IRS). In 2013, there were a variety of tax forms available for individuals to use, depending on their specific financial situation.

Using printable forms can be a convenient way to file your taxes, as it allows you to fill out the forms at your own pace and in the comfort of your own home. Additionally, printable forms are often available for free on the IRS website, making them a cost-effective option for those looking to save money during tax season.

2013 Federal Income Tax Forms Printable

2013 Federal Income Tax Forms Printable

Download and Print 2013 Federal Income Tax Forms Printable

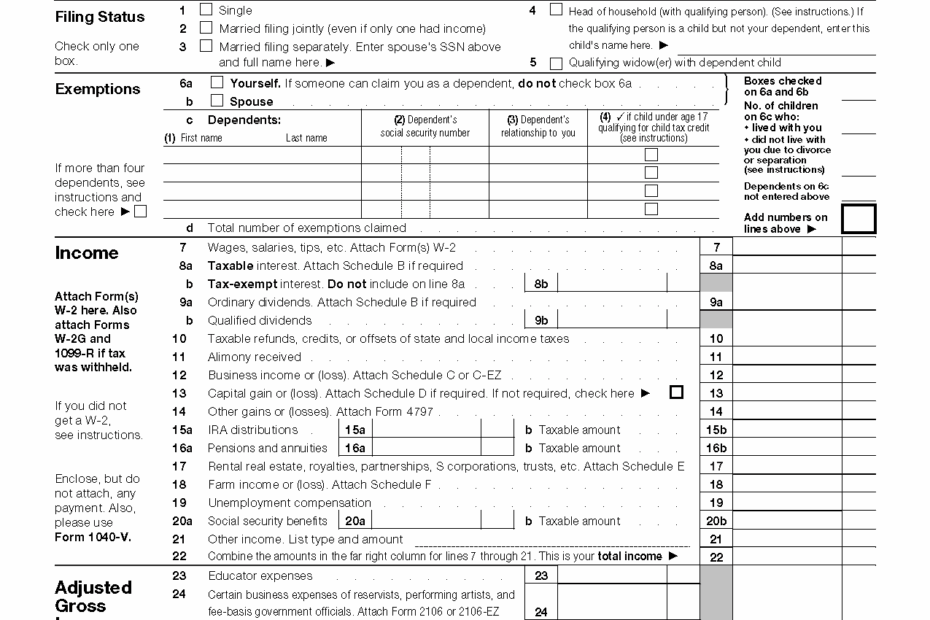

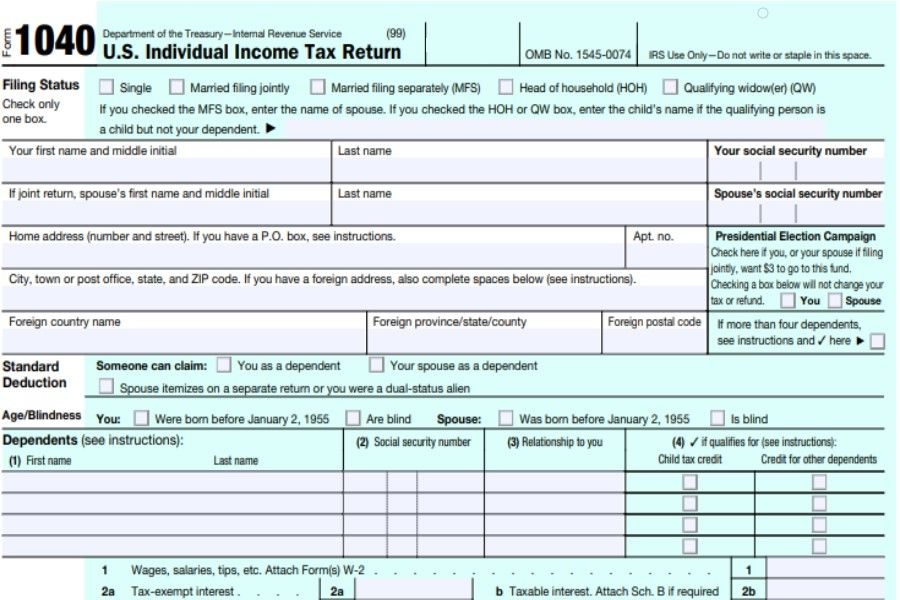

One of the most commonly used tax forms in 2013 was the Form 1040, which is used by individuals to report their annual income and calculate their tax liability. This form is available in printable format on the IRS website, along with instructions on how to fill it out correctly. Additionally, there were other forms available for individuals with more complex financial situations, such as the Form 1040A and Form 1040EZ.

When using printable tax forms, it is important to double-check all information before submitting them to the IRS. Any errors or mistakes on the forms could result in delays in processing your return or even potential penalties from the IRS. It is recommended to review the instructions provided with the forms to ensure accuracy and completeness.

In conclusion, using printable tax forms can be a convenient and cost-effective way to file your federal income taxes. In 2013, there were a variety of forms available for individuals to use, depending on their financial situation. By carefully filling out the forms and reviewing them for accuracy, you can ensure a smooth tax filing process and potentially receive any refunds owed to you in a timely manner.