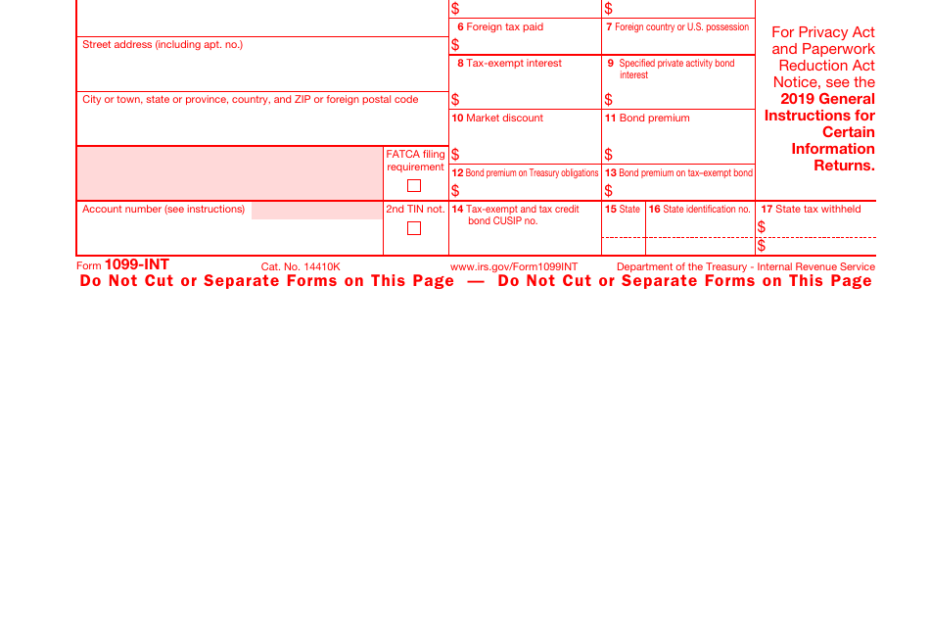

Interest income is income that is earned from investments, such as savings accounts, certificates of deposit, or bonds. This income is usually reported on Form 1099-INT, which is a tax form provided by financial institutions to report interest income to the IRS.

For the years 2019 and 2017, it is important to accurately report your interest income on your tax return. Having a printable version of Form 1099-INT can make this process easier for you.

Interest Income Form 1099-Int From 2019 And 2017 Printable

Interest Income Form 1099-Int From 2019 And 2017 Printable

Easily Download and Print Interest Income Form 1099-Int From 2019 And 2017 Printable

When you receive Form 1099-INT from your financial institution, it will show the amount of interest income you earned during the year. This form is essential for accurately reporting your income to the IRS and ensuring that you pay the correct amount of taxes.

It is important to note that interest income is considered taxable income and must be reported on your tax return. Failing to report this income can result in penalties and interest charges from the IRS.

By using a printable version of Form 1099-INT for the years 2019 and 2017, you can easily input the relevant information into your tax return and ensure that you are in compliance with IRS regulations. This form will help you accurately report your interest income and avoid any potential issues with the IRS.

Make sure to keep a copy of Form 1099-INT for your records and consult with a tax professional if you have any questions about reporting your interest income. By staying organized and following the proper procedures, you can effectively manage your interest income and fulfill your tax obligations.

Overall, having a printable version of Form 1099-INT for the years 2019 and 2017 can simplify the process of reporting your interest income and help you avoid any potential issues with the IRS. Make sure to use this form when preparing your tax return to ensure that you accurately report your income and stay in compliance with tax laws.