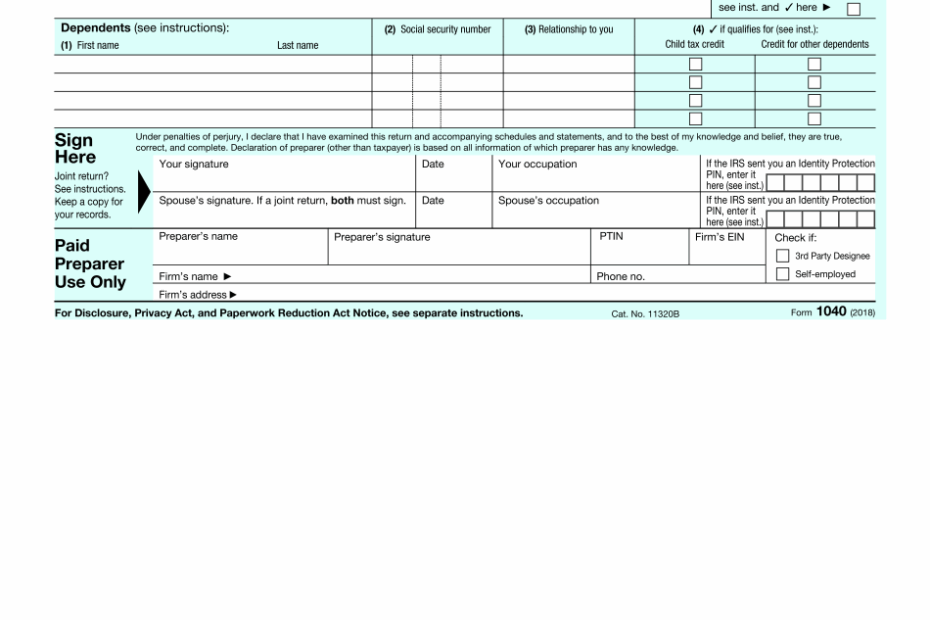

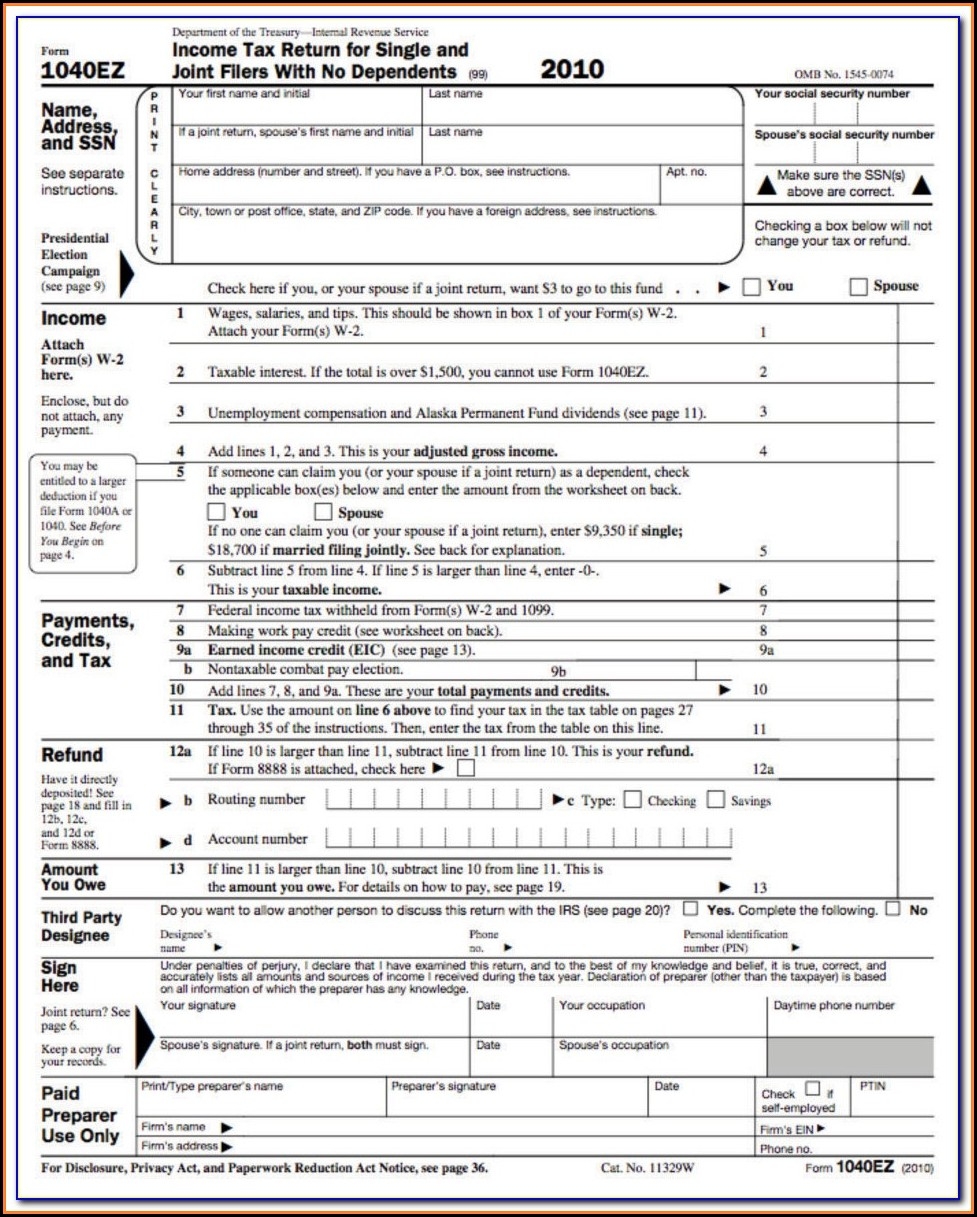

Filing your federal income taxes can be a daunting task, but having the right forms can make the process much easier. Form 1040 is the standard form that individuals use to file their annual income tax returns with the IRS. This form is used to report income, deductions, credits, and calculate the amount of tax owed or refunded.

While many tax preparation software programs can help you fill out and file your taxes electronically, some individuals prefer to fill out their forms by hand. Printable versions of Form 1040 are available on the IRS website, allowing you to easily download and print the form from the comfort of your own home.

Printable Federal Income Tax Forms 1040

Printable Federal Income Tax Forms 1040

Save and Print Printable Federal Income Tax Forms 1040

When filling out Form 1040, you will need to gather information such as your income from various sources, any deductions or credits you may be eligible for, and any taxes that have already been withheld from your paychecks. It’s important to double-check all your calculations and ensure that you have included all necessary information before submitting your form to the IRS.

One of the advantages of using printable federal income tax forms like Form 1040 is that you can take your time to carefully review and complete the form at your own pace. You can also keep a copy of the completed form for your records, which can be helpful in case you need to refer back to it in the future.

Remember that the deadline for filing your federal income tax return is typically April 15th, unless that date falls on a weekend or holiday. If you need more time to file, you can request an extension, but you will still need to estimate and pay any taxes owed by the original deadline to avoid penalties and interest.

Overall, having access to printable federal income tax forms like Form 1040 can make the tax filing process more manageable and convenient. Whether you choose to file electronically or by mail, having the right forms and information at your fingertips is essential for meeting your tax obligations and ensuring compliance with IRS regulations.