Understanding federal income tax brackets is crucial for individuals and businesses alike. By knowing which tax bracket you fall into, you can better plan your finances and make informed decisions about your income and expenses. The federal income tax bracket for 2018 provides a clear guideline for how much tax you owe based on your income level.

It is important to note that the tax brackets can change from year to year, so it is essential to stay updated on the latest information. By having a clear understanding of the federal income tax bracket for 2018, you can ensure that you are paying the right amount of tax and avoiding any penalties or fines.

Federal Income Tax Bracket 2018 Chart Printable

Federal Income Tax Bracket 2018 Chart Printable

Get and Print Federal Income Tax Bracket 2018 Chart Printable

Federal Income Tax Bracket 2018 Chart Printable

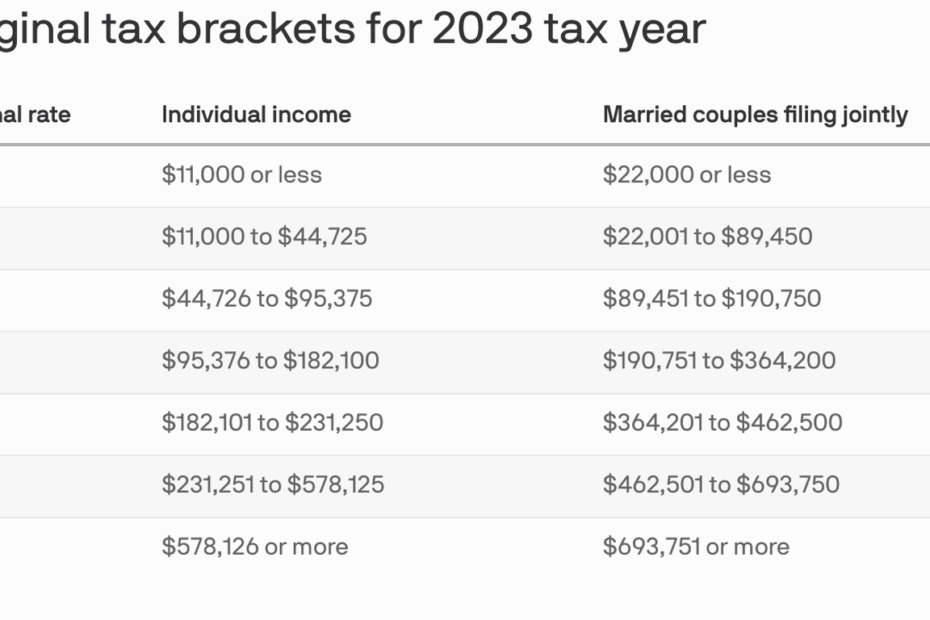

The Federal Income Tax Bracket 2018 Chart Printable provides a visual representation of the tax brackets for the year 2018. This chart shows the different income levels and the corresponding tax rates for each bracket. By referring to this chart, you can easily determine which tax bracket you fall into and how much tax you owe.

For example, the 2018 federal income tax brackets for single filers are as follows:

- 10% tax rate on income up to $9,525

- 12% tax rate on income between $9,526 and $38,700

- 22% tax rate on income between $38,701 and $82,500

- 24% tax rate on income between $82,501 and $157,500

- 32% tax rate on income between $157,501 and $200,000

By using the Federal Income Tax Bracket 2018 Chart Printable, you can easily find out how much tax you owe based on your income level. This can help you make informed decisions about your finances and ensure that you are meeting your tax obligations.

In conclusion, understanding the federal income tax brackets for 2018 is essential for individuals and businesses to manage their finances effectively. By using the Federal Income Tax Bracket 2018 Chart Printable, you can easily determine your tax liability and plan accordingly. Stay informed and updated on the latest tax information to avoid any surprises come tax season.