As tax season approaches, many individuals and businesses are in the process of gathering their financial documents to file their federal income tax returns. One essential component of this process is obtaining the necessary tax forms to accurately report income, deductions, and credits. In 2014, the IRS released a set of printable federal income tax forms that taxpayers could use to file their taxes for the previous year.

Printable federal income tax forms for the year 2014 are crucial for taxpayers who prefer to file their taxes manually or for those who may not have access to online tax filing platforms. These forms provide a standardized format for reporting income and deductions, making it easier for taxpayers to calculate their tax liability and ensure compliance with federal tax laws.

Printable Federal Income Tax Forms 2014

Printable Federal Income Tax Forms 2014

Easily Download and Print Printable Federal Income Tax Forms 2014

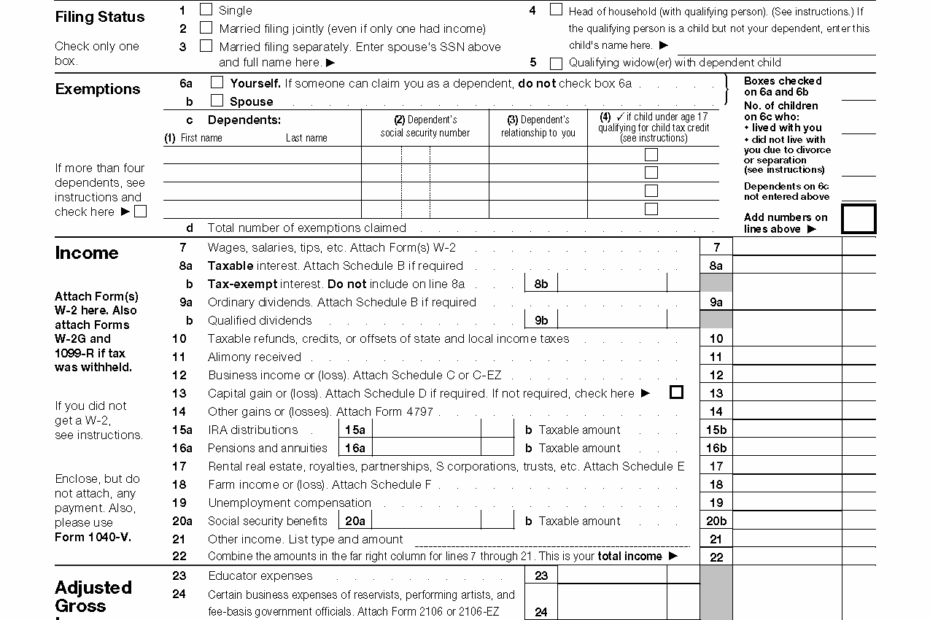

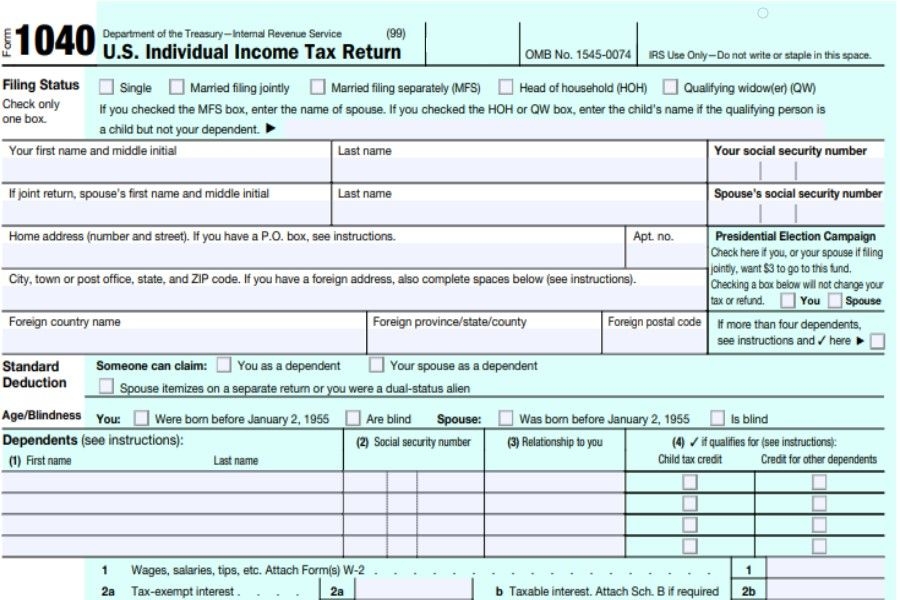

One of the most commonly used forms for individual taxpayers in 2014 was Form 1040, which is used to report income, deductions, and credits. This form is available in a printable format on the IRS website, along with instructions for completing it accurately. Additionally, taxpayers may need to use other forms such as Schedule A for itemized deductions, Schedule B for interest and dividends, and Schedule C for business income.

For businesses, printable federal income tax forms for 2014 include Form 1120 for corporations, Form 1065 for partnerships, and Form 990 for tax-exempt organizations. These forms require detailed information about the business’s income, expenses, and deductions, and must be filed accurately to avoid penalties or audits by the IRS.

It is essential for taxpayers to download and print the correct forms for the tax year 2014 to avoid errors in reporting income and deductions. Using the printable federal income tax forms provided by the IRS ensures that taxpayers can accurately file their taxes and minimize the risk of audits or penalties. Additionally, taxpayers can seek assistance from tax professionals or online resources to help them complete their tax returns accurately and efficiently.

In conclusion, printable federal income tax forms for the year 2014 are essential tools for taxpayers to report their income, deductions, and credits accurately. By using the correct forms and following the instructions provided by the IRS, taxpayers can ensure compliance with federal tax laws and avoid potential penalties. As tax season approaches, it is crucial for individuals and businesses to gather the necessary forms and documents to file their taxes in a timely and accurate manner.