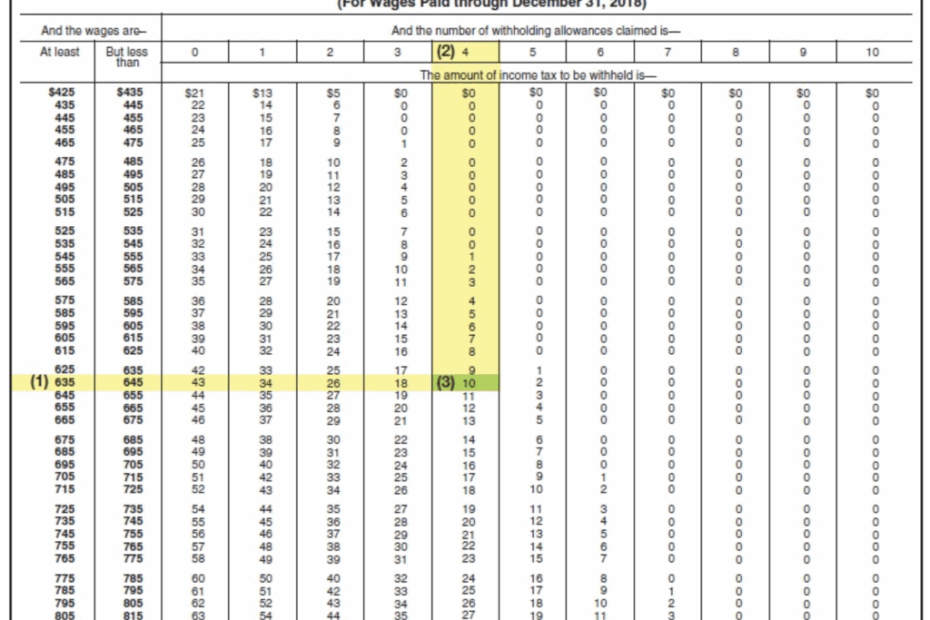

As we approach tax season, it’s important for individuals and businesses to stay informed about the latest changes in tax laws and regulations. The 2018 federal income tax withholding tables are a crucial resource for employers and employees to ensure that the correct amount of taxes are withheld from paychecks.

With the passing of the Tax Cuts and Jobs Act in 2017, there were significant changes to the tax brackets and rates for 2018. This means that it’s essential for everyone to review the new withholding tables to avoid any surprises when filing their taxes.

Printable 2018 Federal Income Tax Withholding Tables

Printable 2018 Federal Income Tax Withholding Tables

Save and Print Printable 2018 Federal Income Tax Withholding Tables

The printable 2018 federal income tax withholding tables provide a detailed breakdown of how much should be withheld based on an individual’s filing status, income, and number of allowances claimed. These tables are designed to help employers calculate the correct amount of federal income tax to deduct from employees’ paychecks.

Employers can use these tables to ensure that they are withholding the right amount of taxes from their employees’ wages, which can help prevent underpayment or overpayment of taxes. This can also help employees avoid owing a large sum of money at tax time or receiving a smaller refund than expected.

It’s important for both employers and employees to stay up-to-date with the latest tax withholding tables to ensure compliance with federal tax laws. By using the printable 2018 federal income tax withholding tables, individuals can accurately calculate their tax liability and make any necessary adjustments to their withholding throughout the year.

Overall, the printable 2018 federal income tax withholding tables are a valuable tool for both employers and employees to ensure accurate withholding and prevent any surprises come tax time. By staying informed and utilizing these tables, individuals can better manage their tax obligations and avoid any potential penalties or interest charges.