It’s that time of year again – tax season! Filing your income taxes can be a daunting task, but having the right forms on hand can make the process much easier. Fortunately, there are many resources available online where you can find free printable 2019 income tax forms to help you get organized and prepared for tax day.

Whether you are a salaried employee, self-employed, or a freelancer, having the correct tax forms is essential to ensure you are reporting your income accurately and claiming any deductions or credits you may be eligible for. These forms are provided by the Internal Revenue Service (IRS) and are necessary for individuals and businesses to report their annual income and calculate the amount of tax owed.

Free Printable 2019 Income Tax Forms

Free Printable 2019 Income Tax Forms

Save and Print Free Printable 2019 Income Tax Forms

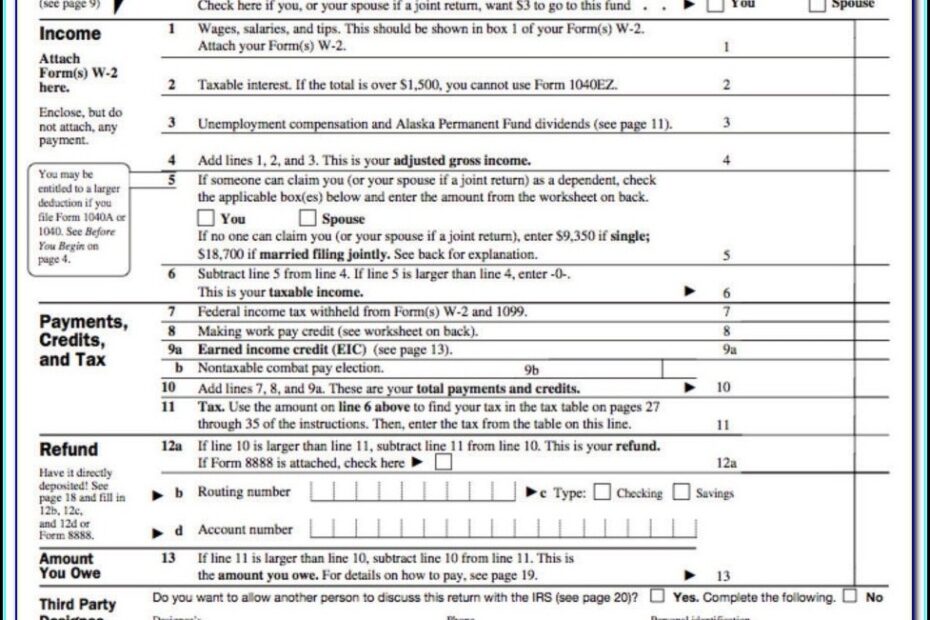

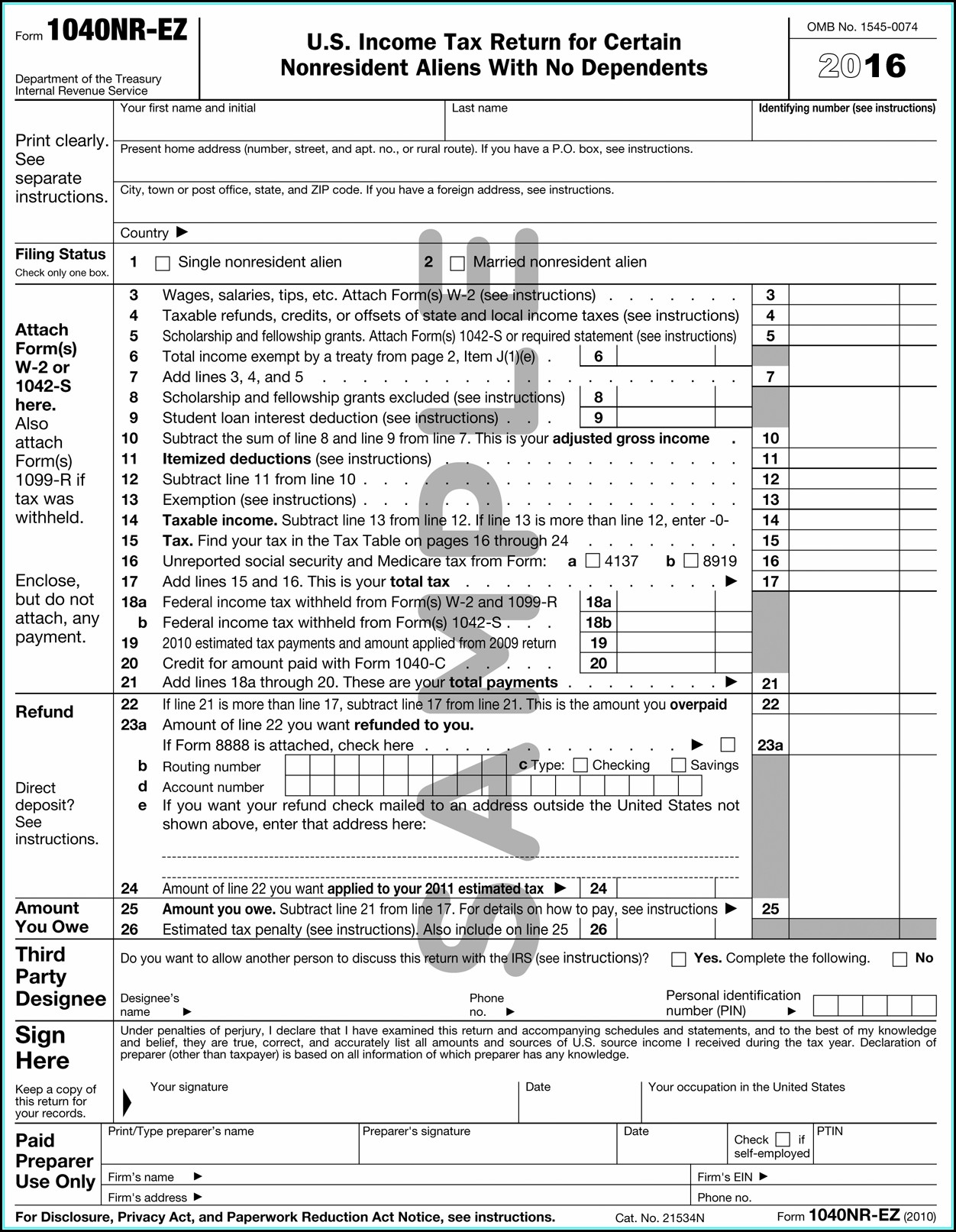

When it comes to finding free printable 2019 income tax forms, there are several reputable websites that offer a wide selection of forms that you can download and print for your use. These forms include the 1040, 1040A, and 1040EZ forms for individual taxpayers, as well as various schedules and worksheets for reporting additional income, deductions, and credits.

One of the benefits of using printable tax forms is that you can fill them out at your own pace and have the option to review and double-check your information before submitting them to the IRS. Additionally, having physical copies of the forms can serve as a helpful reference point in case you need to provide documentation or proof of your income and expenses in the future.

It’s important to note that while printable tax forms are convenient and cost-effective, you may still need to file your taxes electronically depending on your income level and filing status. The IRS offers e-filing options for individuals and businesses, which can expedite the processing of your tax return and help you receive any refunds more quickly.

In conclusion, utilizing free printable 2019 income tax forms can simplify the tax-filing process and ensure that you are compliant with federal tax laws. By taking advantage of these resources, you can stay organized and prepared as you navigate the complexities of tax season.