When it comes to filing your taxes in Canada, having the right forms is essential. In 2016, the Canadian government introduced new income tax forms that were designed to streamline the filing process and make it easier for taxpayers to report their income accurately. These forms are available online for download and printing, making it convenient for individuals to access them from the comfort of their own homes.

Whether you are a salaried employee, a self-employed individual, or a business owner, having the correct income tax forms is crucial for ensuring that you comply with the tax laws in Canada. By using the 2016 income tax forms, you can report your income, claim deductions and credits, and calculate any taxes owing or refunds due accurately and efficiently.

2016 Income Tax Forms Printable Canada

2016 Income Tax Forms Printable Canada

Easily Download and Print 2016 Income Tax Forms Printable Canada

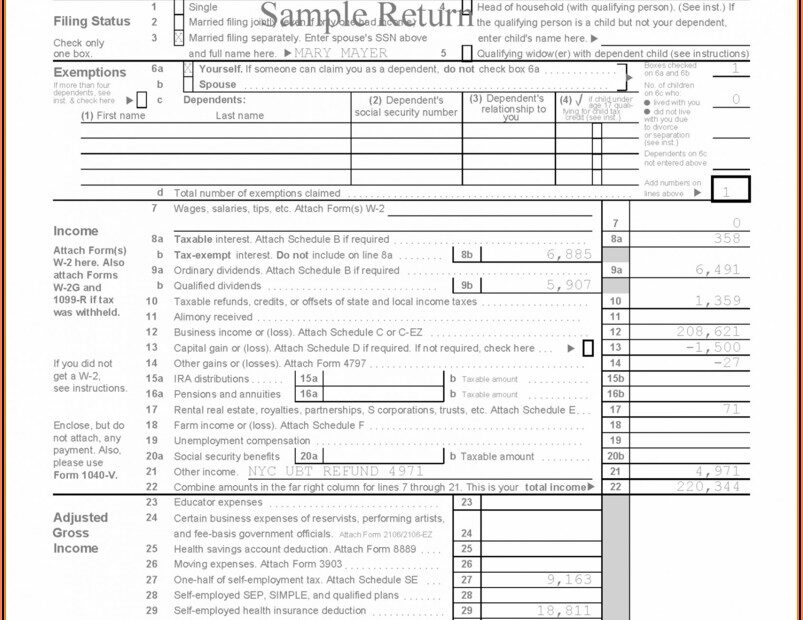

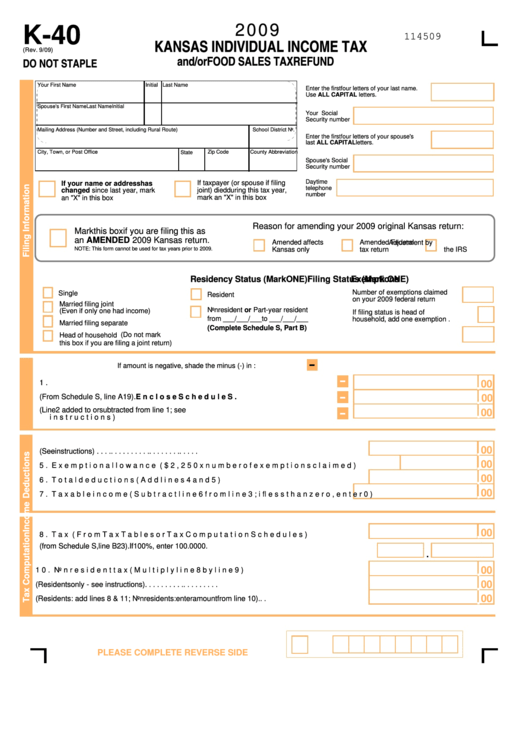

There are several key forms that individuals may need to complete when filing their taxes in Canada for the 2016 tax year. These include the T1 General form, which is used by most individuals to report their income, deductions, and credits. Additionally, self-employed individuals may need to complete the T2125 form to report their business income and expenses, while investors may need to fill out the T5008 form to report capital gains and losses.

It is important to note that the deadline for filing your taxes for the 2016 tax year was April 30, 2017. However, if you have not yet filed your taxes for that year, you can still do so by obtaining the necessary forms online and submitting them to the Canada Revenue Agency (CRA) as soon as possible.

Overall, having access to printable income tax forms for the 2016 tax year in Canada can make the process of filing your taxes much more convenient and efficient. By ensuring that you have the right forms and information ready, you can accurately report your income and claim any deductions or credits that you are entitled to, ultimately helping you to minimize your tax liability or maximize your tax refund.