As we approach tax season, it’s important to be prepared with all the necessary forms and information to file your taxes accurately and on time. The IRS provides a variety of income tax forms for individuals and businesses to report their earnings and deductions. One of the most common ways to file taxes is by using printable forms that can be easily accessed online.

IRS income tax forms for the year 2024 are essential tools for taxpayers to report their income, deductions, credits, and other financial information to the government. These forms help ensure that individuals and businesses are paying the correct amount of taxes based on their earnings and expenses. By using printable forms, taxpayers can easily fill out the necessary information and submit their tax returns in a timely manner.

Irs Income Tax Forms 2024 Printable

Irs Income Tax Forms 2024 Printable

Save and Print Irs Income Tax Forms 2024 Printable

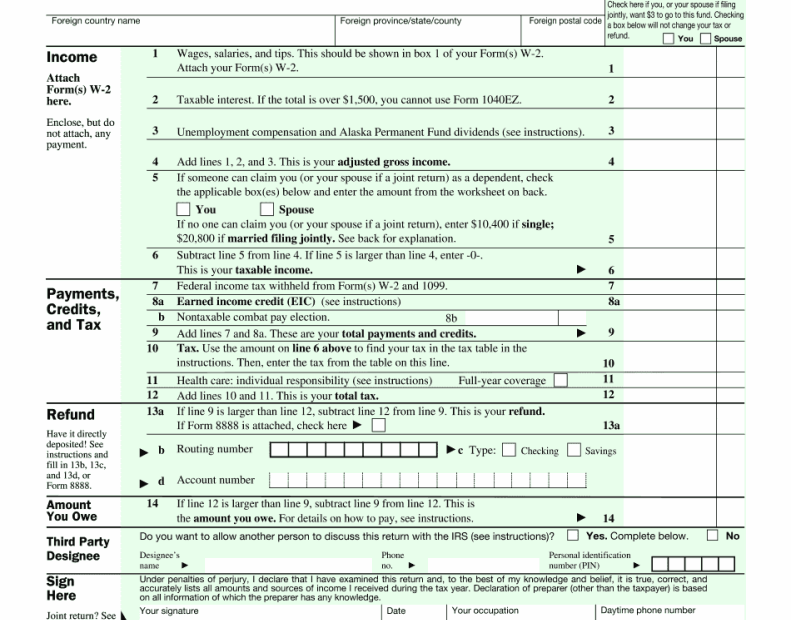

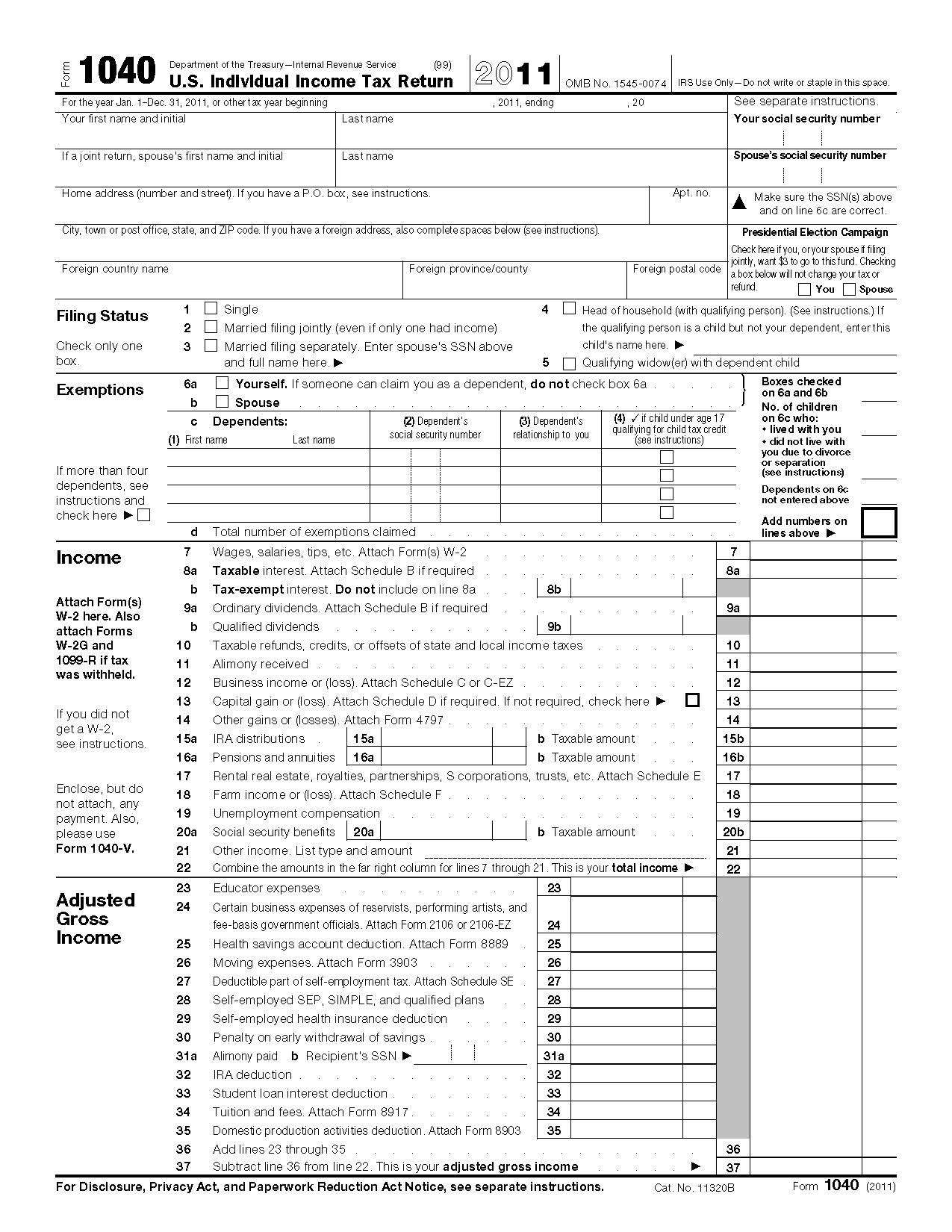

When it comes to IRS income tax forms for the year 2024, there are several key forms that individuals and businesses may need to fill out depending on their financial situation. Some common forms include Form 1040 for individual income tax returns, Form 1065 for partnership income tax returns, and Form 1120 for corporate income tax returns. These forms provide a comprehensive overview of an individual or business’s financial status for the year.

It’s important for taxpayers to accurately report their income, deductions, and credits on their tax forms to avoid any potential audits or penalties from the IRS. By using the printable IRS income tax forms for 2024, individuals and businesses can ensure that they are providing the correct information to the government and are in compliance with tax laws. These forms are designed to be user-friendly and easy to understand, making the tax filing process as smooth as possible.

In conclusion, IRS income tax forms for the year 2024 are essential tools for individuals and businesses to report their financial information to the government. By using printable forms, taxpayers can easily fill out the necessary information and submit their tax returns accurately and on time. It’s crucial to be aware of the various forms available and to use them correctly to avoid any potential issues with the IRS. Make sure to download and print the necessary forms for the upcoming tax season to stay organized and on top of your tax obligations.