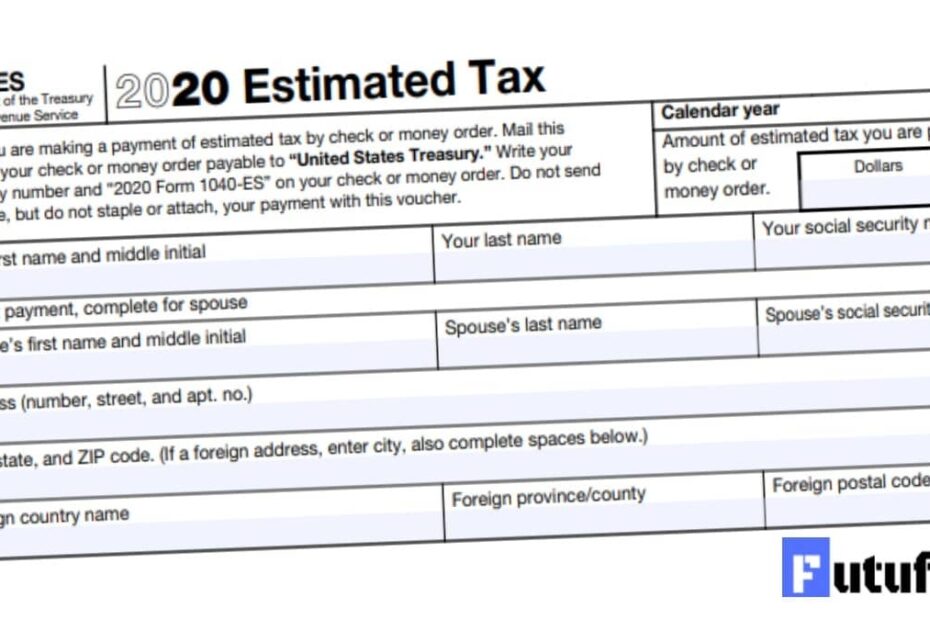

Filing your federal income tax can be a daunting task, but with the help of a printable Form 1040 ES, it can be made easier. This form is specifically designed for individuals who need to make estimated tax payments throughout the year. By using this form, you can ensure that you are meeting your tax obligations and avoid any potential penalties.

Whether you are self-employed, a freelancer, or have other sources of income that require you to make estimated tax payments, the Form 1040 ES is a valuable tool to help you stay on track with your taxes. This form allows you to calculate your estimated tax liability for the year and make quarterly payments to the IRS to avoid any underpayment penalties.

A Printable Forum 1040 Es Federal Income Tax

A Printable Forum 1040 Es Federal Income Tax

Save and Print A Printable Forum 1040 Es Federal Income Tax

A Printable Form 1040 ES Federal Income Tax

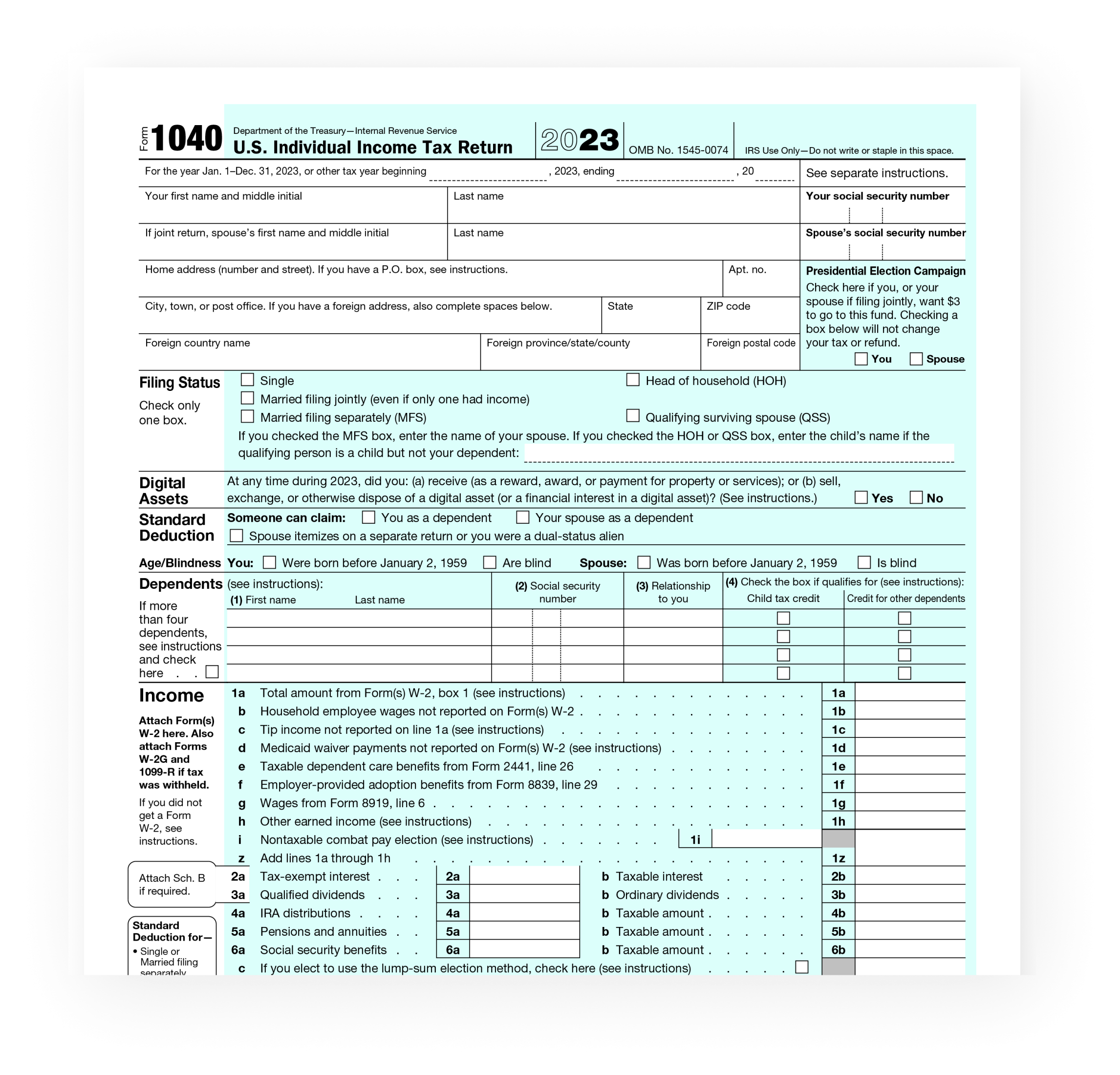

The Form 1040 ES is divided into sections that cover various aspects of your income, deductions, credits, and estimated tax payments. You will need to provide information such as your total income, deductions, and credits to calculate your estimated tax liability. The form also includes a worksheet to help you determine the correct amount to pay each quarter based on your income and deductions.

Once you have completed the Form 1040 ES, you can easily print it out and mail it to the IRS along with your payment. It is important to keep a record of your payments and file them with your tax return at the end of the year to ensure that you have met your tax obligations.

By using the Form 1040 ES, you can take control of your tax payments and avoid any surprises at tax time. This form provides a clear and organized way to calculate and make your estimated tax payments, helping you stay compliant with IRS regulations and avoid any penalties for underpayment.

In conclusion, the Form 1040 ES is a valuable resource for individuals who need to make estimated tax payments throughout the year. By using this form, you can easily calculate your tax liability, make quarterly payments, and stay on track with your taxes. If you have sources of income that require estimated tax payments, be sure to utilize the Form 1040 ES to simplify the process and avoid any potential penalties.