As we approach tax season, it is important for individuals to gather all necessary documents in order to file their federal income taxes accurately. One crucial component of this process is obtaining the correct tax forms for the year in question. In 2016, taxpayers will need to utilize specific forms to report their income, deductions, and credits to the IRS.

Understanding the various tax forms available and knowing which ones pertain to your financial situation is key to ensuring a smooth and successful tax filing process. By familiarizing yourself with the 2016 federal income tax forms and their requirements, you can avoid errors and potential delays in receiving any refunds you may be eligible for.

2016 Federal Income Tax Forms Printable

2016 Federal Income Tax Forms Printable

Quickly Access and Print 2016 Federal Income Tax Forms Printable

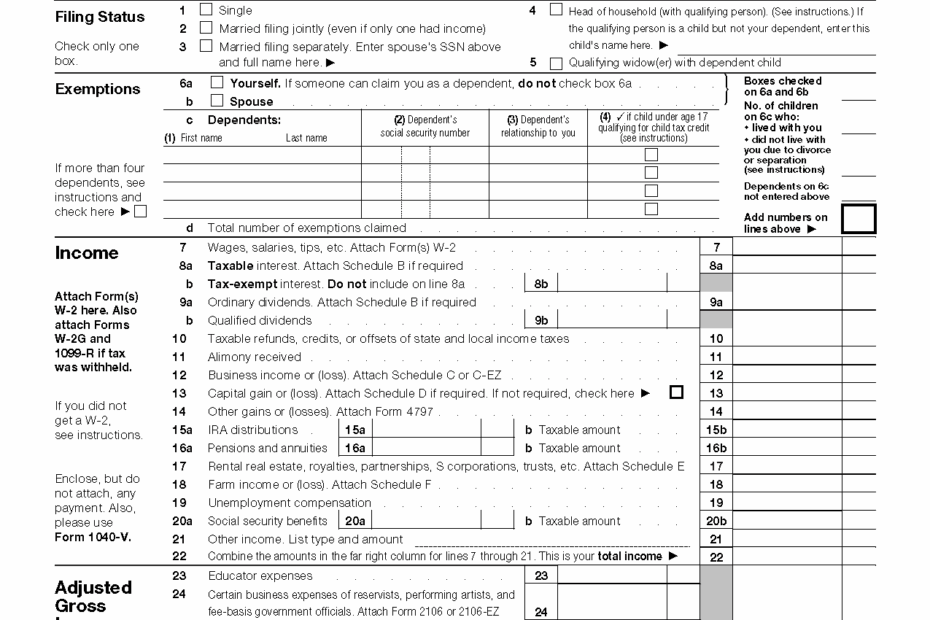

One of the most commonly used forms for individual taxpayers is the Form 1040. This form allows individuals to report their income, deductions, and credits for the tax year. Additionally, there are various schedules and worksheets that may need to be included with Form 1040, depending on the taxpayer’s specific circumstances.

For those who have more complex financial situations, such as self-employment income or investment income, additional forms may be required. This could include forms such as the Schedule C for reporting self-employment income or the Schedule D for reporting capital gains and losses. It is important to carefully review the instructions for each form to ensure accurate reporting.

By accessing the IRS website or visiting a local tax preparation office, individuals can easily obtain printable versions of the 2016 federal income tax forms they need. These forms can be downloaded and printed for free, allowing taxpayers to fill them out at their convenience. It is essential to double-check that you are using the correct version of each form, as the IRS updates forms annually to reflect changes in tax laws.

Overall, being proactive in obtaining and completing the necessary 2016 federal income tax forms is crucial for a successful tax filing experience. By staying organized and informed, individuals can ensure that they are accurately reporting their financial information and maximizing any potential tax benefits available to them.