As tax season approaches, it’s important for individuals to understand the federal income tax brackets for the year 2018. Knowing which bracket you fall into can help you better plan for your taxes and ensure that you are paying the correct amount to the government. The tax brackets are based on your income level and are used to determine how much tax you owe.

Understanding the federal income tax brackets can be overwhelming, but having a printable version can make it easier to reference and calculate your taxes. By having the brackets in front of you, you can see which bracket you fall into based on your income level and how much tax you will owe. This can help you plan ahead and make any necessary adjustments to your finances.

Printable 2018 Federal Income Tax Brackets

Printable 2018 Federal Income Tax Brackets

Easily Download and Print Printable 2018 Federal Income Tax Brackets

Printable 2018 Federal Income Tax Brackets

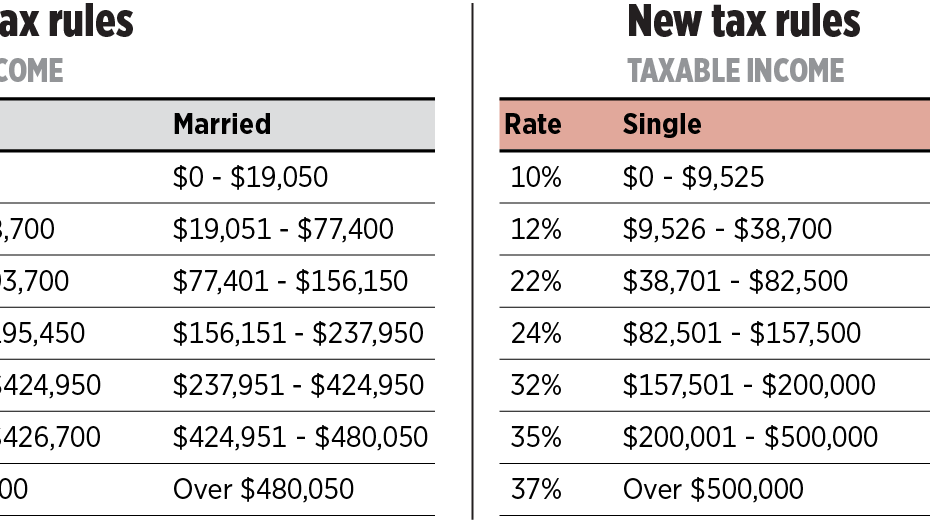

The 2018 federal income tax brackets are divided into seven different brackets based on your income level. The brackets range from 10% for individuals with lower incomes to 37% for individuals with higher incomes. By knowing which bracket you fall into, you can determine how much tax you owe and plan accordingly.

For example, individuals with a taxable income of up to $9,525 fall into the 10% tax bracket. Those with a taxable income between $9,526 and $38,700 fall into the 12% bracket, while incomes between $38,701 and $82,500 fall into the 22% bracket. The brackets continue to increase in percentage as income levels rise, with the highest bracket being 37% for incomes over $500,000.

Having a printable version of the 2018 federal income tax brackets can be a valuable tool for individuals when filling out their tax returns. By referencing the brackets, individuals can ensure that they are paying the correct amount of tax and avoid any potential penalties for underpayment. It’s important to stay informed about the tax brackets and how they may impact your finances.

Overall, understanding the federal income tax brackets for the year 2018 is essential for individuals when preparing their taxes. By having a printable version of the brackets, individuals can easily reference and calculate their tax liability based on their income level. This can help individuals plan ahead and ensure that they are meeting their tax obligations in a timely manner.

In conclusion, having a printable version of the 2018 federal income tax brackets can be a useful tool for individuals when preparing their taxes. By knowing which bracket you fall into, you can better plan for your tax liability and ensure that you are paying the correct amount to the government. Stay informed about the tax brackets and how they may impact your finances to avoid any potential issues during tax season.