As the tax season approaches, it is essential to be prepared with all the necessary documents to file your federal income tax. One of the crucial components of this process is having access to the right tax forms. For the year 2023, there are various federal income tax forms that individuals and businesses need to fill out accurately to comply with the IRS requirements.

Whether you are a salaried employee, self-employed individual, or a business owner, understanding the different tax forms and their requirements is vital to avoid any penalties or fines. Having the option to access printable versions of these forms can make the filing process more convenient and efficient.

2023 Federal Income Tax Forms Printable

2023 Federal Income Tax Forms Printable

Save and Print 2023 Federal Income Tax Forms Printable

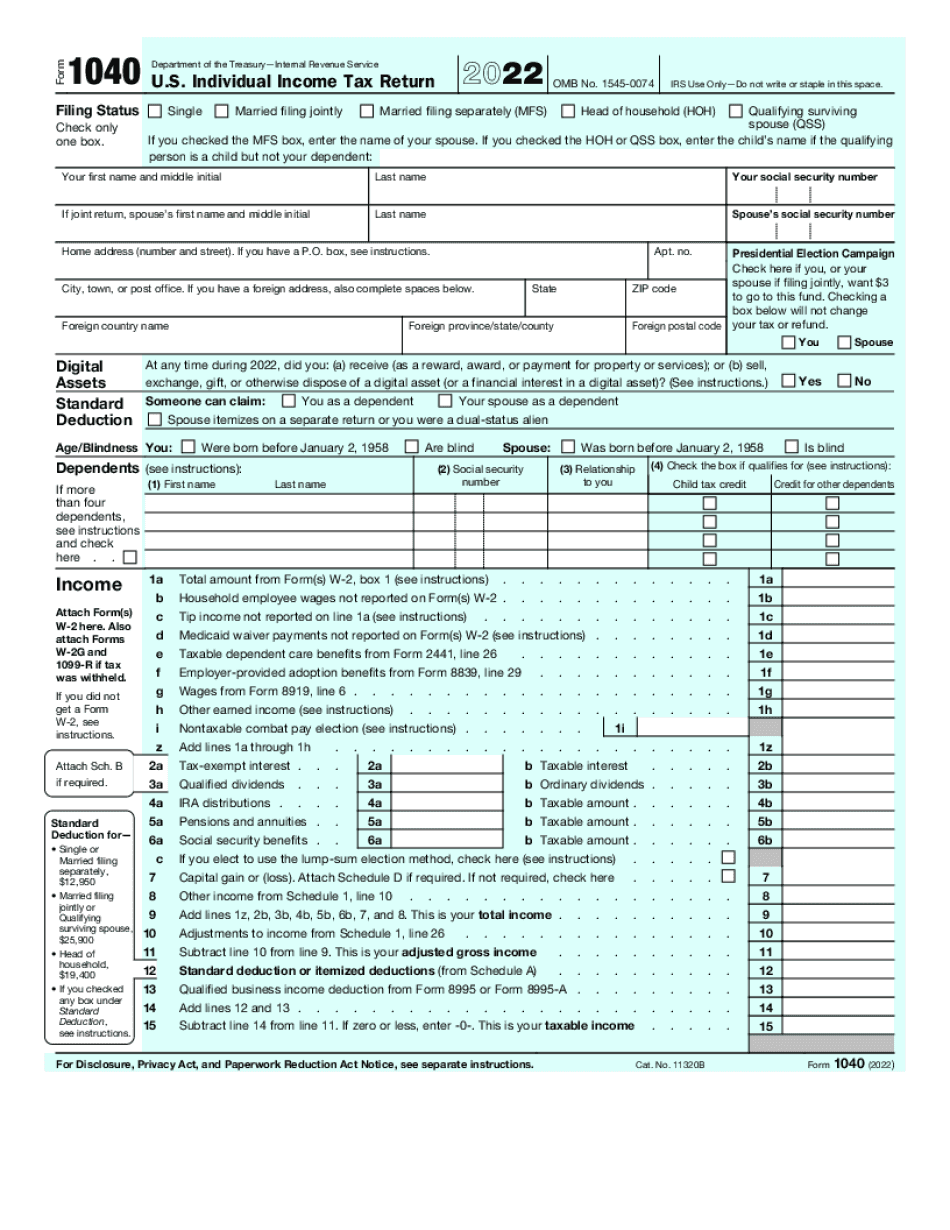

One of the most commonly used federal income tax forms for individuals is the Form 1040. This form is used to report your annual income, deductions, and credits to determine how much tax you owe or the refund you are entitled to. The IRS provides a printable version of Form 1040 on their official website for taxpayers to download and fill out.

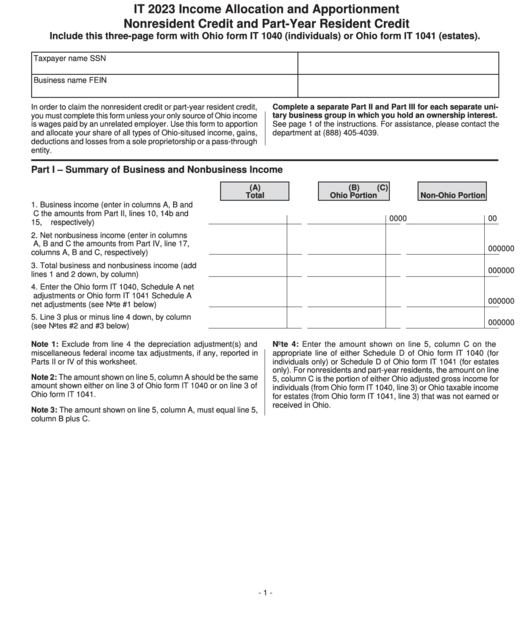

For businesses, the IRS offers various forms such as Form 1065 for partnerships, Form 1120 for corporations, and Form 990 for tax-exempt organizations. These forms are essential for reporting income, expenses, and other financial details to calculate the business’s tax liability accurately. Printable versions of these forms can be easily accessed online for businesses to complete and submit.

In addition to the federal income tax forms mentioned above, there are also specific forms for claiming deductions, credits, and other tax benefits. These include Form 1098 for mortgage interest, Form 1099 for various types of income, and Schedule A for itemized deductions. Having access to printable versions of these forms can help taxpayers organize their financial information and ensure they are claiming all eligible deductions and credits.

Overall, having access to printable 2023 federal income tax forms is crucial for individuals and businesses to meet their tax obligations accurately and on time. By utilizing these forms and filling them out correctly, taxpayers can avoid potential audits or penalties from the IRS. It is recommended to visit the IRS website or consult with a tax professional to ensure you have the right forms and information needed to file your taxes successfully.