Are you a freelancer or independent contractor who received miscellaneous income in the year 2017? If so, you may need to report this income on your taxes using a 1099 form. The 1099 form is used to report various types of income, including freelance work, rental income, and more. It is important to accurately report this income to avoid any potential penalties from the IRS.

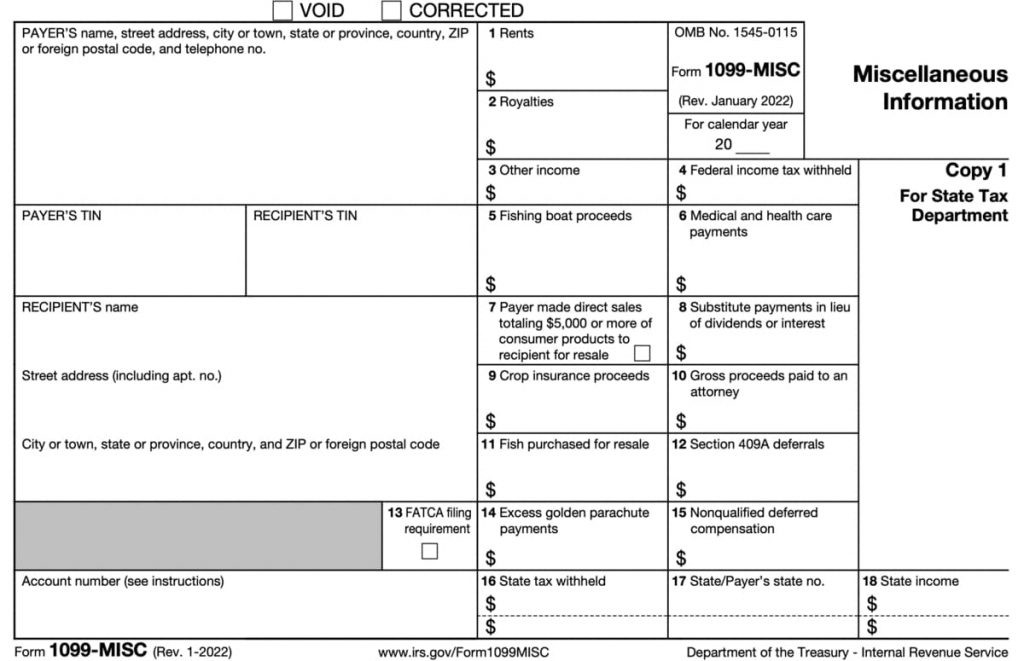

One specific type of 1099 form you may need is the 1099-MISC form for miscellaneous income. This form is used to report income such as non-employee compensation, rents, royalties, and more. If you received $600 or more in miscellaneous income in 2017, the payer is required to provide you with a 1099-MISC form for tax reporting purposes.

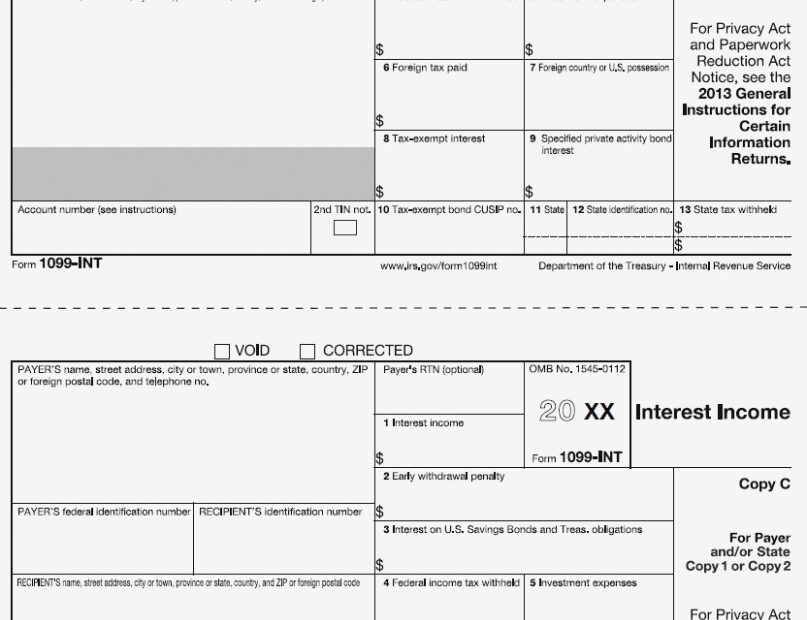

Printable 1099 Form 2017 Miscellaneous Income

Printable 1099 Form 2017 Miscellaneous Income

Quickly Access and Print Printable 1099 Form 2017 Miscellaneous Income

When it comes to filing your taxes, having a printable 1099 form for 2017 miscellaneous income can make the process much easier. You can easily find printable versions of the 1099-MISC form online from reputable sources such as the IRS website or tax preparation software providers. Simply download the form, fill it out with your information, and submit it along with your tax return.

It is important to ensure that the information on your 1099 form is accurate and matches the income you received in 2017. Double-check the amounts reported on the form against your records to avoid any discrepancies that could trigger an IRS audit. If you have any questions or concerns about reporting your miscellaneous income, consider seeking advice from a tax professional.

By using a printable 1099 form for your 2017 miscellaneous income, you can streamline the tax reporting process and ensure that you are in compliance with IRS regulations. Remember to keep copies of all your tax documents for your records and file your taxes on time to avoid any penalties. Reporting your income accurately and honestly is key to maintaining good standing with the IRS and avoiding any potential issues down the road.

Overall, having a printable 1099 form for your 2017 miscellaneous income can help simplify the tax reporting process and ensure that you are in compliance with tax laws. Be sure to accurately report all your income and consult with a tax professional if you have any questions or concerns. By staying organized and thorough, you can successfully navigate the tax filing process and avoid any potential pitfalls.