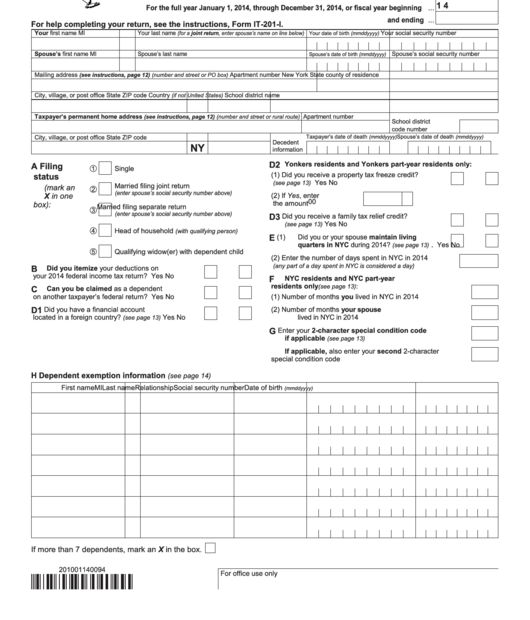

As tax season approaches, many individuals and families are starting to gather their financial documents and prepare to file their taxes. One important form that taxpayers may need to fill out is the 2018 Income Tax Form IT-201. This form is used by residents of New York State to report their income, deductions, and credits for the tax year 2018.

It is crucial for taxpayers to accurately complete the IT-201 form to ensure that they are not overpaying or underpaying their taxes. By carefully filling out this form, individuals can maximize their tax refunds or minimize the amount they owe to the state.

2018 Income Tax Form It-201 Printable

2018 Income Tax Form It-201 Printable

Get and Print 2018 Income Tax Form It-201 Printable

When filling out the IT-201 form, taxpayers will need to provide information about their income, including wages, interest, dividends, and any other sources of income. They will also need to report any deductions they are eligible for, such as mortgage interest, charitable contributions, and student loan interest.

In addition, taxpayers will need to claim any tax credits they qualify for, such as the Earned Income Tax Credit or the Child and Dependent Care Credit. These credits can help reduce the amount of tax owed or increase the taxpayer’s refund.

Once the IT-201 form is completed, taxpayers can file it electronically or mail it to the New York State Department of Taxation and Finance. It is important to file the form by the deadline to avoid penalties and interest on any unpaid taxes.

Overall, the 2018 Income Tax Form IT-201 is an essential document for New York State residents to accurately report their income and deductions for the tax year 2018. By filling out this form correctly, taxpayers can ensure that they are meeting their tax obligations and potentially receive a refund from the state.

As tax season approaches, it is important for individuals and families to start preparing their tax returns. The 2018 Income Tax Form IT-201 is a crucial document for New York State residents to accurately report their income, deductions, and credits. By carefully filling out this form, taxpayers can ensure that they are meeting their tax obligations and potentially receive a refund from the state.