Earned Income Credit (EIC) is a tax credit for low to moderate-income individuals and families. It is designed to help reduce the tax burden on those who may need it most. The EIC is a refundable credit, which means that even if you don’t owe any taxes, you may still be eligible to receive a refund.

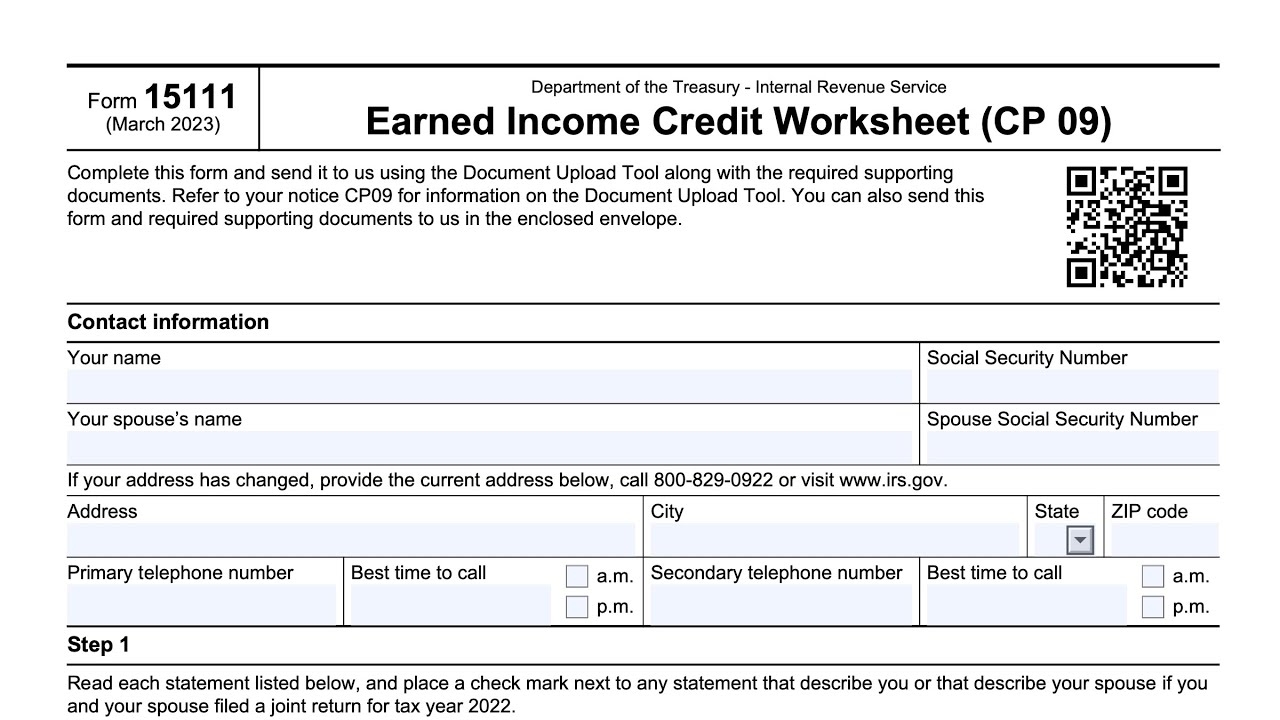

However, in order to claim the Earned Income Credit, you must file a tax return and fill out the necessary forms. One of the most important forms you will need is the Printable Earned Income Credit Form. This form will ask for information about your income, expenses, and dependents in order to determine your eligibility for the credit.

Printable Earned Income Credit Form

Printable Earned Income Credit Form

Get and Print Printable Earned Income Credit Form

Printable Earned Income Credit Form

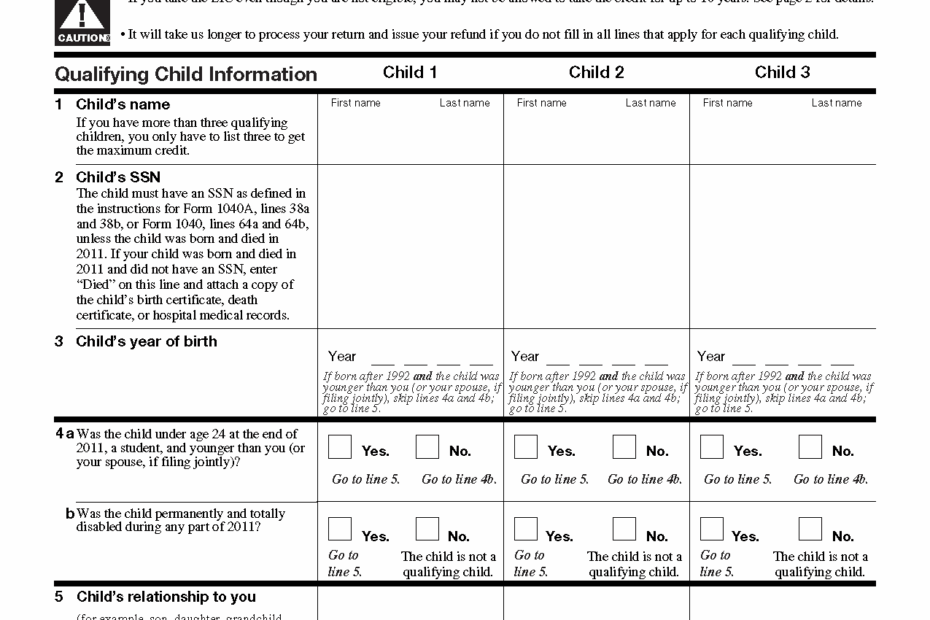

The Printable Earned Income Credit Form is available online and can be easily downloaded and printed. It typically consists of several sections, including personal information, income details, and information about qualifying children. You will need to fill out each section accurately and completely in order to claim the credit.

When filling out the form, be sure to have all relevant documents on hand, such as W-2 forms, proof of income, and Social Security numbers for yourself and any qualifying dependents. It is important to double-check all information before submitting the form to ensure accuracy and avoid any delays in processing.

Once you have completed the Printable Earned Income Credit Form, you can submit it along with your tax return to the IRS. If you are eligible for the credit, it will be applied to your tax liability or you may receive a refund if the credit exceeds the amount of tax you owe.

Overall, the Printable Earned Income Credit Form is a valuable tool for those who may qualify for the EIC. By taking the time to fill out the form correctly and submit it with your tax return, you can potentially receive a significant tax credit that can help alleviate financial burdens and provide much-needed assistance.

In conclusion, the Printable Earned Income Credit Form is an essential document for individuals and families seeking to claim the Earned Income Credit. By accurately completing the form and submitting it along with your tax return, you can potentially receive a valuable tax credit that can make a difference in your financial situation. Be sure to take advantage of this opportunity if you qualify for the EIC.