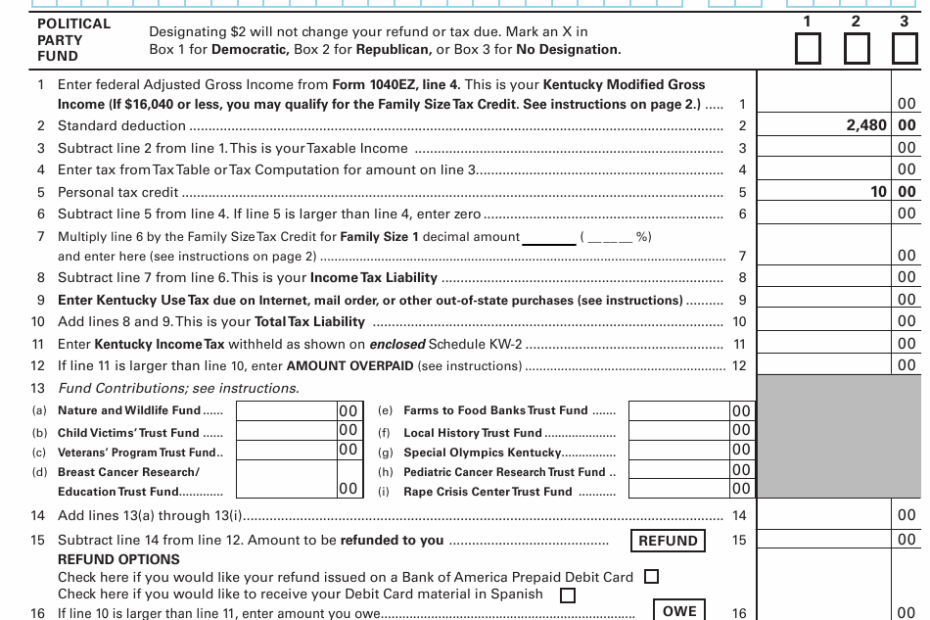

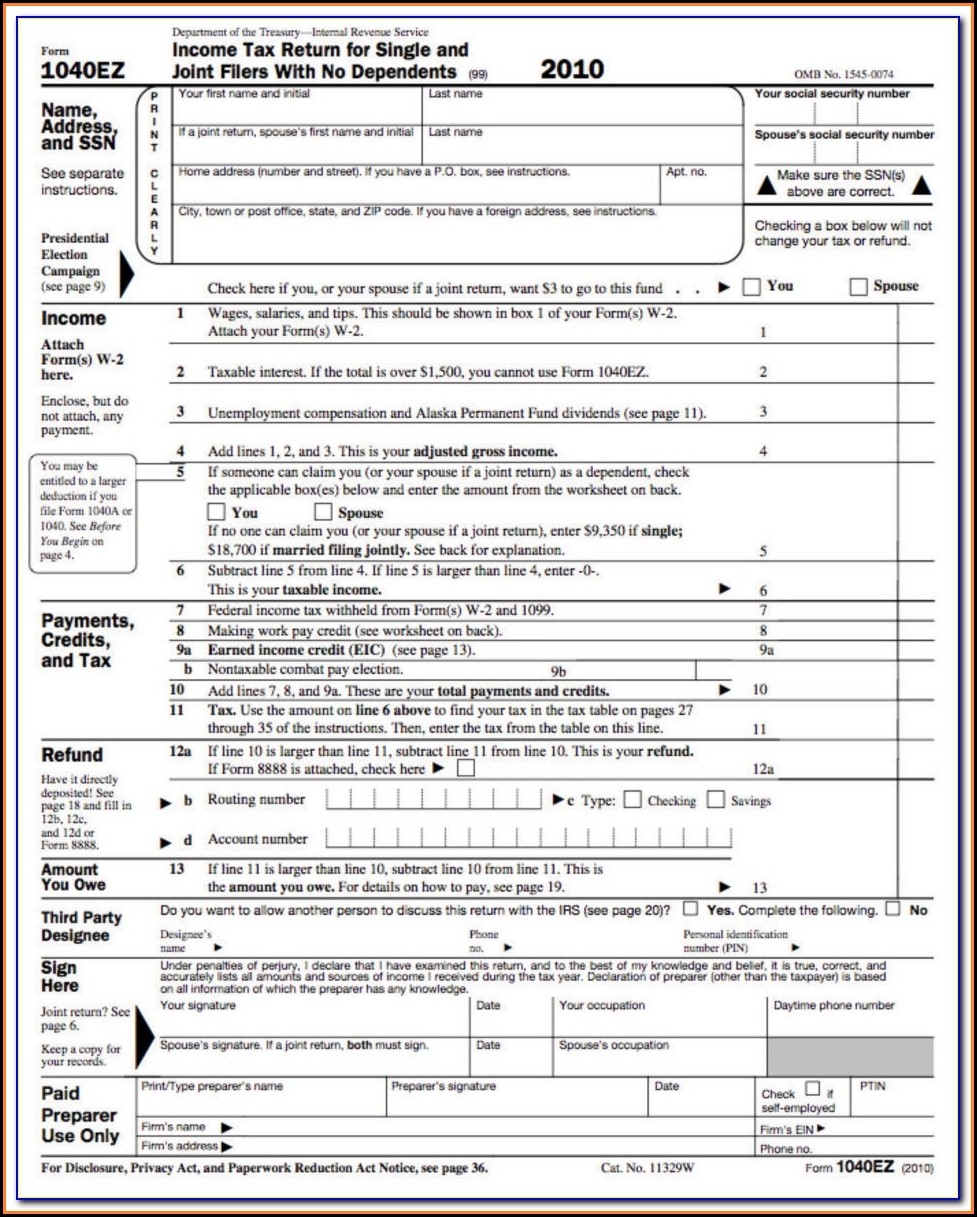

When tax season rolls around, it’s important to have all the necessary forms and documents in order to file your taxes accurately and on time. One commonly used form for individuals with simple tax situations is the 1040ez form. This form is designed for taxpayers who have no dependents, do not itemize deductions, and have a taxable income of less than $100,000.

Printable Income Tax Forms 1040ez provide a convenient way for individuals to easily access and fill out their tax forms without needing to visit a tax preparation office or wait for forms to arrive in the mail. These forms can be easily downloaded from the IRS website or other reputable online sources, filled out electronically or printed out, and then submitted to the IRS.

Printable Income Tax Forms 1040ez

Printable Income Tax Forms 1040ez

Save and Print Printable Income Tax Forms 1040ez

Using the 1040ez form simplifies the tax filing process for individuals who meet the criteria for using this form. It only requires basic information such as income, filing status, and any tax credits or deductions that apply. By using this form, taxpayers can save time and effort in preparing their taxes and may even qualify for a faster refund.

It’s important to note that not everyone is eligible to use the 1040ez form. Individuals with more complex tax situations, such as those who have dependents, itemize deductions, or earn over $100,000 in taxable income, will need to use a different form, such as the standard 1040 form. However, for those who meet the requirements, the 1040ez form is a quick and easy option for filing taxes.

Overall, Printable Income Tax Forms 1040ez offer a convenient and accessible way for individuals with simple tax situations to file their taxes accurately and efficiently. By using this form, taxpayers can streamline the tax filing process and potentially receive their refunds more quickly. Be sure to check if you qualify to use the 1040ez form and take advantage of the printable options available to make tax season a little easier.