Filing income taxes can be a daunting task for many individuals. However, having access to printable income tax forms for the year 2016 can make the process much easier and more convenient. These forms provide a structured way for taxpayers to report their income, deductions, and credits to the Internal Revenue Service (IRS).

By using printable income tax forms for the year 2016, taxpayers can ensure that they are accurately reporting their financial information and taking advantage of any available tax breaks. Whether you are self-employed, a homeowner, or a student, having access to these forms can help you navigate the tax filing process with ease.

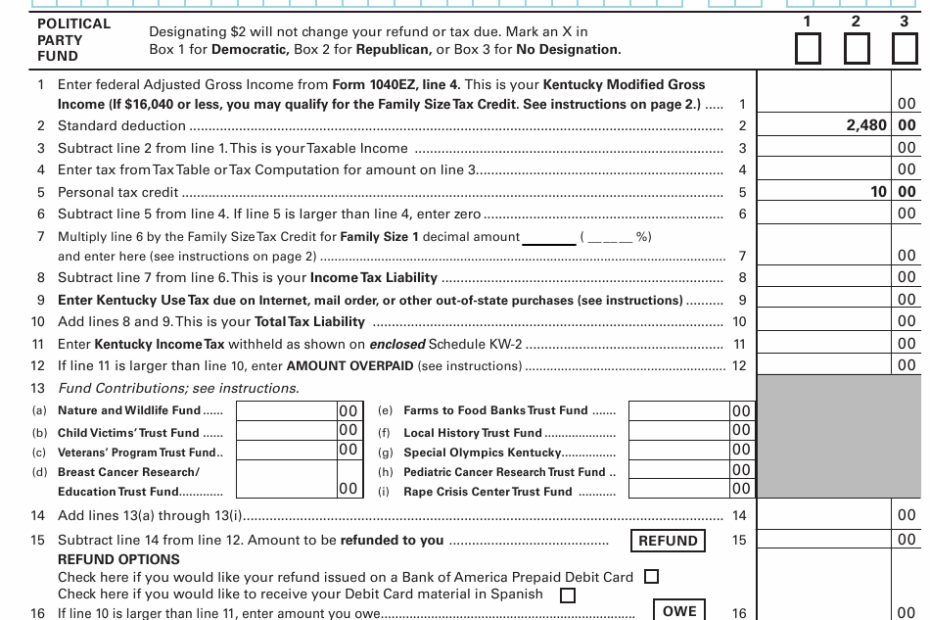

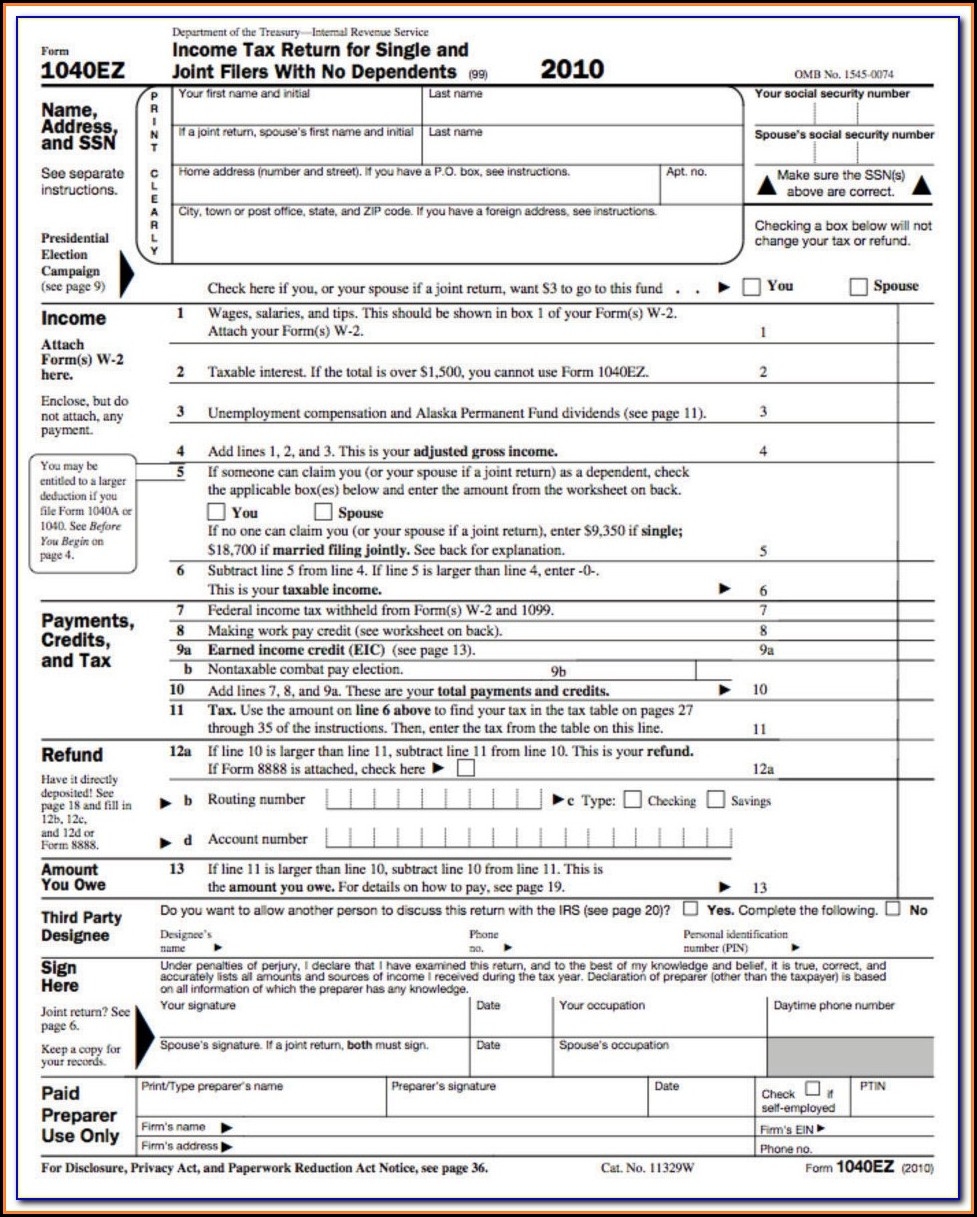

Printable Income Tax Forms 2016

Printable Income Tax Forms 2016

Download and Print Printable Income Tax Forms 2016

It is important to note that the IRS provides a variety of income tax forms for different types of income and deductions. Whether you need to report income from a W-2 form, interest and dividends, or business expenses, there are specific forms available for each situation. By utilizing the correct form for your financial situation, you can ensure that your taxes are filed accurately.

Printable income tax forms for the year 2016 are available for download on the IRS website. Taxpayers can easily access these forms, print them out, and fill them in at their own convenience. Additionally, many tax preparation software programs also offer printable versions of these forms, making it even easier for individuals to file their taxes electronically.

Overall, having access to printable income tax forms for the year 2016 can simplify the tax filing process and help taxpayers ensure that they are meeting their obligations to the IRS. By utilizing these forms, individuals can accurately report their income, deductions, and credits, ultimately leading to a smoother tax filing experience.

As tax season approaches, it is essential to gather all necessary documents and forms to prepare for filing your taxes. By utilizing printable income tax forms for the year 2016, you can streamline the process and ensure that you are meeting all IRS requirements. Take advantage of these resources to make tax season less stressful and more manageable.