Filing your taxes can be a daunting task, especially when it comes to fiduciary income tax. If you are a fiduciary responsible for managing the assets of an estate or trust in the state of New York, you will need to file Form IT-205. This form helps calculate the income tax due on the estate or trust’s income.

Understanding the requirements and guidelines for filing fiduciary income tax is crucial to ensure compliance with state laws and regulations. Fortunately, the New York State Department of Taxation and Finance provides a printable version of Form IT-205 on their website, making it easier for fiduciaries to file their taxes accurately and on time.

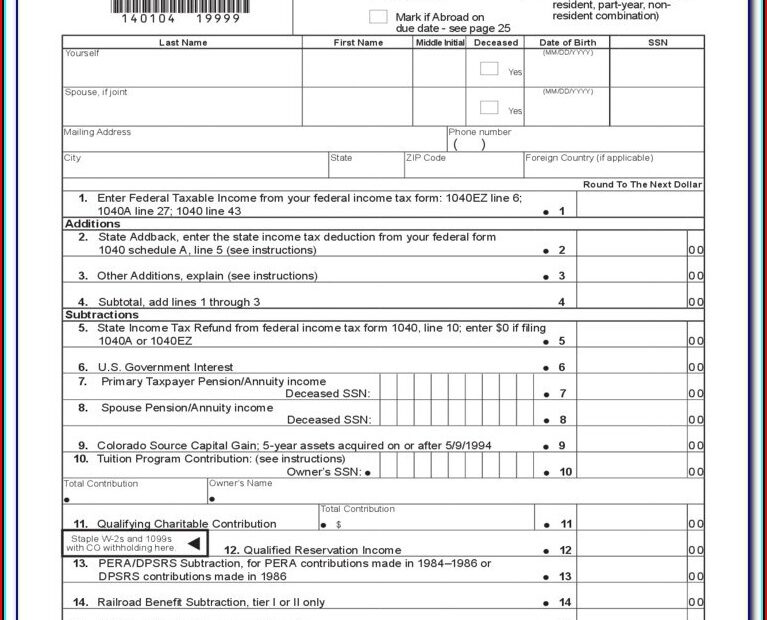

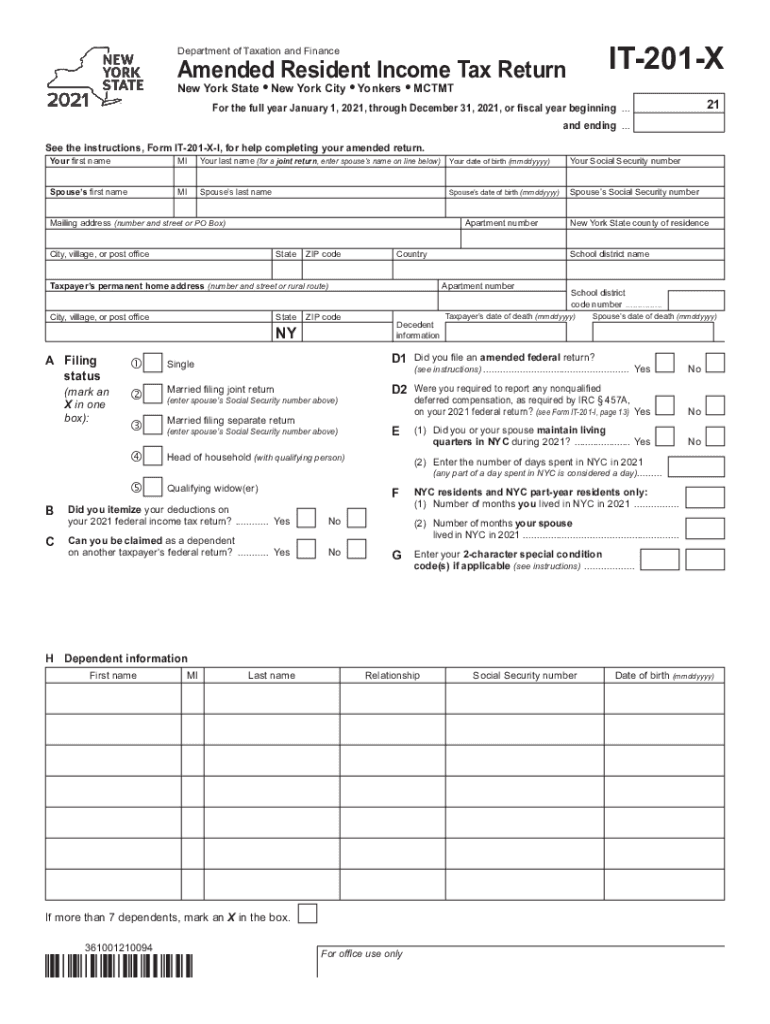

Printable Nys It205 Fiduciary Income Tax

Printable Nys It205 Fiduciary Income Tax

Save and Print Printable Nys It205 Fiduciary Income Tax

When filling out Form IT-205, fiduciaries will need to provide detailed information about the estate or trust’s income, deductions, and credits. This includes reporting income from investments, rental properties, and other sources, as well as any expenses incurred in the administration of the estate or trust.

It is important to keep accurate records and documentation to support the information provided on Form IT-205. Fiduciaries may also need to consult with a tax professional or accountant to ensure that they are completing the form correctly and taking advantage of any available tax deductions or credits.

Once the form is completed, fiduciaries can file it electronically or mail it to the New York State Department of Taxation and Finance. It is important to file the form by the deadline to avoid penalties and interest on any unpaid taxes.

In conclusion, filing fiduciary income tax can be a complex process, but with the help of the printable Nys It205 form and proper guidance, fiduciaries can successfully meet their tax obligations and avoid potential issues with the state tax authorities.