In today’s fast-paced world, it’s easy to lose track of where your money is going. Creating a personal income spending flowchart can help you visualize your financial situation and make informed decisions about your spending habits. By mapping out your income sources and expenses, you can identify areas where you may be overspending or where you could potentially save more.

Having a printable flowchart can serve as a constant reminder for you to stay on track with your financial goals. It can also help you track your progress over time and make adjustments as needed. With a clear visual representation of your income and spending, you can take control of your finances and work towards a more secure financial future.

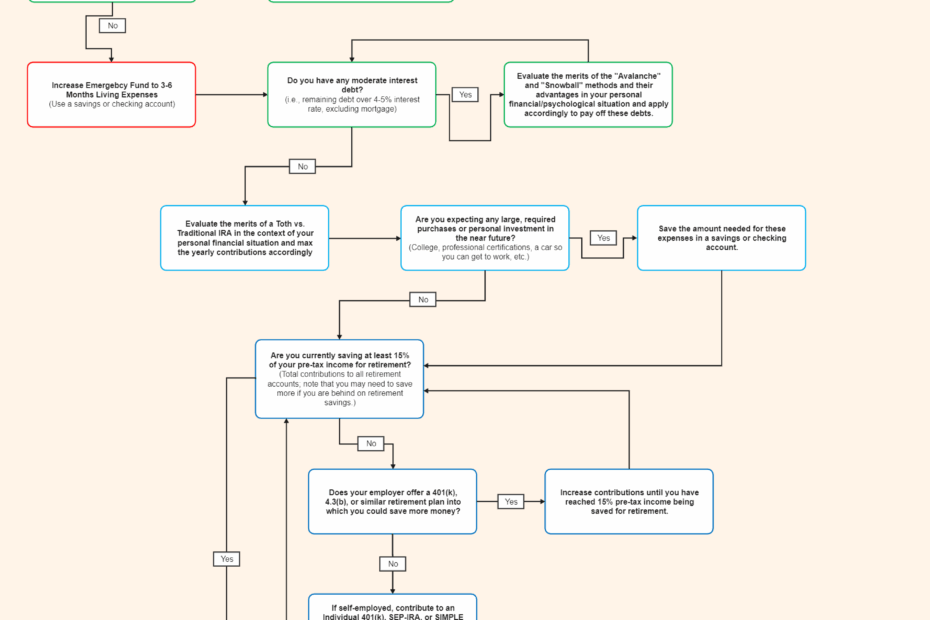

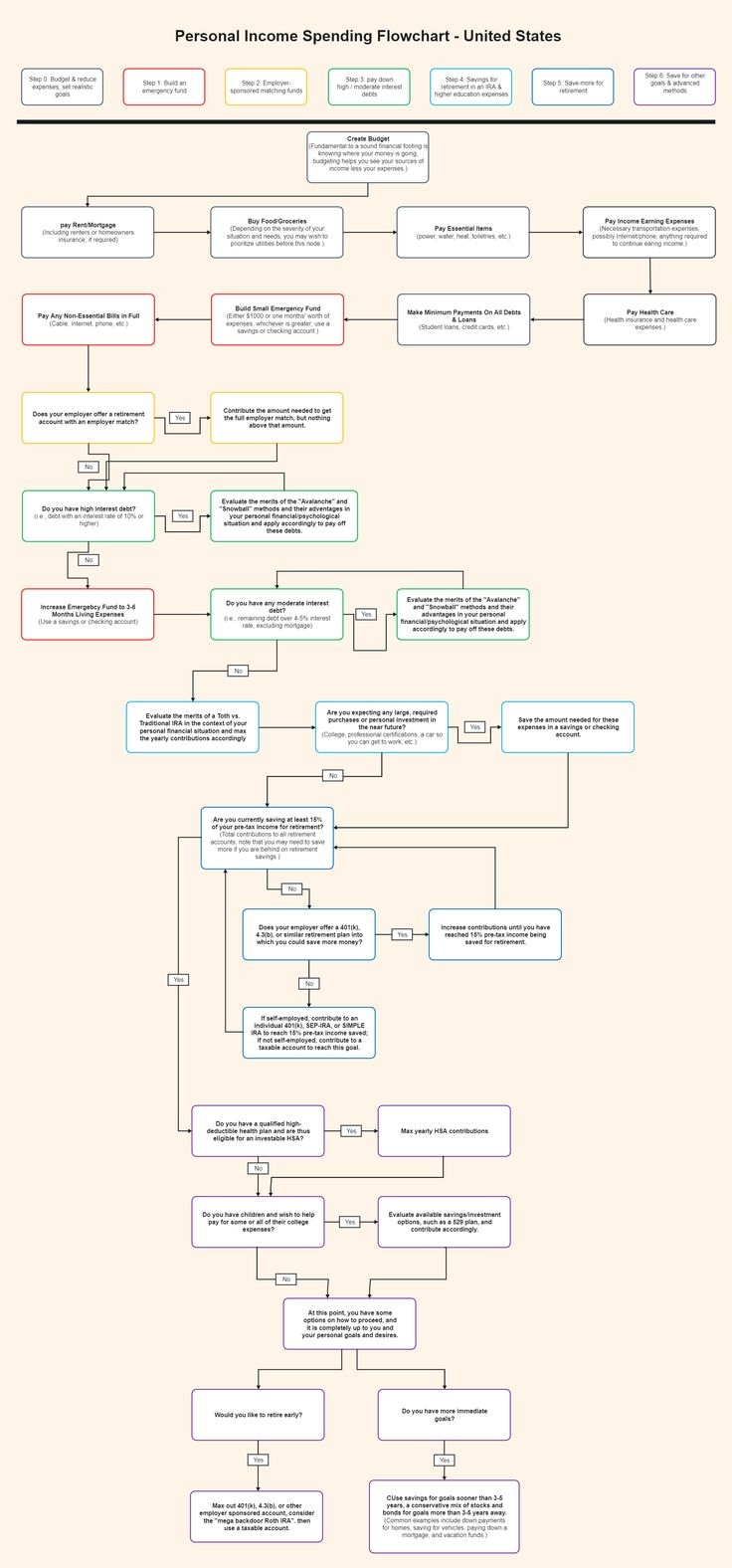

Personal Income Spending Flowchart Printable

Personal Income Spending Flowchart Printable

Save and Print Personal Income Spending Flowchart Printable

Creating a personal income spending flowchart can be a simple and effective way to manage your finances. Start by listing all your sources of income, including salary, bonuses, investments, and any other sources of revenue. Then, list all your expenses, such as rent, utilities, groceries, entertainment, and savings. Use arrows to connect your income sources to your expenses to visualize how your money flows in and out each month.

Once you have created your flowchart, take a closer look at where your money is going. Are there any areas where you could cut back on spending? Are there opportunities to increase your savings or investments? By analyzing your flowchart, you can make informed decisions about how to allocate your money more effectively.

Having a printable version of your income spending flowchart can be helpful for reference and planning. You can keep it in a visible place, such as on your fridge or desk, to remind yourself of your financial goals and progress. Regularly updating and reviewing your flowchart can help you stay accountable and motivated to make positive changes to your financial habits.

In conclusion, creating a personal income spending flowchart printable can be a valuable tool in managing your finances and achieving your financial goals. By visualizing your income sources and expenses, you can make informed decisions about your spending habits and work towards a more secure financial future. Take control of your finances today by creating your own income spending flowchart and start making positive changes to your financial well-being.