As the tax season approaches, it is essential for individuals to gather all the necessary documents and forms to accurately file their federal income tax. The Federal Income Tax Forms 2016 Printable are readily available online for taxpayers to easily access and fill out. These forms are crucial for reporting income, deductions, and credits for the tax year 2016.

Whether you are a salaried employee, self-employed individual, or business owner, it is important to ensure that you have the correct forms for filing your taxes. The Federal Income Tax Forms 2016 Printable provide a convenient way for taxpayers to organize their financial information and comply with the tax laws set by the Internal Revenue Service (IRS).

Federal Income Tax Forms 2016 Printable

Federal Income Tax Forms 2016 Printable

Get and Print Federal Income Tax Forms 2016 Printable

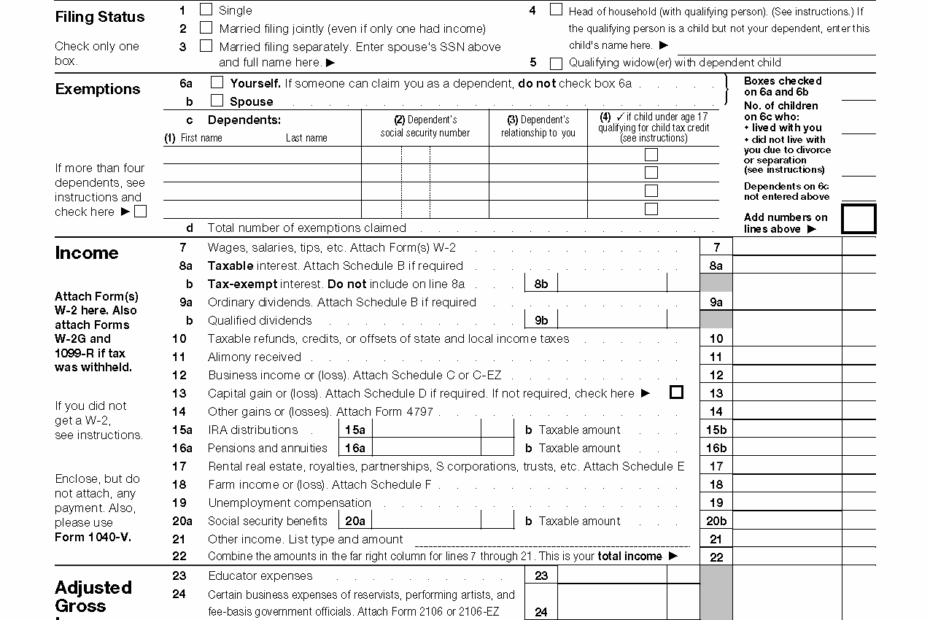

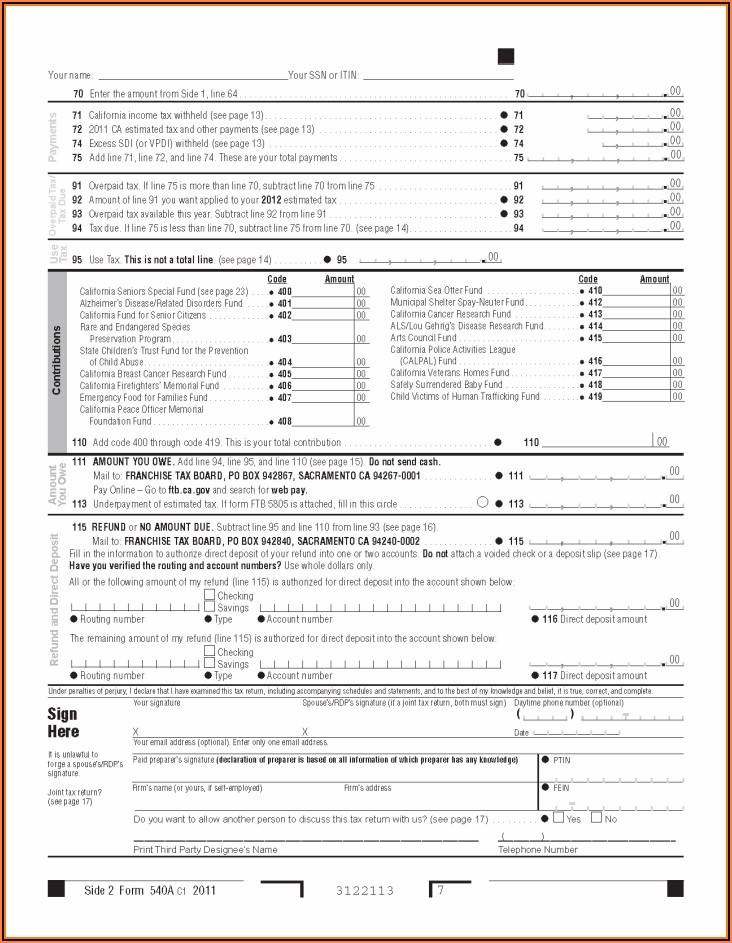

When preparing your federal income tax return for the year 2016, you will need to use various forms depending on your income sources and deductions. Some of the common forms include Form 1040, Form 1040A, and Form 1040EZ. These forms are designed to capture different types of income and deductions, so it is crucial to choose the right form that best fits your tax situation.

In addition to the basic income tax forms, taxpayers may also need to include additional schedules and worksheets to report specific types of income or claim certain tax credits. Some of the commonly used schedules include Schedule A for itemized deductions, Schedule C for self-employment income, and Schedule D for capital gains and losses. These supplemental forms are essential for providing a detailed breakdown of your income and expenses.

It is important to note that the Federal Income Tax Forms 2016 Printable are for the tax year 2016 only and should not be used for filing taxes for subsequent years. Taxpayers are encouraged to download the latest tax forms and instructions from the IRS website to ensure compliance with the current tax laws and regulations. By accurately completing and submitting the required tax forms, individuals can avoid potential penalties and ensure that they receive any eligible tax refunds.

As the tax deadline approaches, taxpayers should take the time to gather all the necessary documents and fill out the Federal Income Tax Forms 2016 Printable accurately. By being proactive and organized, individuals can streamline the tax filing process and avoid any potential errors or omissions. Remember to consult with a tax professional or use tax software if you need assistance with completing your tax return.