As tax season approaches, many individuals are gathering their documents and preparing to file their state income taxes for the year 2015. Pennsylvania residents can access printable forms online to help them navigate the filing process. These forms are essential for accurately reporting income, deductions, and credits to ensure compliance with state tax laws.

It is crucial for taxpayers to be aware of the various forms they may need to complete based on their individual financial situation. Whether you are a full-time employee, self-employed individual, or have other sources of income, having the correct forms on hand will streamline the filing process and help you avoid any potential errors.

2015 Pa State Income Tax Forms Printable

2015 Pa State Income Tax Forms Printable

Download and Print 2015 Pa State Income Tax Forms Printable

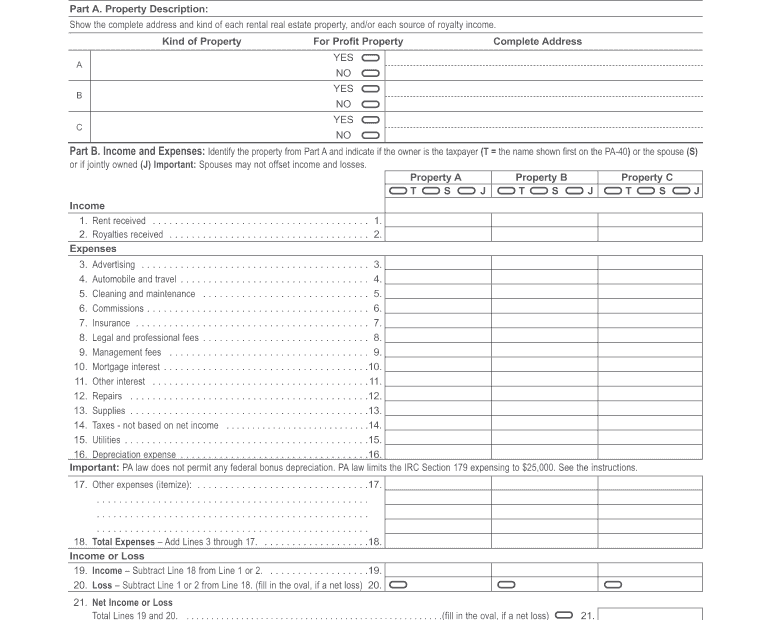

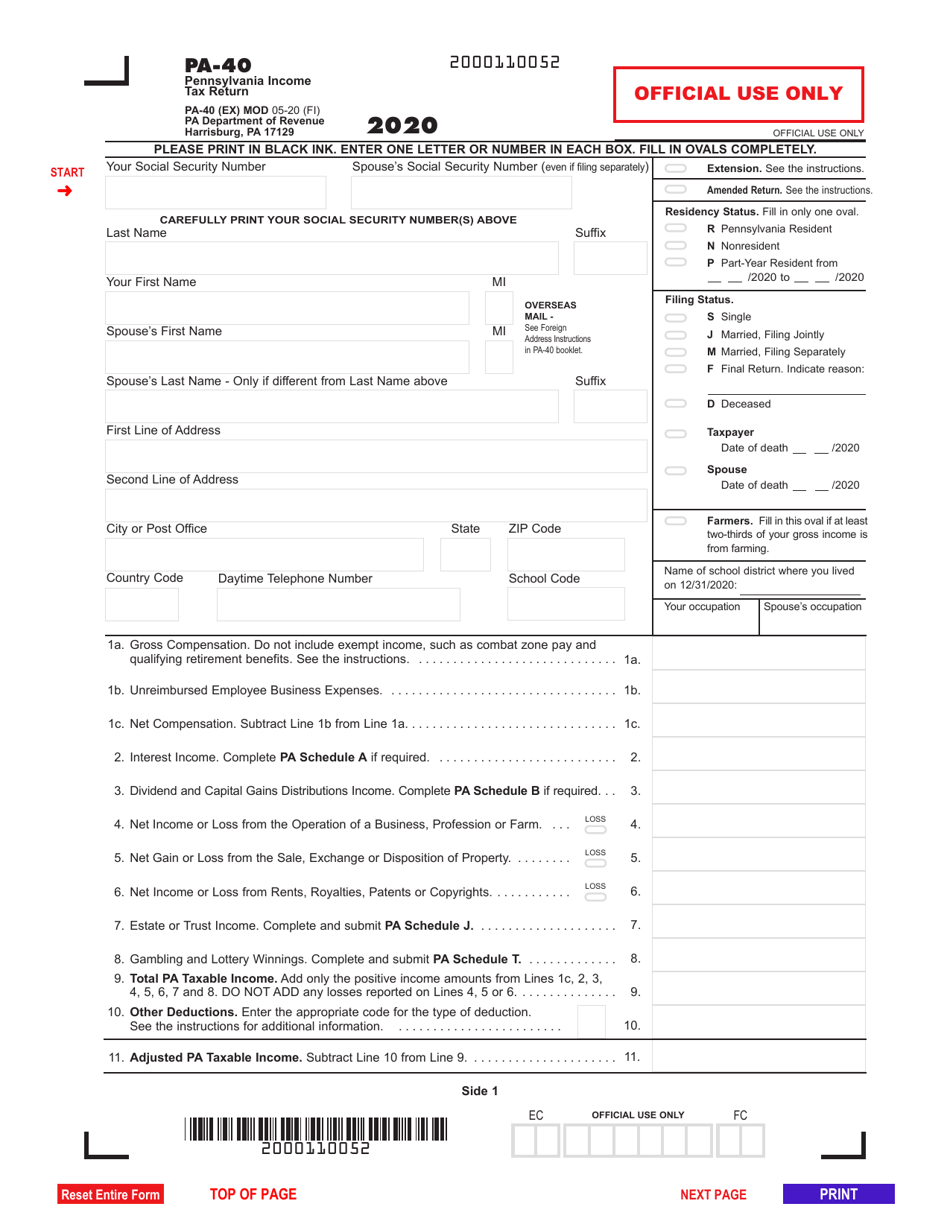

Some of the common forms Pennsylvania residents may need for their 2015 state income tax filing include the PA-40, PA-40 Schedule SP, PA-40 Schedule NRH, and PA-40 Schedule UE. These forms cover a range of income sources, deductions, and credits that taxpayers may need to report. By carefully reviewing each form and following the instructions provided, individuals can ensure accurate reporting and potentially maximize their tax refunds.

Additionally, taxpayers should be mindful of any changes to tax laws or regulations that may impact their filing for the year 2015. Staying informed about updates from the Pennsylvania Department of Revenue can help individuals avoid any surprises or penalties when submitting their tax returns. Utilizing the printable forms available online can also simplify the process and reduce the likelihood of errors.

In conclusion, accessing printable 2015 PA state income tax forms is essential for individuals residing in Pennsylvania who need to file their state taxes for that year. By familiarizing themselves with the required forms and following the instructions provided, taxpayers can ensure a smooth filing process and potentially take advantage of available deductions and credits. Being proactive and organized when gathering documentation and completing forms can help individuals meet their tax obligations and avoid any potential issues with the Pennsylvania Department of Revenue.