When tax season rolls around, it’s important to have all the necessary forms ready to file your taxes accurately and on time. For residents of Wisconsin, this means having access to the Wisconsin income tax forms for the year 2023. These forms are essential for reporting your income, deductions, and credits to the state government.

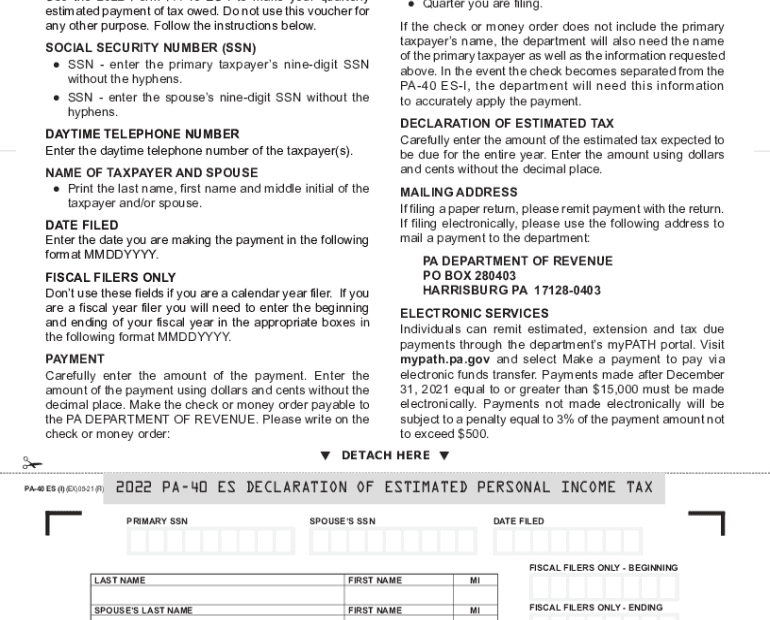

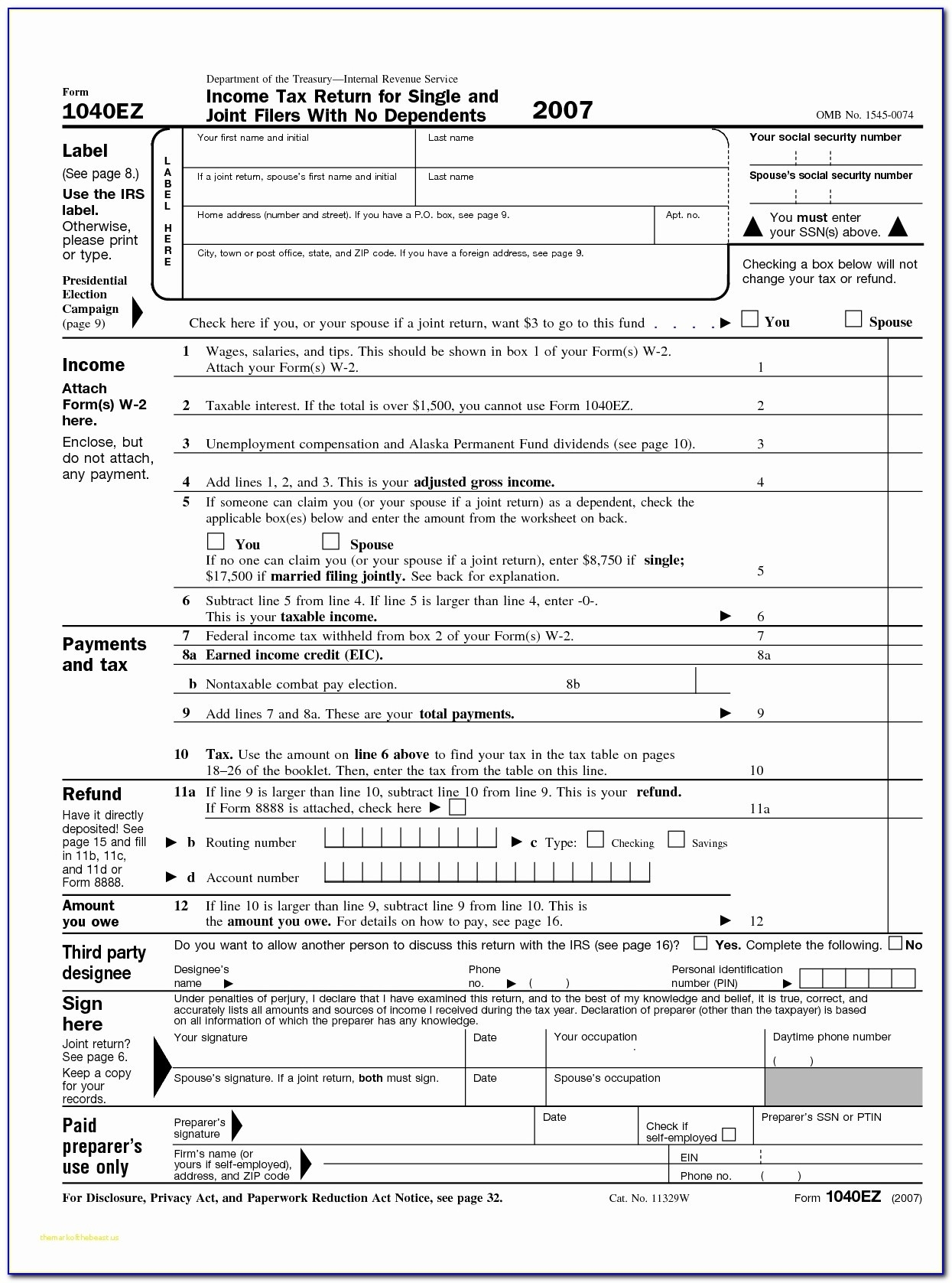

Whether you prefer to file your taxes online or by mail, having printable versions of the Wisconsin income tax forms for 2023 can make the process much easier. You can fill them out at your own pace, double-check your information, and have a physical copy for your records.

Wisconsin Income Tax Forms 2023 Printable

Wisconsin Income Tax Forms 2023 Printable

Save and Print Wisconsin Income Tax Forms 2023 Printable

When it comes to Wisconsin income tax forms for 2023, there are several key documents you may need to complete depending on your financial situation. These forms include the Wisconsin Individual Income Tax Return (Form 1), Schedule WD (Capital Gains and Losses), Schedule I (Adjustments to Income), and Schedule PS (Credit for Tax Paid to Another State).

It’s important to carefully review each form and its instructions to ensure you are providing accurate information. Any mistakes or omissions could result in delays in processing your return or potential penalties from the Wisconsin Department of Revenue. By using the printable versions of these forms, you can take your time and avoid rushing through the process.

For additional assistance with filling out the Wisconsin income tax forms for 2023, you can consult the Wisconsin Department of Revenue website or seek guidance from a tax professional. They can help answer any questions you may have and ensure you are maximizing your deductions and credits to minimize your tax liability.

Overall, having access to printable Wisconsin income tax forms for 2023 can simplify the tax filing process and help you stay organized. By gathering all the necessary documents and completing the forms accurately, you can submit your tax return with confidence and avoid any potential issues with the state government.