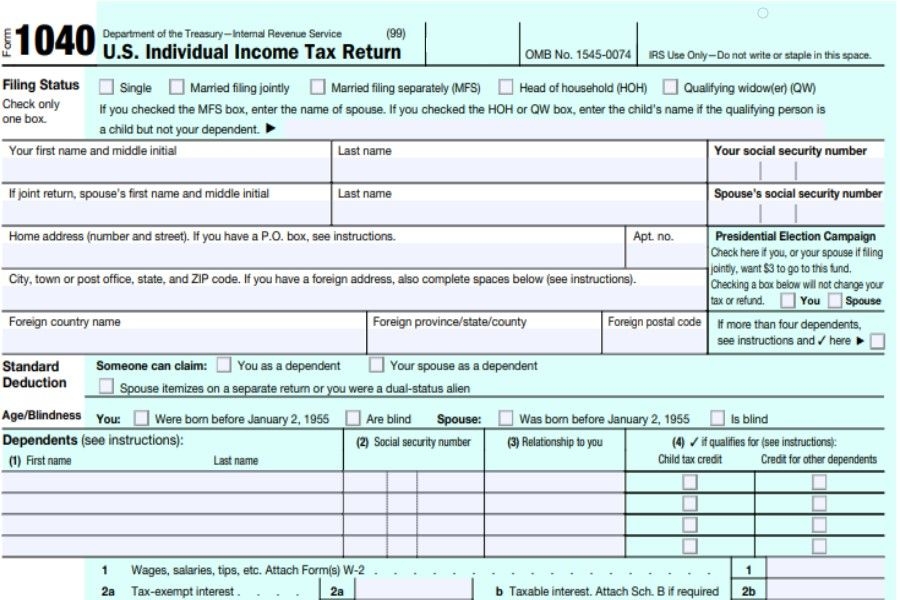

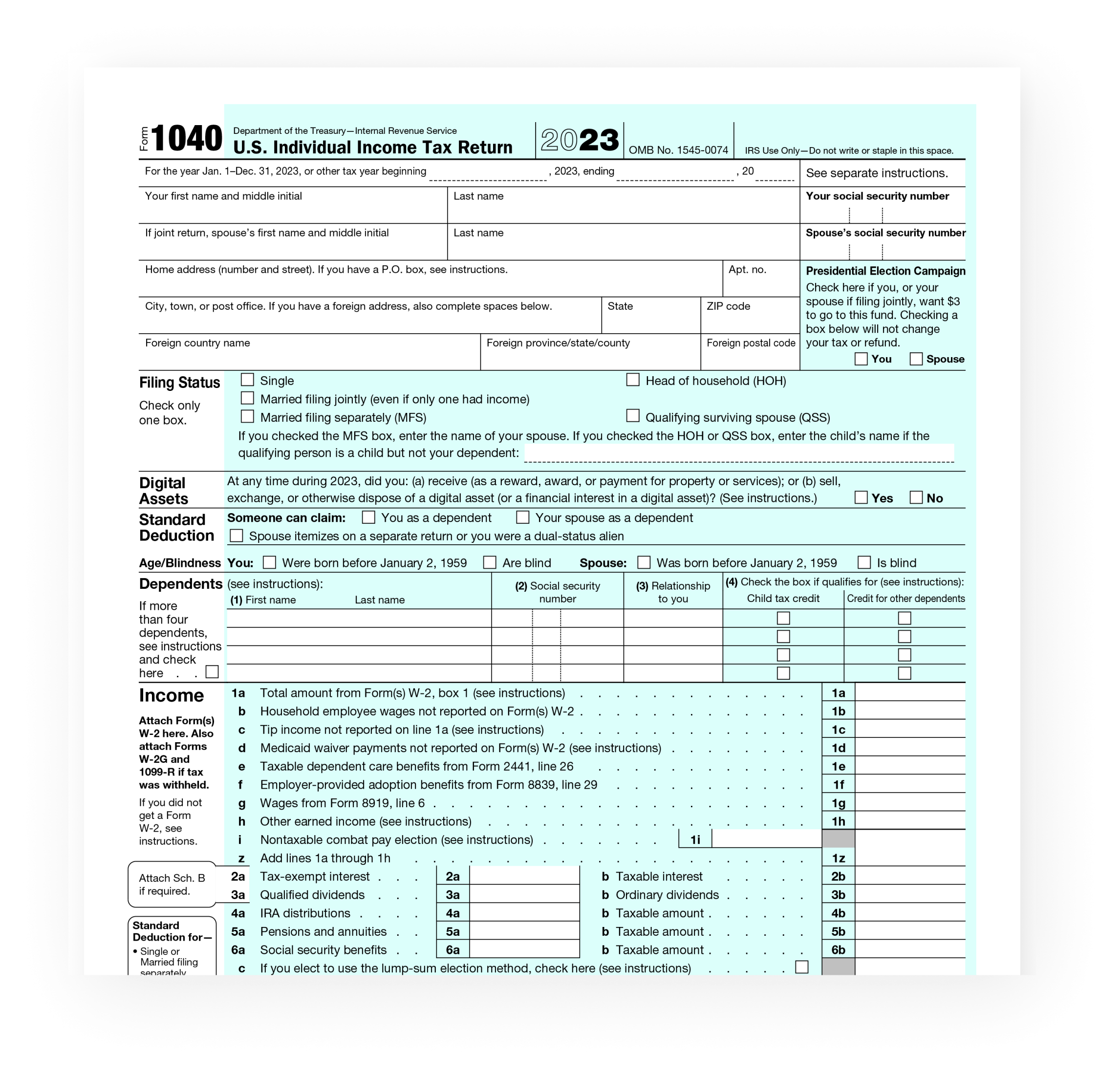

Filing your federal income taxes can be a daunting task, but with the right tools and resources, it can be made much easier. One of the most commonly used forms for filing taxes is the Form 1040a, which is designed for individuals with simple tax situations.

Printable Federal Income Tax Form 1040a provides a simplified way for taxpayers to report their income, deductions, and credits. This form is shorter and easier to fill out compared to the standard Form 1040, making it ideal for those with straightforward tax situations.

Printable Federal Income Tax Form 1040a

Printable Federal Income Tax Form 1040a

Easily Download and Print Printable Federal Income Tax Form 1040a

When filling out the Form 1040a, taxpayers will need to provide information such as their income, deductions, and credits. This form is designed to be used by individuals who do not have complex financial situations, such as those who do not have self-employment income or extensive investments.

One of the key benefits of using the Form 1040a is that it allows taxpayers to claim certain tax credits and deductions that can help reduce their tax liability. Some of the credits that can be claimed on this form include the Earned Income Tax Credit, the Child Tax Credit, and the American Opportunity Credit for education expenses.

Overall, Printable Federal Income Tax Form 1040a is a valuable tool for individuals who have simple tax situations and want to make the process of filing their taxes easier. By using this form, taxpayers can accurately report their income, deductions, and credits in a streamlined manner.

As the tax filing deadline approaches, it is important for individuals to gather all necessary documents and information to complete their tax return. By using Printable Federal Income Tax Form 1040a, taxpayers can ensure that they are accurately reporting their financial information and taking advantage of any available tax credits and deductions.