As tax season approaches, it’s important to start gathering all the necessary documents and information to file your income tax return. Having a comprehensive checklist can help ensure that you don’t miss any important details and can make the process much smoother and stress-free. With the right tools and resources, you can stay organized and on top of your tax obligations.

Whether you’re a first-time filer or a seasoned pro, having a printable income tax checklist can be a game-changer. It can serve as a roadmap to guide you through the process and help you gather all the necessary paperwork, receipts, and forms needed to complete your return accurately. By checking off each item on the list, you can feel confident that you’ve covered all your bases and are ready to file.

Printable Income Tax Checklist

Printable Income Tax Checklist

Easily Download and Print Printable Income Tax Checklist

Printable Income Tax Checklist

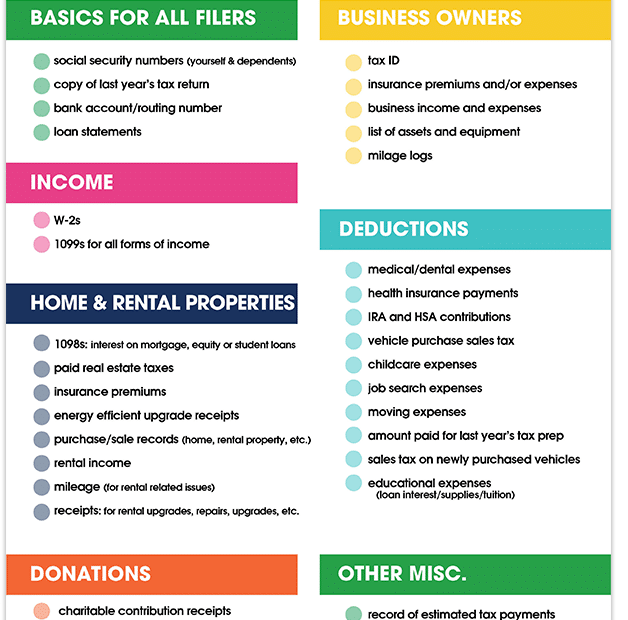

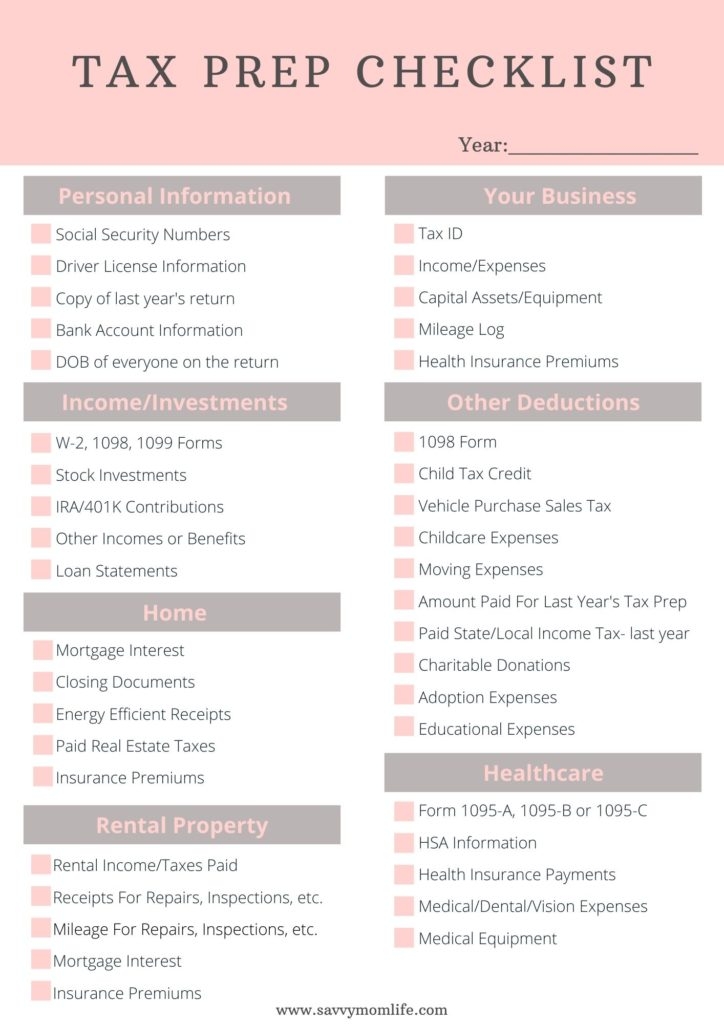

1. Personal Information: Gather your Social Security number, as well as the Social Security numbers of any dependents you’ll be claiming. You’ll also need your filing status, such as single, married, or head of household.

2. Income Documents: Collect all W-2 forms from your employer, 1099 forms for any freelance work or investments, and any other income statements you’ve received throughout the year.

3. Deductions and Credits: Keep track of any deductible expenses, such as mortgage interest, medical expenses, and charitable donations. Make sure to have documentation to support these deductions, such as receipts and statements.

4. Retirement and Savings: If you have retirement accounts or savings plans, gather the relevant statements to report any contributions or distributions you’ve made during the year.

5. Additional Information: Don’t forget to include any other relevant documents, such as rental income statements, student loan interest statements, or state tax refund statements.

By using this printable income tax checklist, you can streamline the tax preparation process and ensure that you have all the necessary information at your fingertips. Being organized and thorough can help you maximize your deductions and credits, potentially saving you money and avoiding any costly mistakes on your return.

As tax season approaches, take the time to gather your documents and use this checklist to stay on track. With the right tools and resources, you can navigate the tax filing process with confidence and peace of mind.