Supplemental Security Income (SSI) is a federal income supplement program designed to help aged, blind, and disabled people who have limited income. It provides cash to meet basic needs for food, shelter, and clothing. Individuals receiving SSI are required to report any changes in their income to the Social Security Administration (SSA) on a regular basis to ensure they are receiving the correct amount of benefits.

One way to report changes in income is through the Supplemental Security Income Printable Wage Reporting Form. This form can be easily downloaded and printed from the SSA website. It allows SSI recipients to report their wages, self-employment income, and other sources of income to the SSA in a clear and organized manner.

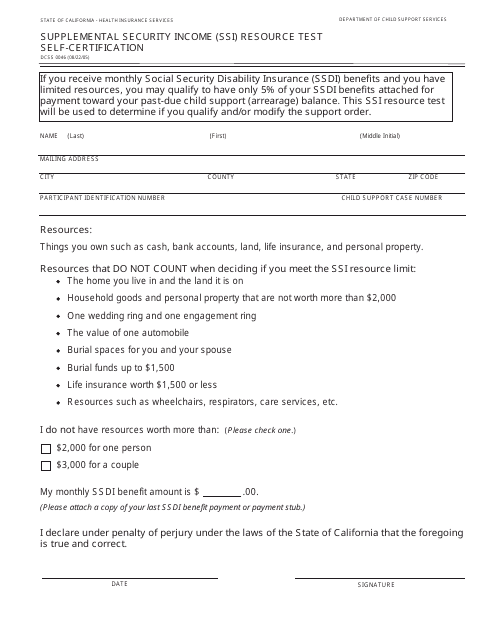

Supplemental Security Income Printable Wage Reporting Form

Supplemental Security Income Printable Wage Reporting Form

Save and Print Supplemental Security Income Printable Wage Reporting Form

When filling out the form, individuals must provide accurate information about their income for the specified reporting period. This includes details such as gross wages, net earnings from self-employment, and any other income received during that time. It is important to fill out the form completely and accurately to avoid any potential overpayments or underpayments of SSI benefits.

After completing the form, individuals can either mail it to the SSA or bring it in person to their local Social Security office. The information provided on the form will be used by the SSA to adjust the individual’s SSI benefits accordingly. Failure to report changes in income in a timely manner can result in penalties or even loss of benefits.

In conclusion, the Supplemental Security Income Printable Wage Reporting Form is a valuable tool for SSI recipients to report changes in their income and ensure they are receiving the correct amount of benefits. By accurately completing and submitting this form, individuals can avoid potential issues with their SSI payments and ensure they continue to receive the assistance they need.