As the April deadline for filing your federal income tax return approaches, you may find yourself feeling overwhelmed and rushed to get everything in order. However, if you need more time to gather your documents or simply can’t file by the deadline, there is an option available to you: filing for a tax extension. Understanding how to properly file for an extension can give you the extra time you need to ensure your taxes are filed accurately and on time.

Many people are unaware of the fact that they can file for a tax extension if they are unable to meet the April deadline. By filing for an extension, you can push your tax filing deadline back by six months, giving you until October to file your federal income tax return. This can be a lifesaver for those who need more time to gather all of their necessary documents or who simply need more time to prepare their taxes.

Federal Income Tax Extension Form Printable

Federal Income Tax Extension Form Printable

Quickly Access and Print Federal Income Tax Extension Form Printable

Federal Income Tax Extension Form Printable

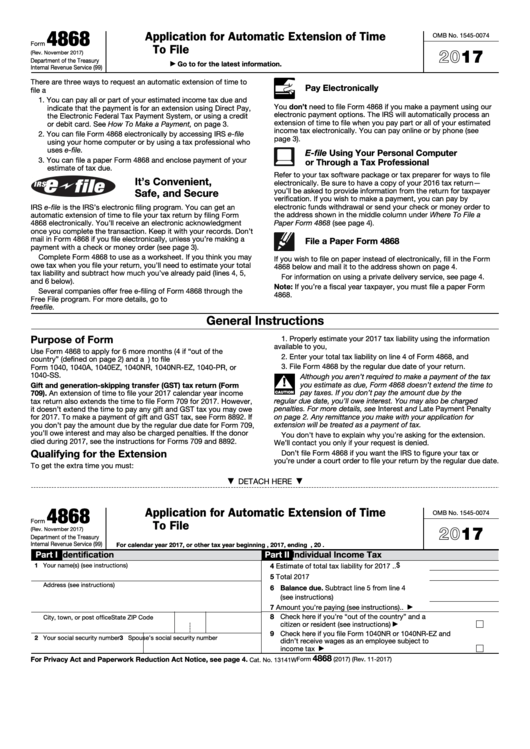

One of the easiest ways to file for a tax extension is by using the Federal Income Tax Extension Form, also known as Form 4868. This form is readily available online and can be easily downloaded and printed from the IRS website. Once you have filled out the form, you can submit it electronically or by mail to request an extension of time to file your federal income tax return.

When filling out the Federal Income Tax Extension Form, you will need to provide basic information such as your name, address, and Social Security number. You will also need to estimate the total amount of tax liability you expect to owe for the year. It’s important to note that filing for an extension does not give you more time to pay any taxes owed; it only extends the deadline for filing your return.

After submitting Form 4868, you will receive a confirmation from the IRS indicating that your extension request has been approved. This will give you peace of mind knowing that you have extra time to ensure your tax return is accurate and complete. Remember, it’s always better to file for an extension than to file your taxes late and risk facing penalties.

In conclusion, understanding how to file for a tax extension using the Federal Income Tax Extension Form can be a valuable tool for those who need more time to prepare their taxes. By utilizing this form, you can avoid the stress of rushing to meet the April deadline and ensure that your taxes are filed accurately and on time.