If you are a resident of New Jersey and need to file your income taxes for the year 2014, you may be wondering where you can find the necessary forms. Fortunately, the New Jersey Department of Revenue provides printable forms online for your convenience. These forms are essential for accurately reporting your income and claiming any deductions or credits you may be eligible for.

By using the printable NJ income tax forms for 2014, you can ensure that you are fulfilling your tax obligations and avoiding any penalties for late or incorrect filing. Whether you are filing as an individual, a business, or another entity, having the proper forms on hand is crucial for a smooth and efficient tax filing process.

Printable Nj Income Tax Forms 2014

Printable Nj Income Tax Forms 2014

Download and Print Printable Nj Income Tax Forms 2014

Printable NJ Income Tax Forms 2014

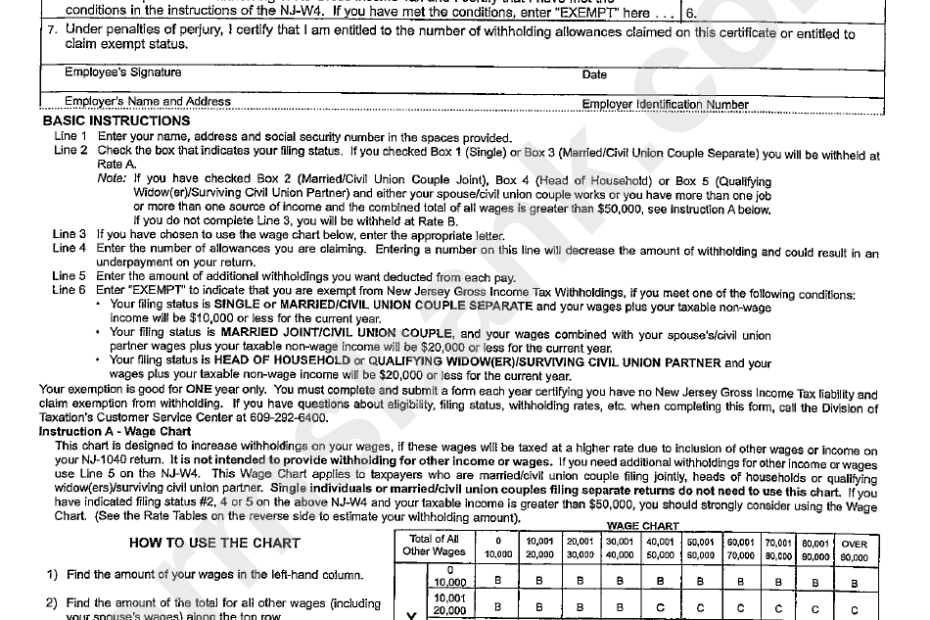

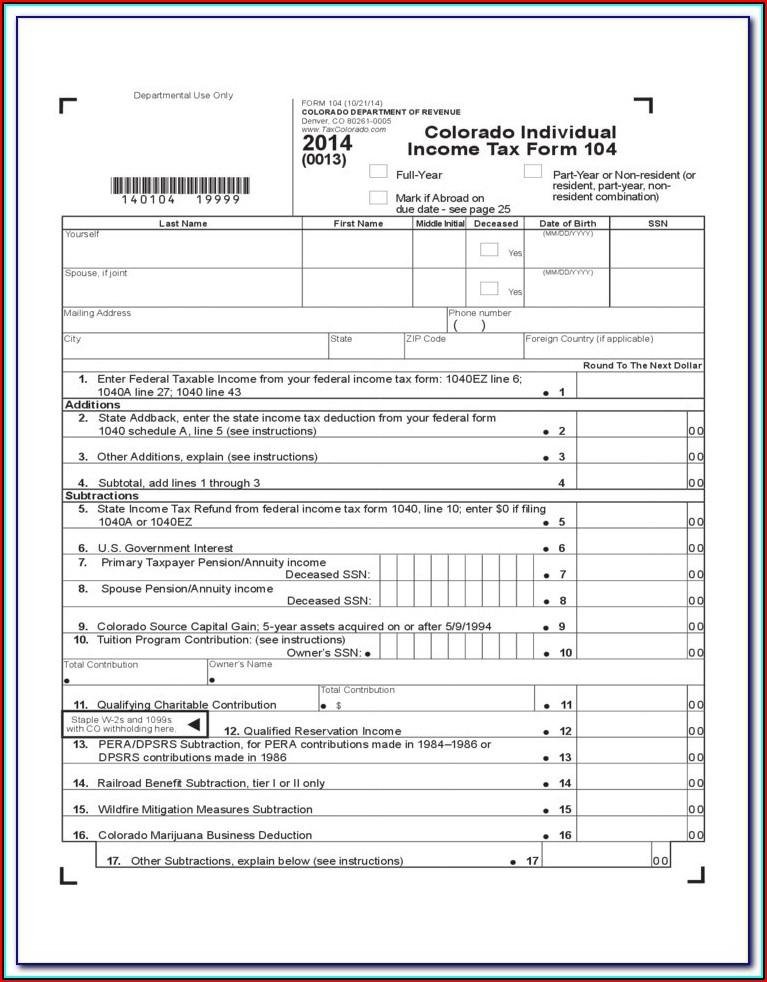

When looking for the printable NJ income tax forms for 2014, you can visit the official website of the New Jersey Department of Revenue. There, you will find a comprehensive list of forms for various types of tax filings, including Form NJ-1040 for individual income tax, Form NJ-1040NR for nonresident and part-year resident returns, and Form NJ-927 for employer withholding tax.

It is essential to carefully review each form and its instructions to ensure that you are providing accurate and complete information. Failing to do so could result in delays in processing your tax return or even potential audits by the tax authorities. By using the printable forms provided by the state, you can easily fill them out and submit them according to the specified deadlines.

Additionally, if you have any questions or need assistance with completing the forms, you can contact the New Jersey Department of Revenue for guidance. They have resources available to help taxpayers navigate the tax filing process and ensure that they are in compliance with state tax laws.

In conclusion, utilizing the printable NJ income tax forms for 2014 is crucial for fulfilling your tax obligations as a resident of New Jersey. By accessing these forms online and following the instructions provided, you can accurately report your income and claim any deductions or credits you are entitled to. Make sure to file your taxes on time and avoid any potential penalties by utilizing the resources available to you.