As the tax season approaches, many individuals and businesses are gearing up to file their income tax returns for the year 2020. One of the essential steps in this process is to obtain the necessary tax forms to accurately report your income, deductions, and credits. Luckily, the Internal Revenue Service (IRS) makes it easy for taxpayers to access printable income tax forms online.

By providing printable income tax forms for the year 2020, the IRS enables taxpayers to conveniently fill out their tax returns without the need to visit a physical location or wait for forms to arrive in the mail. This streamlined process saves time and ensures that taxpayers have everything they need to meet the filing deadline.

Printable Income Tax Forms 2020

Printable Income Tax Forms 2020

Get and Print Printable Income Tax Forms 2020

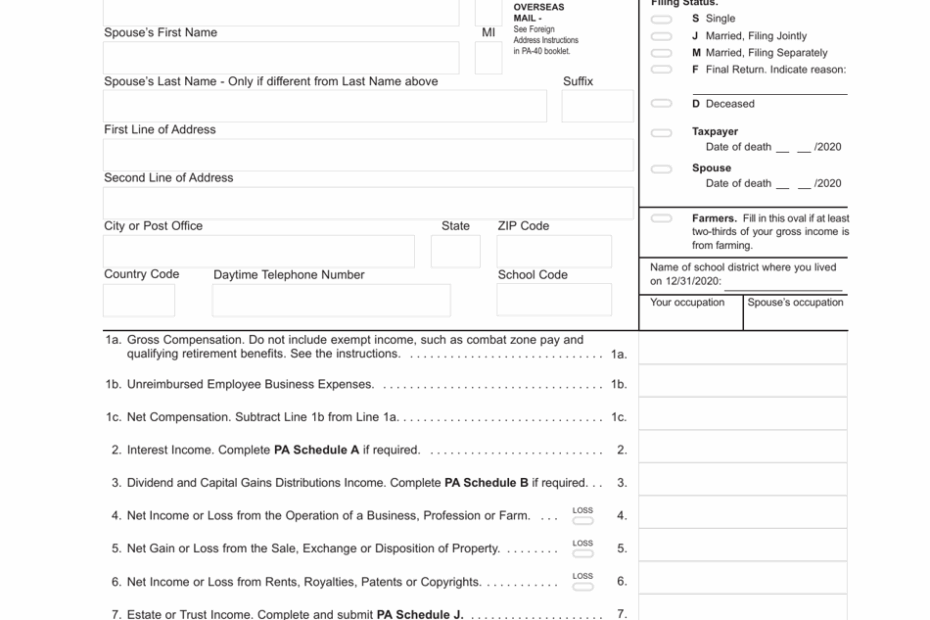

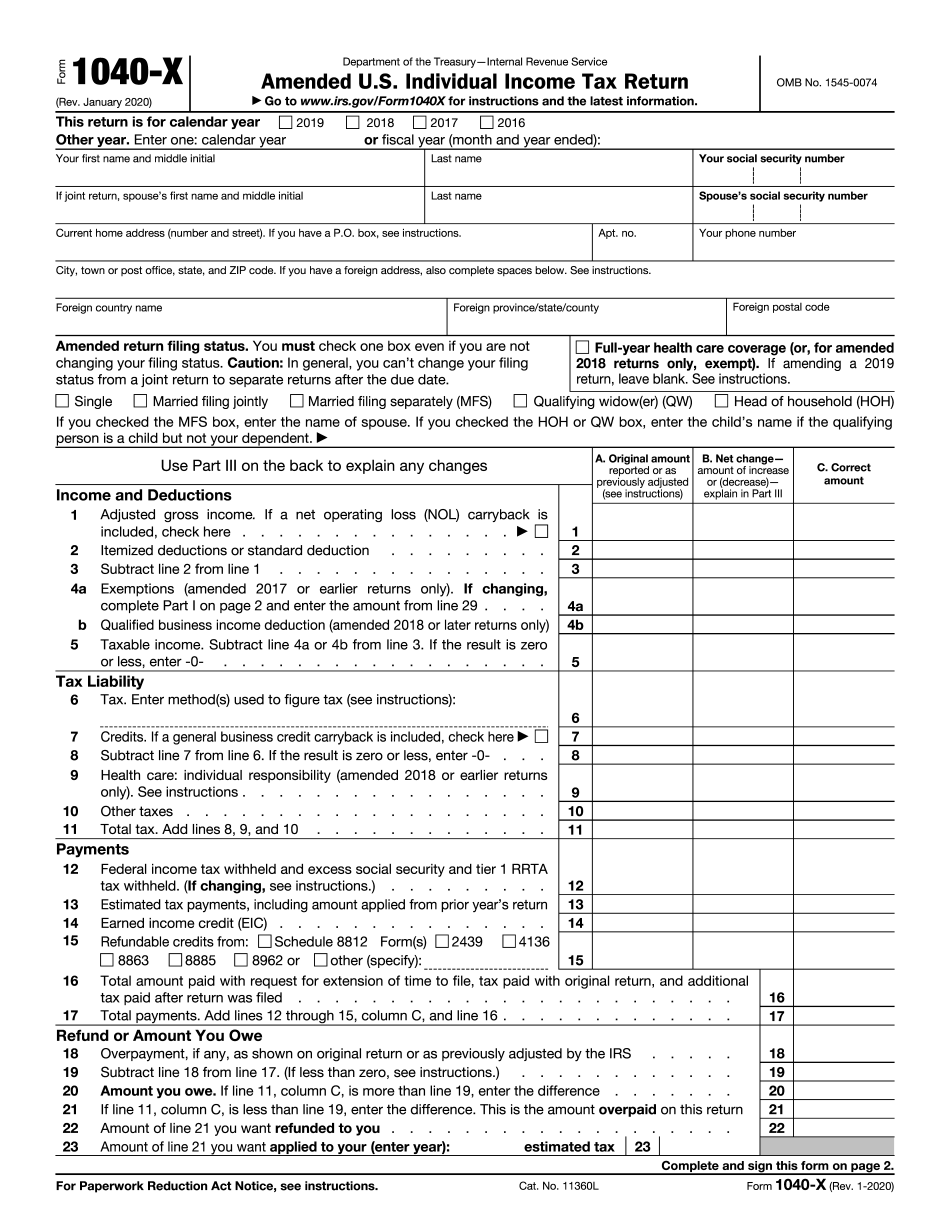

When accessing printable income tax forms for 2020, taxpayers can choose from a variety of forms depending on their filing status, income sources, and deductions. Common forms include the 1040, 1040A, and 1040EZ for individuals, as well as Schedule C for self-employed individuals and Schedule D for capital gains and losses.

In addition to federal income tax forms, taxpayers may also need to fill out state-specific forms to report income and pay state taxes. Many states provide printable income tax forms on their Department of Revenue websites, making it easy for taxpayers to file both federal and state tax returns in one sitting.

Before filling out printable income tax forms for 2020, taxpayers should gather all necessary documents, such as W-2s, 1099s, and receipts for deductions. By having all relevant information on hand, taxpayers can accurately report their income and claim all eligible deductions and credits to minimize their tax liability.

In conclusion, printable income tax forms for 2020 are a valuable resource for taxpayers looking to file their tax returns accurately and on time. By accessing these forms online, taxpayers can save time and ensure that they have everything they need to complete their tax returns successfully. Be sure to visit the IRS website or your state’s Department of Revenue website to download the necessary forms and start preparing your income tax return for the year 2020.