As the tax season approaches, it’s important to make sure you have all the necessary forms to file your federal income taxes for the year 2017. Whether you are filing as an individual, a business, or a non-profit organization, having the correct forms is essential to ensure that your taxes are filed accurately and on time.

Fortunately, the Internal Revenue Service (IRS) provides printable versions of all the necessary federal income tax forms on their website. These forms can be easily accessed and downloaded for free, making it convenient for taxpayers to complete their tax returns.

2017 Printable Federal Income Tax Forms

2017 Printable Federal Income Tax Forms

Save and Print 2017 Printable Federal Income Tax Forms

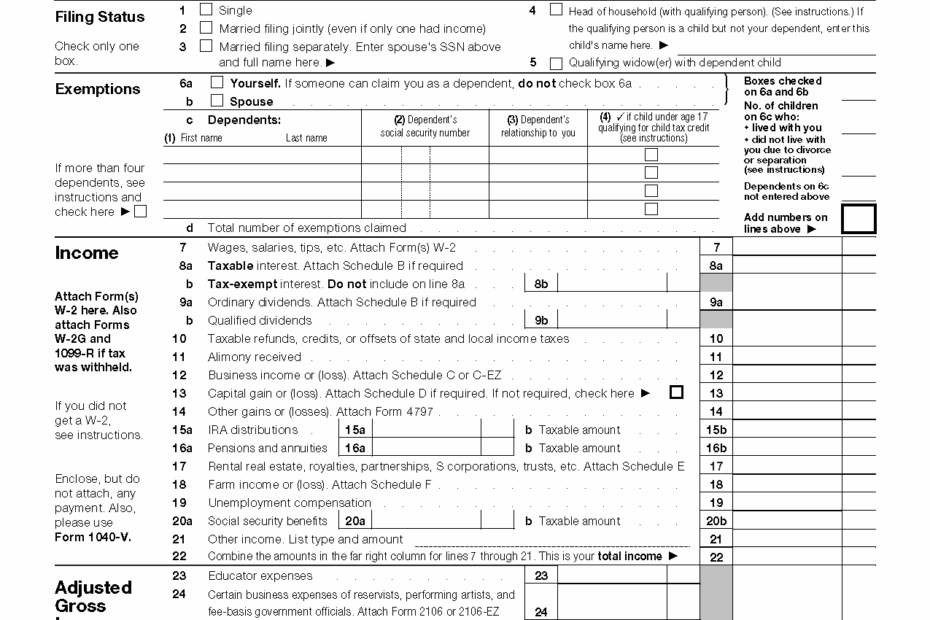

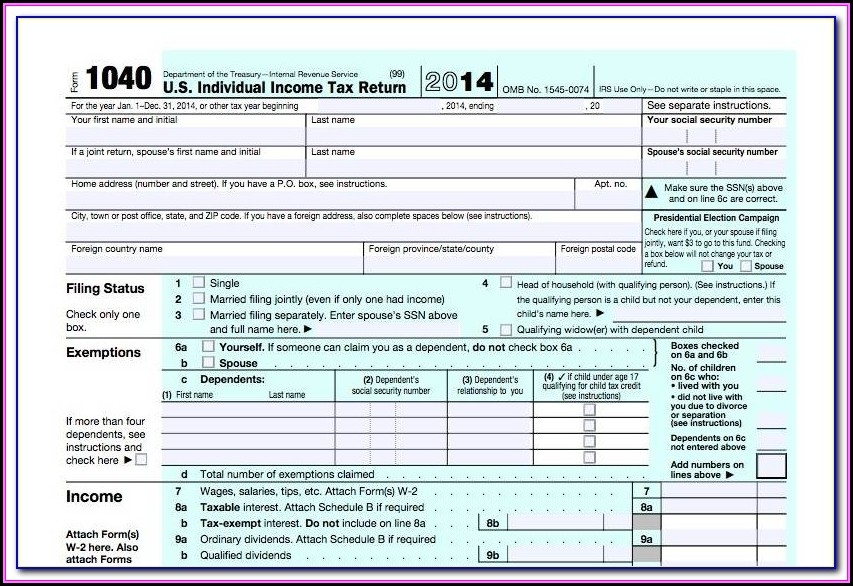

When preparing your 2017 federal income tax return, it’s important to have the right forms on hand. Some of the key forms you may need include Form 1040 for individual tax returns, Form 1120 for corporate tax returns, and Form 990 for non-profit organizations. Additionally, there are various schedules and worksheets that may be required depending on your specific tax situation.

Before filling out your tax forms, be sure to gather all the necessary documentation, such as W-2s, 1099s, and receipts for deductions. Having all your paperwork organized will make the tax filing process much smoother and help prevent errors on your return.

If you prefer to file your taxes electronically, many tax preparation software programs also offer printable versions of the 2017 federal income tax forms. These programs can help guide you through the filing process and ensure that you don’t miss any important deductions or credits.

In conclusion, having access to printable federal income tax forms for the year 2017 is essential for filing your taxes accurately and on time. Whether you choose to file by mail or electronically, having the correct forms and documentation will help ensure that your tax return is completed correctly. Be sure to visit the IRS website or use a reputable tax preparation software program to access the forms you need for this tax season.