Filing taxes can be a daunting task, but having the right forms can make the process much easier. For residents of Illinois, the State Income Tax Form is a crucial document that needs to be filled out accurately to ensure compliance with state tax laws.

Whether you are a full-time employee, self-employed individual, or a retiree, understanding how to properly fill out the Illinois State Income Tax Form is essential to avoid any penalties or issues with the Illinois Department of Revenue.

Illinois State Income Tax Form Printable

Illinois State Income Tax Form Printable

Easily Download and Print Illinois State Income Tax Form Printable

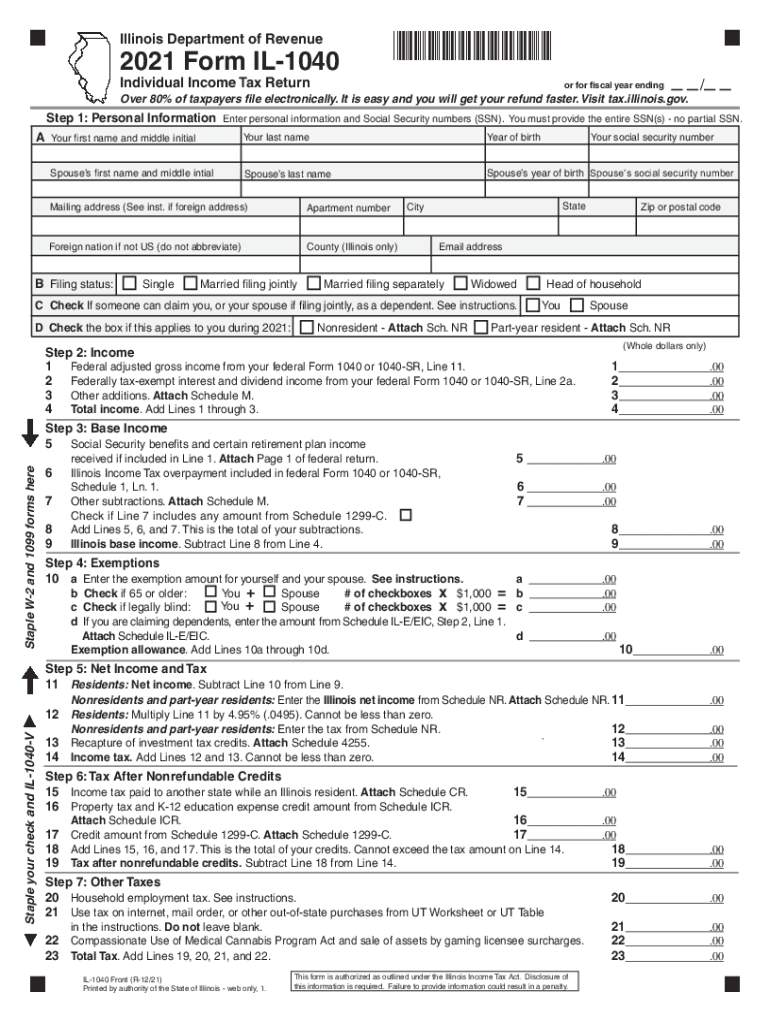

Instructions for filling out the Illinois State Income Tax Form:

1. Start by gathering all necessary documentation, including W-2 forms, 1099 forms, and any other relevant financial documents.

2. Fill out your personal information, including your name, address, Social Security number, and filing status.

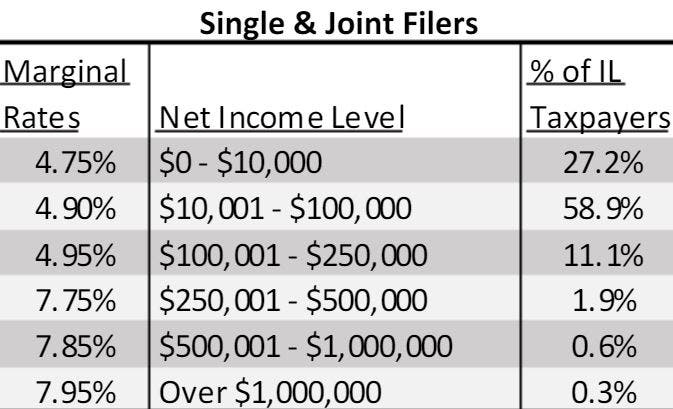

3. Enter your income from all sources, including wages, salaries, tips, and any other income you may have earned throughout the tax year.

4. Deduct any eligible deductions and credits to lower your taxable income and potentially reduce the amount of taxes you owe.

5. Double-check all information before submitting your Illinois State Income Tax Form to ensure accuracy and avoid any delays in processing.

By following these instructions and utilizing the Illinois State Income Tax Form Printable, you can streamline the tax-filing process and ensure compliance with state tax laws.

Remember, it is essential to file your taxes on time and accurately to avoid any penalties or issues with the Illinois Department of Revenue. Utilize the Illinois State Income Tax Form Printable to make the process easier and ensure you are fulfilling your tax obligations as a resident of Illinois.