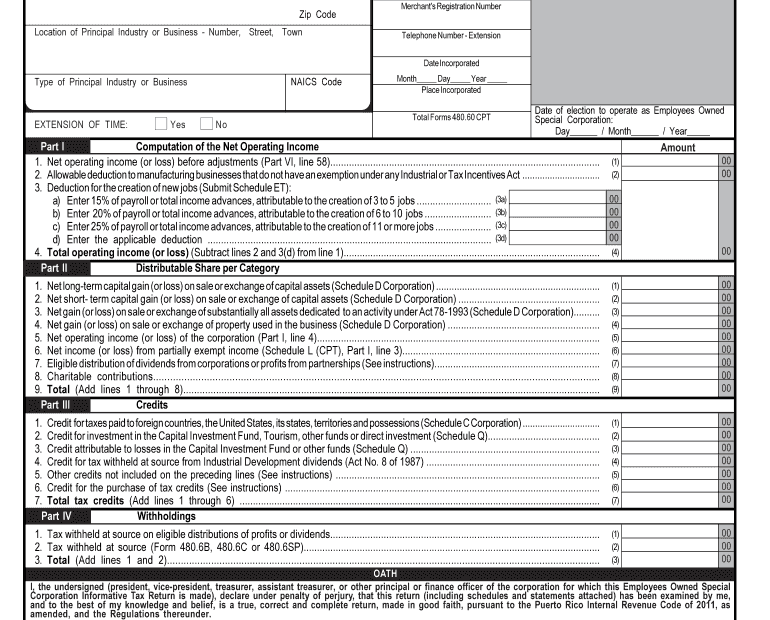

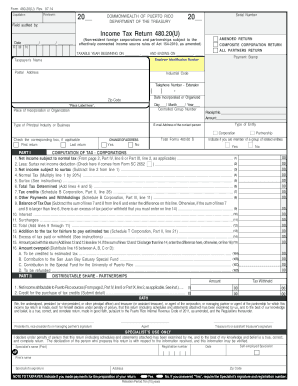

Filing income taxes can be a stressful and overwhelming task, but having the right forms can make the process much easier. For residents of Puerto Rico, it is crucial to have access to the necessary tax forms to ensure compliance with local tax laws. Fortunately, there are printable 2018 Puerto Rico income tax forms available online that can help individuals accurately report their income and deductions.

These printable forms are designed to streamline the tax filing process and provide taxpayers with a clear outline of the information they need to submit. By using these forms, individuals can ensure that they are accurately reporting their income and deductions, which can help them avoid potential penalties or audits from the tax authorities.

Printable 2018 Puerto Rico Income Tax Forms

Printable 2018 Puerto Rico Income Tax Forms

Download and Print Printable 2018 Puerto Rico Income Tax Forms

When using printable 2018 Puerto Rico income tax forms, individuals should carefully review the instructions provided with each form to ensure that they are completing it correctly. It is important to double-check all information before submitting the forms to avoid any errors that could delay the processing of the tax return.

Some of the common printable 2018 Puerto Rico income tax forms include Form 480.7C, which is used to report individual income tax returns, and Form 480.7D, which is used to report corporate income tax returns. These forms are essential for accurately reporting income and deductions to the Puerto Rico Department of Treasury.

By utilizing these printable forms, individuals can take the first step towards fulfilling their tax obligations and ensuring compliance with Puerto Rico tax laws. It is important to file taxes accurately and on time to avoid any potential penalties or fines. With the right forms in hand, taxpayers can navigate the tax filing process with confidence and ease.

Overall, printable 2018 Puerto Rico income tax forms are a valuable resource for individuals and businesses in Puerto Rico to accurately report their income and deductions. By using these forms and following the provided instructions, taxpayers can simplify the tax filing process and ensure compliance with local tax laws.